Article Text

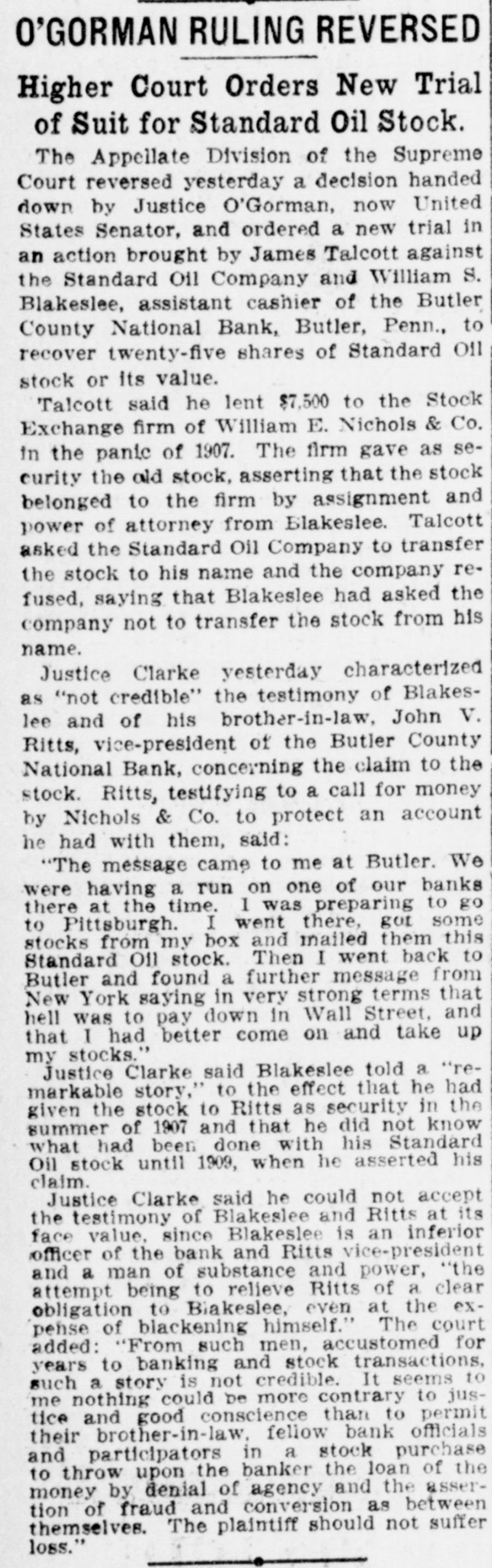

O'GORMAN RULING REVERSED Higher Court Orders New Trial of Suit for Standard Oil Stock. The Appellate Division of the Supreme Court reversed yesterday a decision handed down by Justice O'Gorman, now United States Senator, and ordered a new trial in an action brought by James Talcott against the Standard Oil Company and William S. Blakeslee, assistant cashier of the Butler County National Bank, Butler, Penn., to recover twenty-five shares of Standard Oil stock or its value. Talcott said he lent $7,500 to the Stock Exchange firm of William E. Nichols & Co. in the panic of 1907. The firm gave as security the old stock, asserting that the stock belonged to the firm by assignment and power of attorney from Blakeslee. Talcott asked the Standard Oil Company to transfer the stock to his name and the company refused, saying that Blakeslee had asked the company not to transfer the stock from his name. Justice Clarke yesterday characterized as "not credible" the testimony of Blakeslee and of his brother-in-law, John V. Ritts, vice-president of the Butler County National Bank, concerning the claim to the stock. Ritts, testifying to a call for money by Nichols & Co. to protect an account he had with them, said: "The message came to me at Butler. We were having a run on one of our banks there at the time. I was preparing to go to Pittsburgh. I went there, got some stocks from my box and mailed them this Standard Oil stock. Then I went back to Butler and found a further message from in strong New York saying very Street, terms that and hell was to pay down in Wall that I had better come on and take up my stocks." Justice Clarke said Blakeslee told a "remarkable story," to the effect that he had given the stock to Ritts as security in the that he summer of 1907 and did not know what had been done with his Standard Oil stock until 1909, when he asserted his claim. Justice Clarke said he could not accept the testimony of Blakeslee and Ritts at its face value, since Blakeslee is an inferior officer of the bank and Ritts vice-president and a man of substance and power, "the attempt being to relieve Ritts of a clear to even exobligation Biakeslee, himself." at The the court pense of blackening added: "From such men, accustomed for to banking and stock transactions, is not such years a story credible. It seems to jus- to me nothing could be more contrary tice and good conscience than to permit in a and their participators brother-in-law. fellow stock bank purchase officials to throw upon the banker the loan of the by denial of agency and the asserand as money tion of fraud conversion between themselves. The plaintiff should not suffer loss."