Click image to open full size in new tab

Article Text

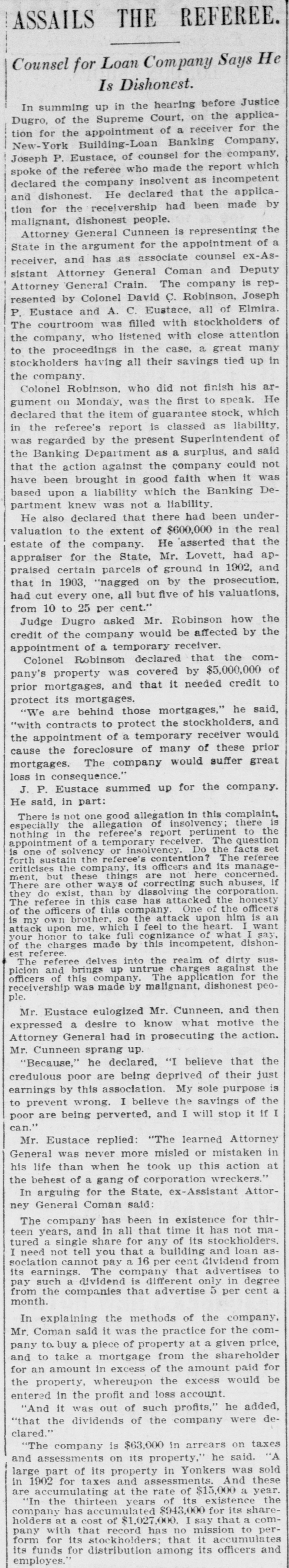

ASSAILS THE REFEREE. Counsel for Loan Company Says He Is Dishonest. In summing up in the hearing before Justice Dugro, of the Supreme Court, on the application for the appointment of a receiver for the New-York Building-Loan Banking Company, Joseph P. Eustace, of counsel for the company, spoke of the referee who made the report which declared the company insolvent as incompetent and dishonest. He declared that the application for the receivership had been made by malignant. dishonest people. Attorney General Cunneen is representing the State in the argument for the appointment of a receiver, and has as associate counsel ex-Assistant Attorney General Coman and Deputy Attorney General Crain. The company is represented by Colonel David C. Robinson, Joseph P. Eustace and A. C. Eustace, all of Elmira. The courtroom was filled with stockholders of the company, who listened with close attention to the proceedings in the case, a great many stockholders having all their savings tied up in the company. Colonel Robinson. who did not finish his argument on Monday, was the first to speak. He declared that the item of guarantee stock, which in the referee's report is classed as liability, was regarded by the present Superintendent of the Banking Department as a surplus, and said that the action against the company could not have been brought in good faith when it was based upon a liability which the Banking Department knew was not a liability. He also declared that there had been undervaluation to the extent of $600,000 in the real estate of the company. He asserted that the appraiser for the State, Mr. Lovett, had appraised certain parcels of ground in 1902, and that in 1903, "nagged on by the prosecution, had cut every one, all but five of his valuations, from 10 to 25 per cent." Judge Dugro asked Mr. Robinson how the credit of the company would be affected by the appointment of a temporary receiver. Colonel Robinson declared that the company's property was covered by $5,000,000 of prior mortgages, and that it needed credit to protect its mortgages. "We are behind those mortgages," he said, "with contracts to protect the stockholders, and the appointment of a temporary receiver would cause the foreclosure of many of these prior mortgages. The company would suffer great loss in consequence." J. P. Eustace summed up for the company. He said, in part: There is not one good allegation in this complaint, especially the allegation of insolvency; there is nothing in the referee's report pertinent to the appointment of a temporary receiver. The question is one of solvency or insolvency. Do the facts set forth sustain the referee's contention? The referee criticises the company, its officers and its management, but these things are not here concerned. There are other ways of correcting such abuses, if they do exist, than by dissolving the corporation. The referee in this case has attacked the honesty of the officers of this company. One of the officers is my own brother, so the attack upon him is an attack upon me, which I feel to the heart. I want your honor to take full cognizance of what I say, of the charges made by this incompetent, dishonest referee. The referee delves into the realm of dirty suspicion and brings up untrue charges against the officers of this company. The application for the receivership was made by malignant, dishonest people. Mr. Eustace eulogized Mr. Cunneen, and then expressed a desire to know what motive the Attorney General had in prosecuting the action. Mr. Cunneen sprang up. "Because," he declared, "I believe that the credulous poor are being deprived of their just earnings by this association. My sole purpose is to prevent wrong. I believe the savings of the poor are being perverted, and I will stop it if I can." Mr. Eustace replied: "The learned Attorney General was never more misled or mistaken in his life than when he took up this action at the behest of a gang of corporation wreckers." In arguing for the State, ex-Assistant Attorney General Coman said: The company has been in existence for thirteen years, and in all that time it has not matured a single share for any of its stockholders. I need not tell you that a building and loan association cannot pay a 16 per cent dividend from its earnings. The company that advertises to pay such a dividend is different only in degree from the companies that advertise 5 per cent a month. In explaining the methods of the company, Mr. Coman said it was the practice for the company to. buy a piece of property at a given price, and to take a mortgage from the shareholder for an amount in excess of the amount paid for the property, whereupon the excess would be entered in the profit and loss account. "And it was out of such profits," he added, "that the dividends of the company were declared." "The company is $63,000 in arrears on taxes and assessments on its property," he said. "A large part of its property in Yonkers was sold in 1902 for taxes and assessments. And these are accumulating at the rate of $15,000 a year. "In the thirteen years of its existence the company has accumulated $943,000 for its shareholders at a cost of $1,027,000. I say that a company with that record has no mission to perform for its stockholders: that it accumulates its funds for distribution among its officers and employes.