Click image to open full size in new tab

Article Text

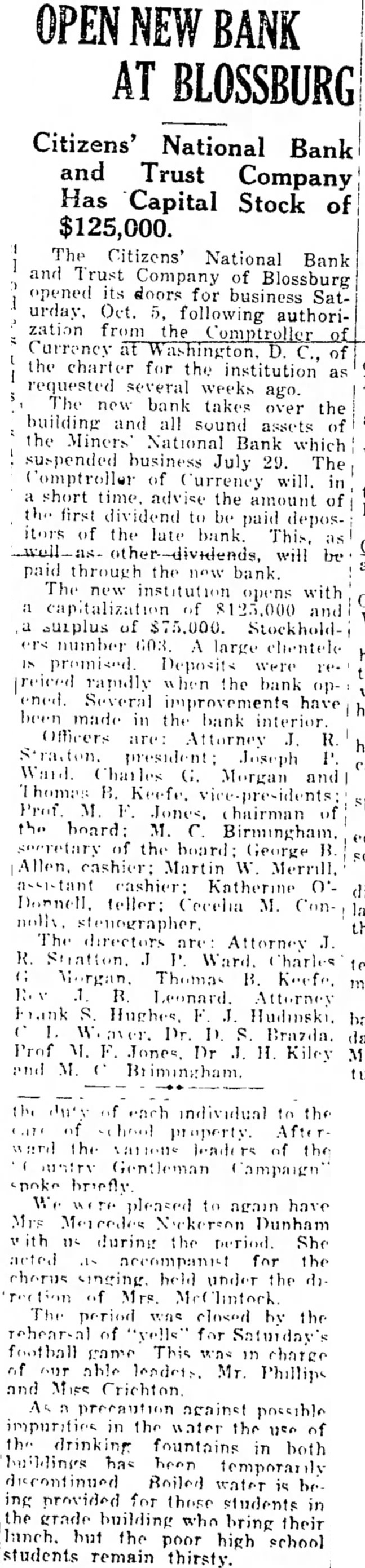

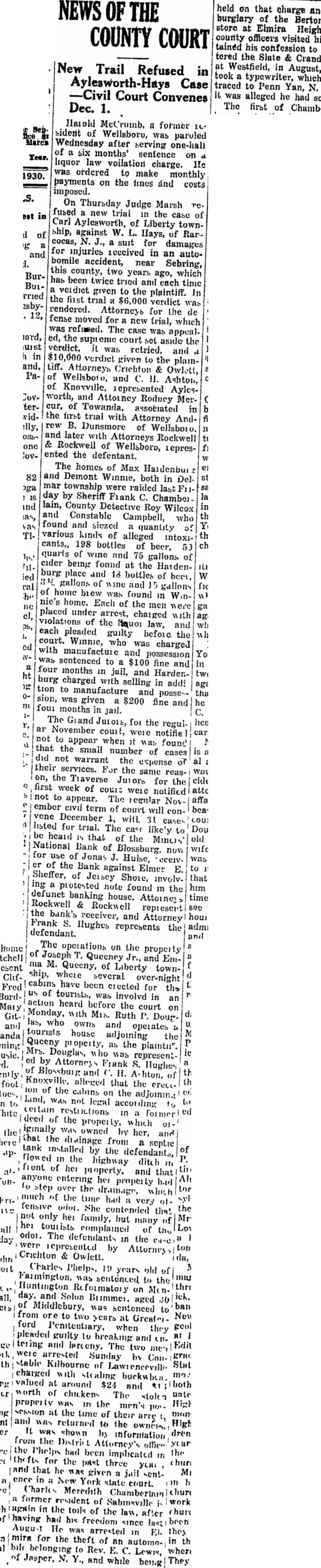

NEWS OF THE COUNTY COURT

New Trail Refused in Aylesworth-Hays Case Civil Court Convenes it was alleged he had sold it. Dec. 1.

Harold McCrumb. a former 16. sident of Wellsboro, was paroled Wednesday after serving one-half of a six months' sentence on liquor law voilation charge. He was ordered to make monthly payments on the fines and costs imposed. On Thursday Judge Marsh refused a new trial in the case of Carl Aylesworth, of Liberty township, against W. L. Hays, of Rancocas, N. J., a suit for damages for injuries received in an autobomile accident, near Sebring, this county, two years ago, which has been twice tried and each time a verdict given to the plaintiff. In the first trial $6,000 verdict was rendered. Attorneys for the de fense moved for a new trial, which was refused. The case was appealed, the supreme court set aside the verdict, it was retried, and a $10,000 verdict given to the plaintiff. Attorneys Crichton & Owlett, of Wellsboro, and C. 11. Ashton, of Knoxville, represented Aylesworth, and Attorney Rodney Mercur, of Towanda, associated in the first trial with Attorney Andrew B. Dunsmore of Wellsboro. and later with Attorneys Rockwell & Rockwell of Wellsboro, iepresented the defentant. The homes of Max Haidenbur and Demont Winnie, both in Delmar township were raided last F11day by Sheriff Fiank C. Chamberlain, County Detective Roy Wilcox and Constable Campbell, who found and siezed quantity of various kinds of alleged intoxicants,, 198 bottles of beer, 50 quarts of wine and 75 gallons of cider being found at the Haidenburg place and 18 bottles of beet, 34 gallons of wine and 15 gallons of home biew was found in Winnic's home. Each of the men were placed under arrest, charged with violations of the Neuor law, and each pleaded guilty before the court. Winnie, who was charged with manufacture and possession was sentenced to a $100 fine and four months in jail, and Hardenburg charged with selling in add! tion to manufacture and posse-sion, was given a $200 fine and four months in jail. The Grand Juiois, foi the regular November couit, were notifie car. not to appear when it was found that the small number of cases did not warrant the expense of their services. For the same reason, the Tiaverse Juiors for the first week of COULD were notified not to appear. The regular November civil term of court will convene December 1, with 31 cases listed for trial. The cast like'y to be heard that of the Mincis National Bank of Blossburg, now for use of Jonas J. Hulse, eceivcr of the Bank against Elmer E. Sheffer, of Jersey Shore, involving a protested note found in the defunct banking house. Attorney Rockwell & Rockwell repiesert the bank's receiver, and Attorney Frank S. Hughes represents the defendant.

The operations on the property of Joseph T. Queeney Jr., and Emma M. Queeny, of Liberty township, where several over-night cabins have been crected for the us of tourists, was involvd in an action heard before the court on Monday, with Mrs. Ruth P. Douglas, who owns and operates tourists house adjoining the Queeny property, as the plaintu" Mrs. Douglas, who was represent ed by Attorney Fiank S. Hughes of Blossburg and C. H. hton, of Knoxville. alleged that the crect. ton of the cabins on the adjoining land, was not legal according to certain restrictions in a former deed of the property, which 01iginally Was owned by her, and that drainage from a septic tank installed by the defendants, flowed in the highway ditch 111 front of her property, and that anyone entering her property had to step over the dramage, which much of the time had a very of. fensive odot. She contended that not only her family, but many of her tourists complained of the odoi. The defendants in the case were represented by Attorney Crichton & Owlett. Charles Phelps, 19 years old of Farmington, was sentenced to the Huntington Rt formatory on Monday, and Solon Brimmer. aged 30 of Middlebury, was sentenced to from ore to two years at Greaterford Pententiary, when they pleaded guilty to breaking and Ln. tering and lareny. The two men were arrested Sunday by Constable Kilbourne of Lawienceville valued at around $24 and worth of chickens The stolen property WHS in the men's pos. session at the time of their arre and was returned to the owners. It was shown by information from the District Attorney's office the Phelps had been implicated in the in for the past three your church. and that he was given a jail sentence in a New York state court. a former resident of Sabmsville again in the toils of the law, after having had his freedom since last Augu-1 He was arrested in E. mira for the theft of an automobile belonging to Rev. E. C. Lewis, of Jasper, N. Y., and while being