Click image to open full size in new tab

Article Text

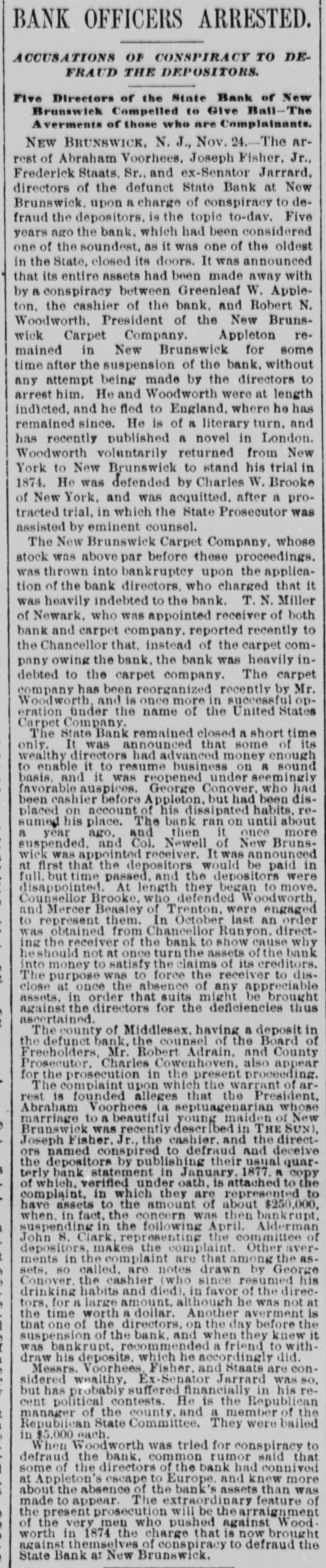

NEW-YORK DAILY TRIBUNE, WEDNESDAY, JANUARY 21, 1880.

Secretary of State and Supreme Court Clerk as the totals of their receipts are not less than the true figures, and whether these officials have not found a loophole for escaping the provisions of the law which was intended to make them "show their hands."

A second resolution for the same inquiry into the reports of county officers was adopted. The Judiciary Committee (consisting of Senators Hobart, Rabe and Francis) was appointed to make the investigation.

Senator Frencis introduced a resolution for an inquiry into the condition of the sinking fund, which has been largely invested in mortgages on farm lands by the Democrats who have controlled it for years. The Commissioners have an immense amount of real estate on their hands, and a great deal of interest is overdue.

Mr. Allan McDermott, of Hudson County, a Democrat, introduced to-day a measure providing that the State shall pay for the postage on all letters and documents sent by members during the session. The Republicans voted down the resolution twice, the Democrats generally voting in its favor.

Among the bills introduced are the following: By Senator Hobart, requiring court fees to be paid to the clerk and by him to the judge; also reducing the number of Common Pleas judges to three in each county; by Assemblyman Morehead, providing for county Boards of Inspectors of State Lunatic Asylums; by Senator Hobart, extending the time for insurance proxies from one year to three years.

Senator Rabe (Dem., Hudson) introduced a resolution this afternoon inquiring as to the facts concerning the deposit of about $35,000 of State funds made in the State Bank of New-Brunswick, which suspended some time ago. It is charged that the private depositors have received a large proportion of their money, while the State Treasury has recovered nothing.

HOME NEWS.

PROMINENT ARRIVALS

Windsor Hotel-Ex-Congressman F. Jones of New-Hampshire; J. N. McCullough, of Pittsburg, and General John N. Knapp, of Auburn, N. Y...... Fifth Avenue Hotel-Judge Joseph Potter, of the New-York Supreme Court......

Grand Central Hotel-Judge Hoyt H. Wheeler, of Vermont.

Clarendon Hotel-John Newell, of Chicago, and Edward J. Phelps, of Vermont.... Hotel Brunswick-General A. C. McClarg, of Chicago...... Gilsey House-Alexander Graham Bell, of Washington, and Samuel M. Shoemaker, of Baltimore.

......New-York Hotel-Sidney Lanier, of Baltimore...... St. James Hotel-George B. Spriggs, of the Great Western Railway of Canada...... Hoffman House-William McMichael, of Philadelphia.

NEW-YORK CITY.

At a meeting of shoemakers, held at No. 100 Chatham-st., reports were received of an increase of wages in the different shoe factories.

The fifth anniversary of the New-York Society for the Prevention of Cruelty to Children will be held at Chickering Hall next Monday evening at 8 o'clock.

Robert Simpson and C. F. Priest, by whose shooting at a rat C. H. Murtagh was accidentally wounded on Monday, are still held as prisoners, to allow the police to investigate the case further.

The scores at the chess tournament yesterday were as follows: Grundy, number of games won, 10; Judd, 9; Mohle, 8½; Mackenzie, 8; Sellman, 7½; Delmar, 7½; Ryan, 5; Ware, 3; Congdon, 2½.

An unknown sailor, about thirty three years old

trial on a sin

Carroll had

A magical

Ann's Episc

evening at

Edgar S. Al

late Robert

hundred per

entertainme

formances b

with card m

hat, from w

neous stock

spectators.

At the reg

empt Firem

ing, the foll

sning year:

ken, first

vice-preside

retary; Fram

James Y. W

report show

were $2,05

$1,885 85.

urer a balan

Theodore

he-st., has b

Bernard F

ern District.

illness. He