Click image to open full size in new tab

Article Text

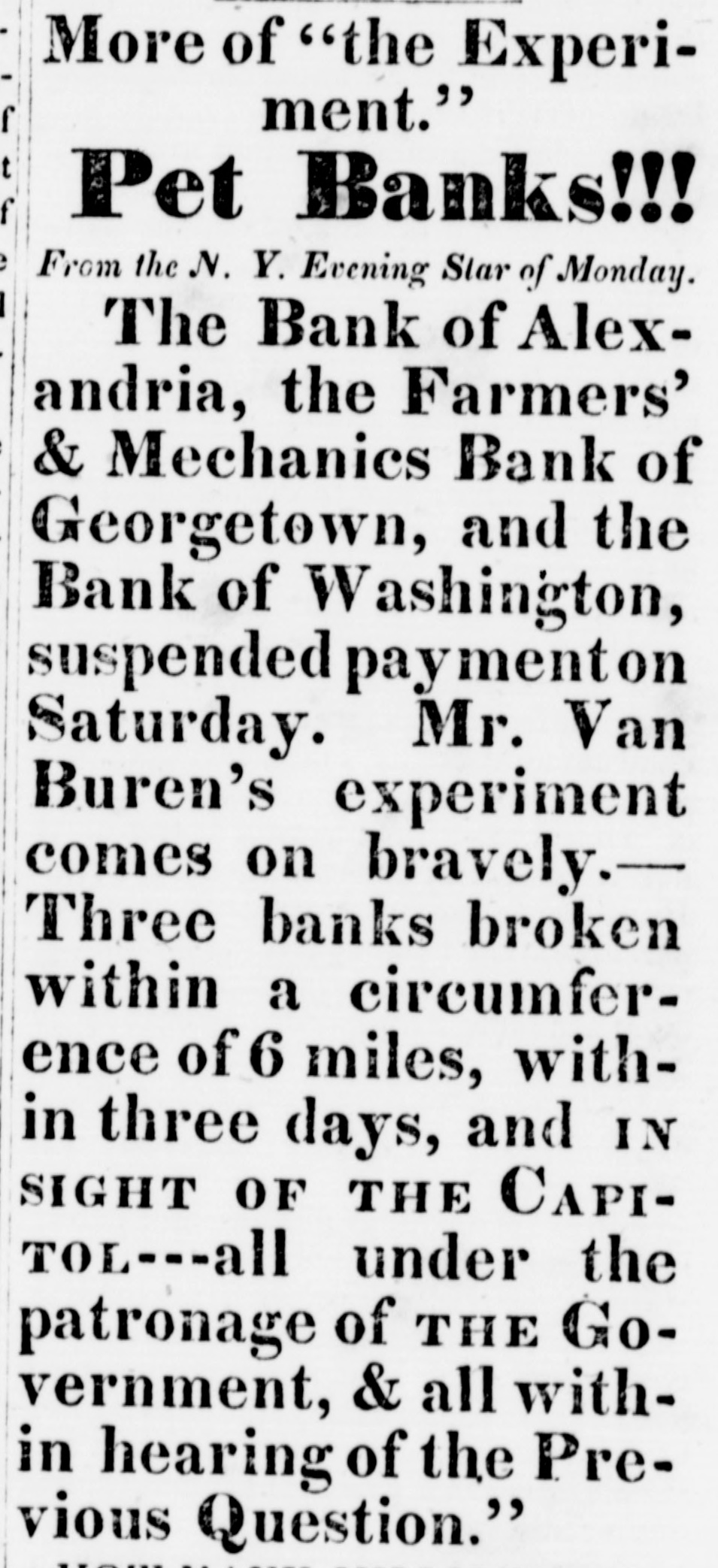

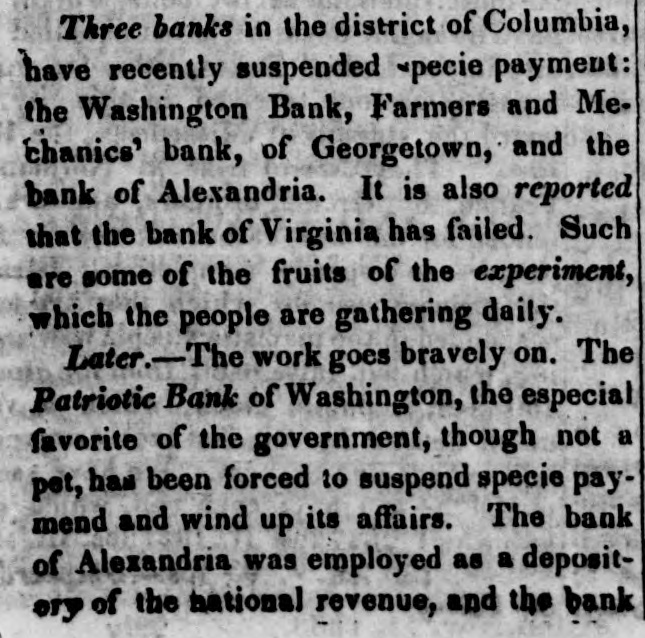

KenuraT arrest, and no person should be permitted to charge him with having done FO, without being contradicted in such terms - admitted of equivocation. He made the motion in reference to those who were then outraging and insuling the Senate whom he heard over his head. He asked it the business of the Senate was not interrupted. He asked if it was possible for business to proceed while the tumult rasgoing on; and if hisses as well as applauses were not heard. Those who were permitted to applaud in a legislative body would find the same right to censure; and he asked it this was not a commencement of such scenes as were exhibited by the fish women of Paris in the French Legislature, when the members were threatened with bludgeous? He did not know whether the applauses or the hisses were loudest, but both ere equally censurable. Hedid not, he repeated, move to take into custody those who applauded the gentleman from Virginia, but those n who insulted the Senate and interrupted its proceedings long after be had sat down; those who were hissing, those who were applauding, and those W ho were trampling over his head at the time The Sergeant-al-Arms could have designated the individuals-Inseye would have been sufficient-and taken them into custody while committing the offence. He hoped those who heard him, and those " ho were taking notes, would not represent him as making a motion for general order of arrest. Mr. B. then withdrew his motion, because, he said, the people were all gone. Mr. Leigh then resumed and concluded his remarks Mr. Ewing then obtained the floor, but, forbeating to proceed with the discussion at so late an hour, yielded the floor for the present, and Mr. ilkins moved that the Senate proceed to the consideration of Executive business. This motion was resisted by Mr. Clayton, on the ground that it did not become the Senate to transact any other Executive business until the present debate should have terminated, and the communication of the President be disposed of. Mr. Calhoun and Mr. Sprague followed on the same side, and Mr. Wilkins explained that his only object was to consider a treaty which would require ratification in few He days. withdrew subsequently his motion, giving notice that he should renew it on Monday, alter the Se. nator from Ohio should have concluded his remarks. The Senate then adjourned to Monday. HOUSE OF REPRESENTATIVES Mr. Jar.is now renewed the request he had made yes. terday, for leave to introduce a resulution for inquiry into the state of the Banks within the District of Columbia which have suspended specie payments. Mr. H ardin inquired of Mr. J., whether he would consent to modify his resolution so as to include all the Banks in the District, and the state of the public moneys therein? It 80, he should have his vote to suspend the rule. Mr. Jarvis replied that there was no such power in this body Objection being made to granting leave to offer hisreso. lution, Mr. Jarvis moved to suspend the rules to allow him to it. do Mr. Wilde asked whether it would be in order to move to postpone this motion ? The Chair replied in the negative. Mr. Archer asked whether the mover would extend his resolution, as requested by Mr. Hardin Mr. Jarvis said, that, it the rules should be suspended, he would ex end the resolution as far as any gentleman might wish. he question being put, the rules were suspendedYeas 151; Nays 22 Mr. Jarvis's resolution was then offered, as follows: Resolved, That a Committee be appointed to investigate the situation of the Bank of Washington, the Farmers' and Mechanies' Bank of Georgetown, the Patriotic Bank, and the Bank of Alexandria, situaled in the District of Columbia, and to inquire into the causes which have led said to the recent suspension of specie payments by the afore. Banks, h power send for persons and papers, and that the Committee be directed to report the result of their proceedings to the House. Mr. Hardin said he had an amendment to offer; but before it was read, the morning hour expired; and the resolution and amendment lie over. [Mr. Hardin proposed to amend the resolution by add. ing- and to inquire into the present condition of the Bank of the Metropolis; and also what is the amount of debts and obligations, and the means it has to pay them, and particularly the species of property it possesses, what amount to the its officers, or any and of them."] Mr. Wise of THE Virginia, PUBLIC now asked TREASURE. leave to offer the following resolutions: Resolved, the That the custody and control of the of United States, not appropriated by law, are, moneys the Constitution, placed under the order and direction by of the Congress of the United States. United Resolved. That no change of the Constitution of the the United States is necessary to authorize the Congress of States to entrust the custody of the money, not appropriated by law, whenever or public obtained, to other agency than that of the Executive howsoever partment, and that the custody of the public money deto NOT BE, necessarily, under the Constitution, entrusted MUST the Executive department. Resolved, That Congress can take our of the hands the Executive department the custody of the public of perty or money, without an assumption of Executive proer,or a subversion of the first principles of the Constitu- pow. tion, by the repeal and enactment of such laws as may be necessary to that end. Objection being made, Mr. Wise moved to suspend the rules of the House, and asked the year and pays; whereupon, Mr. Love moved a call of the House; which was agreed 10. ed The that names 140 members of the members were present. being called over it appearthat The 163 absentees were then called over, when it appeared m mbers had answered to their names. The of doors of the House were then closed, and fered names absentees being again called, excuses the in by their colleagnes or friends. Most were offered few cases, the House refused to admit the excused; susficient and for some, no excuses excuses of. they Repeated attempts were made to suspend the were given. those were uniformly negatived. At length, on call; motion. but mitted members who were waiting at the doors, The to enter. There were now 171 members ad. were Sergeant-at- still was ordered to notify present. sitting absent, and within reach, that the House those who [It was with closed doors, and demanded their attendance. was in the Senate understood, Chamber.] and stated, that many of them were After much ful motion desultory conversation, and an at to adjourn, (lost by 4 votea only) the unsuccess. open. length suspended, and the doors of the House call thrown was Mr. On Reed now moved an adjournment. The When motion, this, Mr. however, Beadsley was demanded withdrawn- the yeas and nays. rules of Mr. Wise renewed his motion to this the House, in order to offer his suspend the They motion. Mr. Beardsley demanded the resolutions. Yeas On Nays 93. were ordered and stood as follows Yeas 103 Nays. rules Two-thirds were not not having voted in the affirmative, the suspended. saine Mr. motion Wise then gave notice, that he should resolutions. troduce the every until leave should be given renew toin- the rules, Mr. to Peyton of Tennessee, asked for a the Resolved, enable him to offer the following suspenson of the late That the President of the United resolutions Revenue, Executive proceedings in relation to States, in has not assumed " himself the Public but power that he not conferred by the Constitution upon and authority Laws," and has acted in conformity to both. solution Resolved, That the Senate o the U. States, in wit: " passed by that body, in the words a late re. to tive Resolved, That the President, in following, proceeding in relation to the public the late Execu. by sumed the Constitution upon himself authority and power not conferred have, by and laws, but in derogation action, but that as a resolution, solemn not with a view to legislative of both," rogatives fringed upon the rightful and censure legitimate upon the powers President. and pre. of the House of Representatives se. have the power, by law, to Resolved, That Congress