Click image to open full size in new tab

Article Text

INDUSTRIAL NOTES

Col. Hugh L. Cooper. retired United States engineer, sailed on Leviathan to begin work at once on the hydro-electric project near Odessa, Russia. Will make Dnieper river navigable for 1000 miles and permit of development of 650,000 horsepower.

New York, Westchester Boston railway about to increase its train facilities and passenger accommoda tions at Harlem River terminal by 50 per cent, according to L. S. Miller. Increase in commuter travel has created congestion at Harlem terminal which must be remedied immediately. Average of 1,000,000 commuters month being carried by road.

Edwin L. James, in London special to says it is generally conceded that British. already most heavily taxed people in world, will have to pay taxes to meet annual expenditure which will be between £820,000,000 and under new budget. British debt charges about an nually, while those of Germany are maximum of French war debt cost is 50 per cent more than German maximum. It almost conclusion that of new taxes will bring. comments Britain' pay. ments to United States: These pay. ments aggregate eight per cent of total debt costs and four per cent of total budget.

Leading insurance companies of country will make no further investment in junior railroad securities without definite assurance, in the form of "living" rates, that carriers will be permitted to earn sufficient to protect principal of such securities according to virtual ultimatum to be presented by repesentatives of insurance companies to interstate commerce sitting railroad rate hearing at Kansas City.

About 50,000 anthracite miners put to work on full time Monday, It announced by several of the large coal-producing companies operating in Luzerne county, Pa., and adjoining regions. Glen Alden and Hudson Coal companies are two re. suming full time. One factor in resumption prospect of much earlier opening of lake navigation than year ago.

Number of buses and trucks operat ed by railroads doubled during past year, according review by Dominick Dominick. Steam railroads 1926 operated 1300 motor buses with route mileage of 11,440; and 265 motor trucks with route mileage of 5332. Independent companies in competition with railroad service, operat19,683 buses over 344,000 route miles and 43,532 trucks over 715,000 miles.

Times says possibility of making high grade fuel from lignite deposits demonstrated by bureau of mines using cheap process of carbonization of raw lignite. Extensive lignite fields lie in states west of Mississippi river notably in North Dakota, Wyoming, Colorado and Texas.

Dr. Abbot, scientist and acting head Smithsonian institution, says there possibility in future that millions of homes radio programs can be equipped with ma. chines modeled after "television" receiver, permitting visual as well as ordinary radio programs.

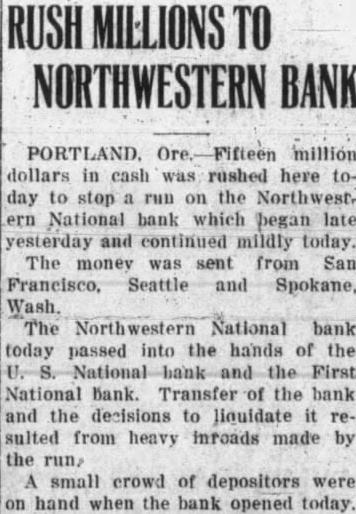

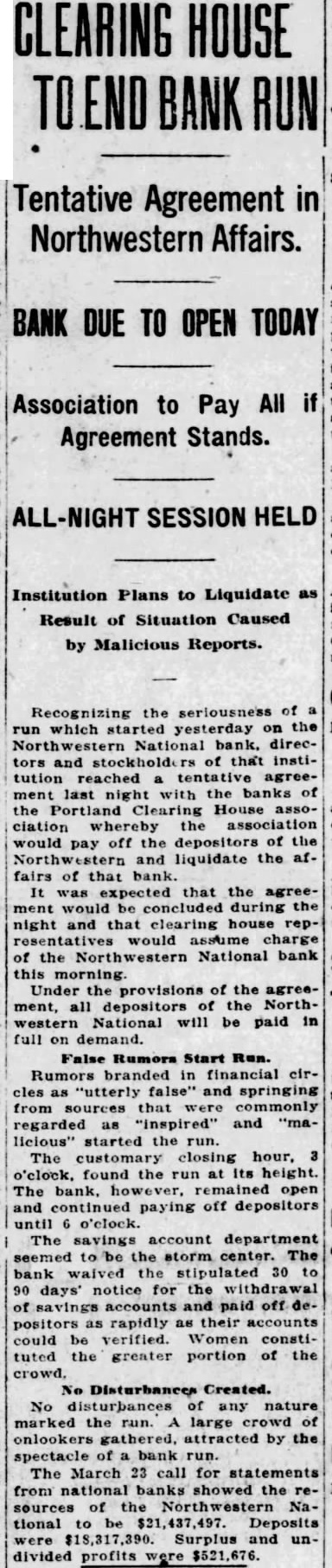

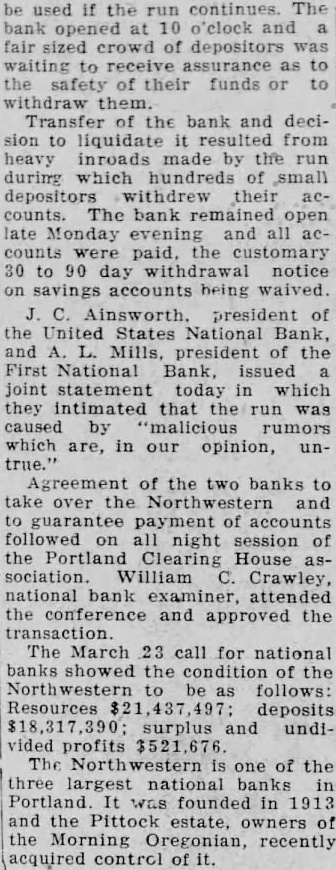

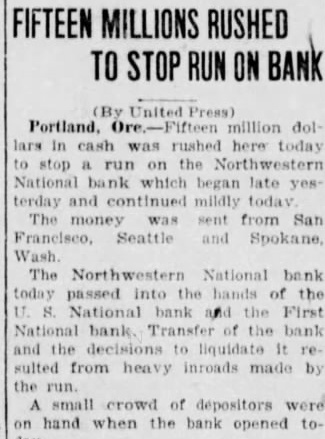

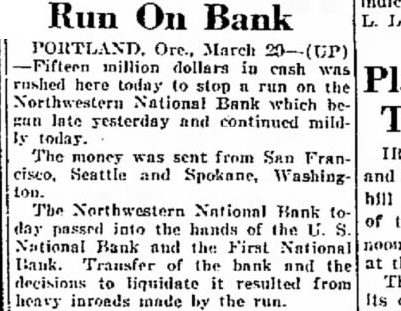

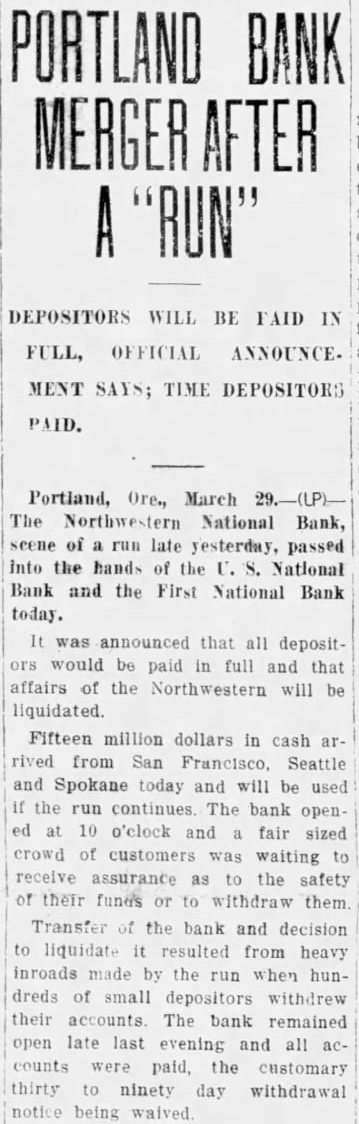

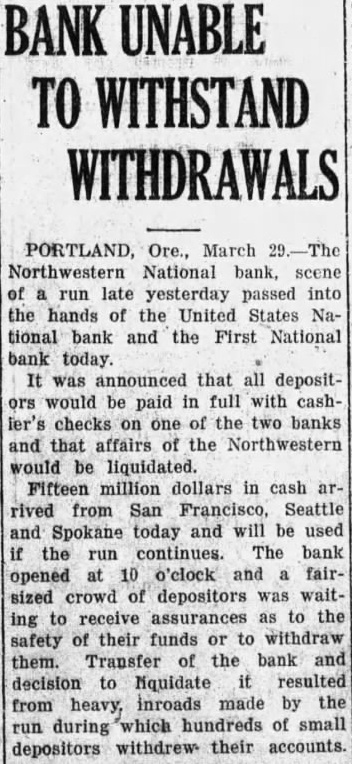

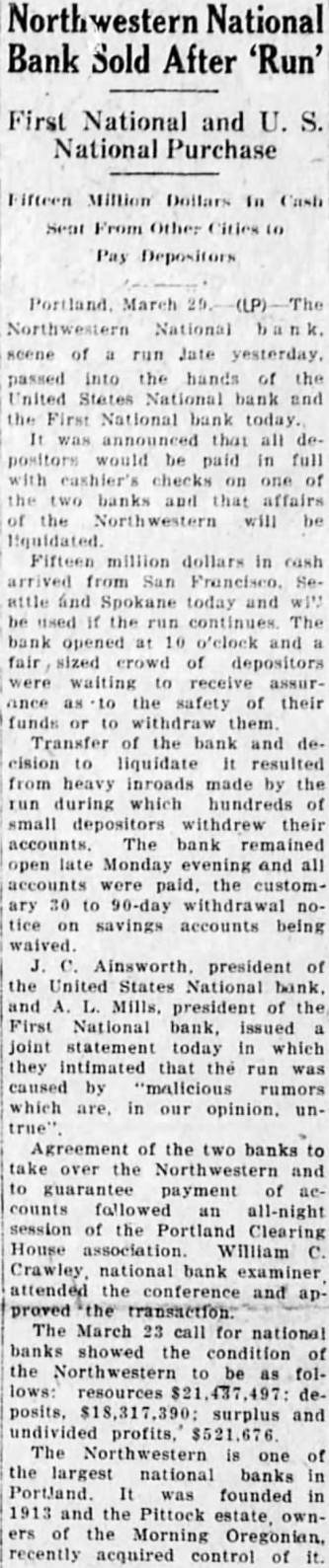

San Francisco special to Times says Fortland, Ore., has been shaken by suspension of the Northwestern Na. tional bank, with deposits of between $18,000,000 and $19,000,000. Stockhold ers were recently 100 per of their holdings, which leaked out and run on bank started. First National and United States Na tional banks payments to depositors, but did not prevent collapse. Thought assets will equal obLarge of froz en and methods believed responsible for failure.

Times London special says White Star line ordered from Harland Wolff, Belfast shipbuilders, what will be largest British motorship. er will be placed in London-New York service. Tonnage between 25,000 and 80,000. White tends to but date of laying keel has been fixed.

Berlin wireless to Times numof unemployed in Germany being rapidly reduced, indicative of flourish condition industries. sons found work Berlin the past week, while the figure for the past six weeks 52,000, thereby reducing number of idle more than 20 per cent.