Article Text

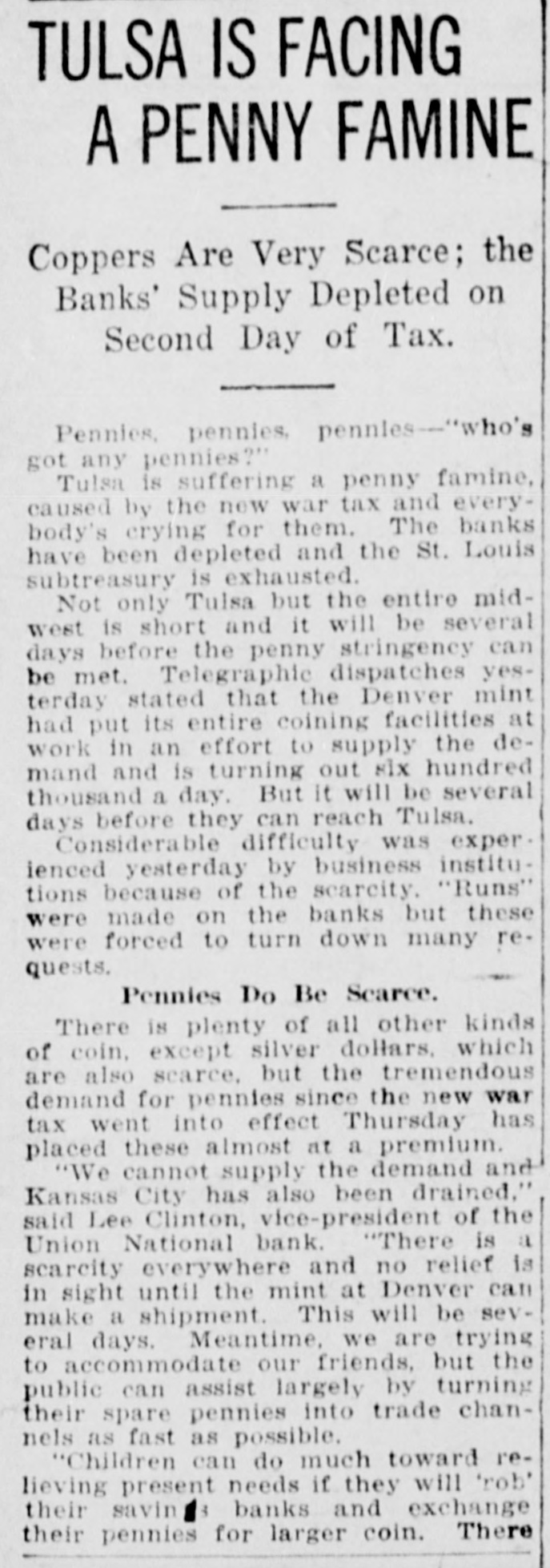

TULSA IS FACING A PENNY FAMINE Coppers Are Very Scarce; the Banks' Supply Depleted on Second Day of Tax. Pennies, pennies, pennles-"who's got any pennies?" Tulsa is suffering a penny famine, caused by the new war tax and everybody's crying for them. The banks have been depleted and the St. Louis subtreasury is exhausted. Not only Tulsa but the entire midwest is short and it will be several days before the penny stringency can be met. Telegraphic dispatches yesterday stated that the Denver mint had put its entire coining facilities at work in an effort to supply the demand and is turning out six hundred thousand a day. But it will be several days before they can reach Tulsa. Considerable difficulty was experienced yesterday by business institutions because of the scarcity. "Runs" were made on the banks but these were forced to turn down many requests. Pennies Do Be Scarce. There is plenty of all other kinds of coin, except silver dollars, which are also scarce, but the tremendous demand for pennies since the new war tax went into effect Thursday has placed these almost at a premium. "We cannot supply the demand and Kansas City has also been drained," said Lee Clinton, vice-president of the Union National bank. "There is a searcity everywhere and no relief is in sight until the mint at Denver can make a shipment. This will be several days. Meantime, we are trying to accommodate our friends, but the public can assist largely by turning their spare pennies into trade channels as fast as possible. "Children can do much toward relieving present needs if they will 'rob' their savin 3 banks and exchange their pennies for larger coin. There