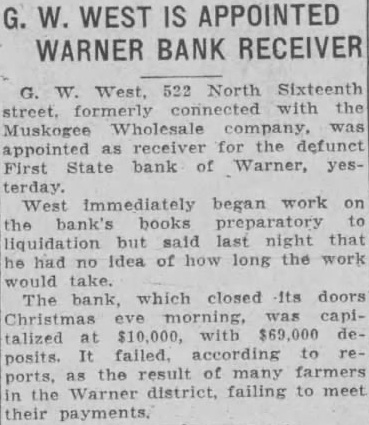

Article Text

G. W. WEST IS APPOINTED WARNER BANK RECEIVER 522 North Sixteenth street, with the Muskogee Wholesale appointed as receiver for the defunct First State bank of Warner, terday. West immediately began work books preparatory liquidation but night had no Idea of how long the work would take. The bank, which closed its doors morning, was with $69,000 talized according posits. the result of many farmers Warner district, failing to meet their