Click image to open full size in new tab

Article Text

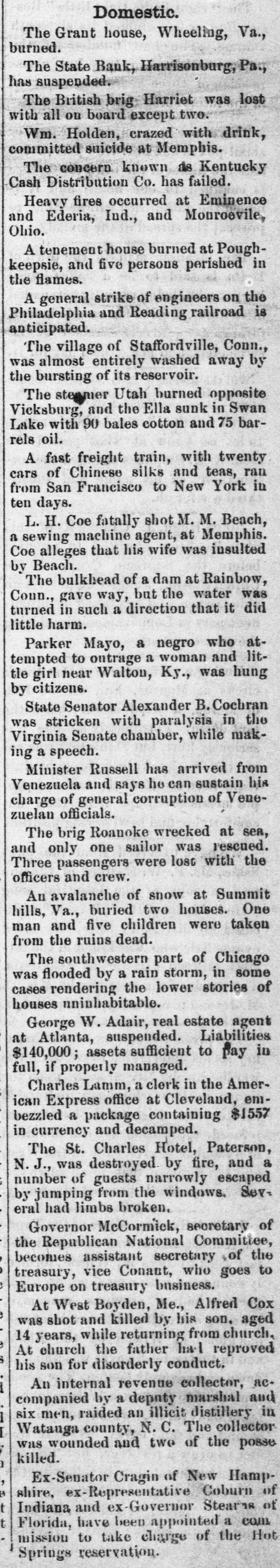

Domestic. The Grant house, Wheeling, Va., burned. The State Bank, Harrisonburg, Pa., has suspended The British brig Harriet was lost with all ou board except two. Wm. Holden, crazed with drink, committed suicide at Memphis. The concern known as Kentucky Cash Distribution Co. has failed. Heavy fires occurred at Eminence and Ederia, Ind., and Mouroevile, Ohio. A tenement house burned at Poughkeepsie, and five persons perished in the flames. A general strike of engineers on the Philadelphia and Reading railroad is anticipated. The village of Staffordville, Conn., was almost entirely washed away by the bursting of its reservoir. The stegnier Utah burned opposite Vicksburg, and the Ella sunk in Swan Lake with 90 bales cotton and 75 barrels oil. A fast freight train, with twenty cars of Chinese silks and teas, ran from San Francisco to New York in ten days. L. H. Coe fatally shot M. M. Beach, a sewing machine agent, at Memphis. Coe alleges that his wife was insulted by Beach. The bulkhead of a dam at Rainbow, Coun., gave way, but the water was turned in such a direction that it did little harm. Parker Mayo, a negro who atto a woman tempted ontrage and little girl near Walton, Ky., was hung by citizens. State Senator Alexander B. Cochran was with the stricken paralysis while in makVirginia Senate chamber, ing a speech. Minister Russell has arrived from Venezuela and says he can sustain his charge of general corruption of Venezuelan officials. The brig Roanoke wrecked at sea, and one was only sailor rescued. the Three passengers were loss with officers and crew. Au avalanche of snow at Summit hills, Va., buried two houses. One man and five children were taken from the ruins dead. The southwestern part of Chicago was flooded by a rain storm, in some cases rendering the lower stories of houses uninhabitable. George W. Adair, real estate agent at Atlanta, suspended. Liabilities $140,000; assets sufficient to pay in full, if properly managed. Charles Lamm, a clerk in the American Express office at Cleveland, embezzled a package containing $1557 in currency and decamped. The St. Charles Hotel, Paterson, J., was destroyed. by fire, and a number of guests narrowly escaped by jumping from the windows. Sev: eral had limbs broken. Governor McCormick, secretary of the Republican National Committee, becomes assistant secretary of the treasury, vice Conant, who goes to Europe on treasury business. At West Boyden, Me., Alfred Cox was shot and killed by his son. aged 14 years, while returning from church, At church the father hal reproved his son for disorderly conduct. An internal revenue collector, RCI companied by a depnty marshal and i six men, raided an illicit distillery in Watanga county, N. C. The collector was wounded and two of the posse killed. ) Ex-Senator Cragin of New Hampa shire, ex-Representative Coburn of t Indiana and ex-Governor Stearns of t Florida, have been appointed a com mission to take charge of the Hot Springs reservation.