Click image to open full size in new tab

Article Text

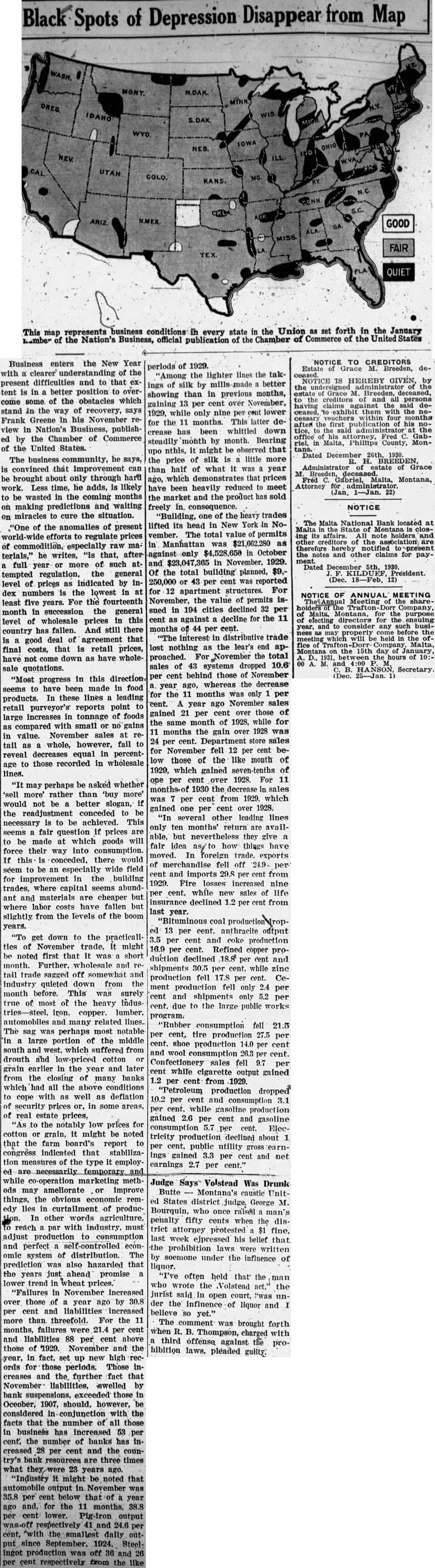

Black Spots of Depression Disappear from Map

Business enters the New Year with clearer understanding of the present difficulties and to that extent is in better position to overcome some of the obstacles which stand in the way of recovery, says Frank Greene in his November review in Nation's Business, published by the Chamber of Commerce of the United States. The business community, he says, is convinced that improvement can be brought about only through hard work. Less time, he adds, is likely to be wasted in the coming months on making predictions and waiting on miracles to cure the situation. "One of the anomalies of present efforts to regulate prices of commodition, especially raw materials," he writes, "is that, after a full year or more of such attempted regulation, the general level of prices as indicated by index numbers is the lowest in at least five years. For the fourteenth month in succession the general level of wholesale prices in this country has fallen. And still there is a good deal of agreement that final costs, that is retail prices, have not come down as have wholesale quotations. "Most progress in this direction seems to have been made in food products. In these lines a leading retail purveyor's reports point to large increases in tonnage of foods as compared with small or no gains in value. November sales at retail as whole, however, fail to reveal decreases equal in percentage to those recorded in wholesale lines. "It may perhaps be asked whether 'sell more' rather than 'buy more' would not be better slogan, if the readjustment conceded to be necessary is to be achieved. This seems fair question if prices are to be made at which goods will force their way into consumption. If this conceded. there would seem to be an especially wide field for improvement in building trades, where capital seems abundant and materials are cheaper but where labor costs have fallen but slightly from the levels of the boom years. "To get down to the practicalities of November trade, it might be noted first that it was short month. Further. wholesale and retail trade sagged off somewhat and industry quieted down from the month before. This was surely true of most of the heavy Industries-steel. iron. copper. lumber. automobiles and many related lines. The sag was perhaps most notable 'in large portion of the middle south and west. which suffered from drouth and low-priced cotton or grain earlier in the year and later from the closing of many banks which had all the above conditions to cope with as well as deflation of security prices or, in some areas, of real estate prices, "As to the notably low prices for cotton or grain, it might be noted that the farm board's report to congress indicated that stabilization measures of the type it employed are necessarily temporary and while co-operation marketing methods may ameliorate or improve things, the obvious economic remedy lies in curtailment of production. In other words agriculture. reach a par with industry. must adjust production to consumption and perfect a self-controlled economie system of distribution. The prediction was also hazarded that the years just ahead promise a lower trend in wheat "Failures in November increased over those of a year ago by 30.8 per cent and liabilities more than threefold. the 11 months, failures were 21.4 per cent and liabilities 88 per cent above those of 1929. November and the year, in fact, set up new high records for those periods, Those increases and the further fact that November liabilities, swelled by bank those in Oceober, 1907, should, however, be considered in conjunction with the facts that the number of all those in business has increased 53 per cent, the number of banks has increased 28 per cent and the country's bank are three times what they, 23 years ago. "Industry it might be noted that automobile output in was 35.8 per cent below that of a year ago and, for the 11 months. 38.8 per cent lower. Pig-iron output was.off respectively 41 and 24.6 per cent, *with smallest daily output since September. 1924. Steelingot production was off 36 and 26 per cent respectively from the like periods of 1929. "Among the lighter lines the takings of silk by mills made better showing than in previous months, gaining 13 per cent over November, 1929. while only nine per cent lower for the 11 months. This latter decrease has been whittled down steadily month by month. Bearing upo nthis, it might be observed that the price of silk is little more than half of what it was year ago, which demonstrates that prices have been heavily reduced to meet the market and the product has sold freely in. consequence. "Building, one of the heavy trades lifted its head in New York in November. The total value of permits in Manhattan was $21,662,280 as against only $4,528,650 in October and $23,047,365 in November, 1929. Of the total building planned, $9,250,000 or 43 per cent was reported for 12 apartment structures. For November, the value of permits issued in 194 cities declined 32 per cent as against decline for the 11 months of 44 per cent. "The interest in distributive trade lost nothing as the lear's end approached. For November the total sales of 43 systems dropped 10.6 per cent behind those of November year ago, whereas the decrease for the 11 months was only per cent. year ago November sales gained 21 per cent over those of the same month of 1928, while for 11 months the gain over 1928 was 24 per cent. Department store sales for November fell 12 per cent below those of the like month of 1929, which gained seven-tenths of one per cent over 1928. For 11 months-of 1930 the decrease in sales was 7 per cent from 1929. which gained one per cent over 1928. "In several other leading lines only ten months' return are available, but nevertheless they give a fair idea how things have moved. In foreign trade. exports of merchandise fell off 24.9. per cent and imports 29.8 per cent from 1929. Fire losses increased nine per cent, while new sales of life insurance declined 1.2 per cent from last year. "Bituminous coal production ed 13 per cent. anthracite output 3.5 per cent and coke production 16.9 per cent. Refined copper production declined 18.8 per cent and shipments 30.5 per cent. while zinc production fell 17.8 per cent. Cement production fell only 2.4 per cent and shipments only 5.2 per cent. due to the large public works program. "Rubber consumption fell 21.5 per cent, tire production 27.5 per cent. shoe production 14.0 per cent and wool consumption 26.3 per cent. Confectionery sales fell 9.7 per cent while cigarette output gained 1.2 per cent from 1929. "Petroleum production dropped 10.2 per cent and consumption 3.1 per cent. while gasoline production gained 2.6 per cent and gasoline consumption 5.7 per cent. Flectricity production declined about 1 per cent, public utility gross earnings gained 3.3 per cent and net earnings 2.7 per cent."

Judge Says Volstead Was Drunk Butte Montana's caustie United States district judge. George M. Bourquin, who once raisel man's penalty fifty cents when the district attorney protested $1 fine, last week ejpressed his belief that the prohibition laws were written by soemone under the influence of liquor. "I've often held that the man who wrote the Volstead act." the jurist said in open court, "was under the influence of liquor and I believe so yet." The comment was brought forth when R. B. Thompson, charged with third offense against the prohibition laws, pleaded guilty.

NOTICE TO CREDITORS Estate of Grace M. Breeden, deceased NOTICE IS HEREBY GIVEN, the Grace Breeden, the creditors of and all persons having claims the said deceased, exhibit them with the cessary vouchers within four months after the first of his tice, to said administrator' the Fred Gabriel, in Malta, Phillips County, Montana. Dated December 26th. 1930. H. BREEDEN, Administrator estate of Grace M. Fred Breeden, deceased. Malta, Montana, Attorney 1-Jan. 22)

NOTICE

The Malta National Bank located at Malta ing its affairs. note holders and other creditors of the association are therefore notified the notes and other claims for pay. Dated December 5th, 1930. President. (Dec. 18-Feb. 12)

NOTICE OF ANNUAL MEETING Meeting the shareTrafton Company, Montana, for the purpose efecting Malta, directors for the ensuing year, and to consider any such business as may properly come the meeting fice Malta, Montana the 15th day January, D., 1931, the hours of 10:Secretary. (Dec. 25-Jan.