Click image to open full size in new tab

Article Text

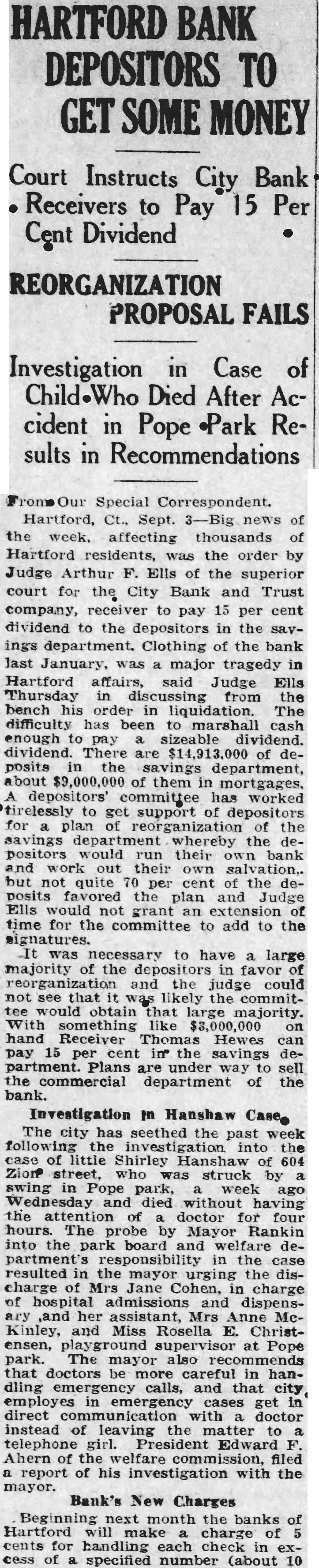

BANKERS TELL HOW THEY MET "RUNS"

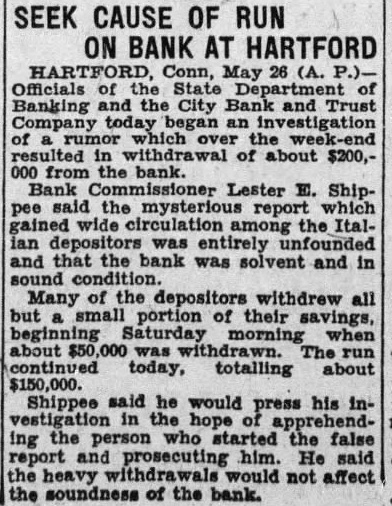

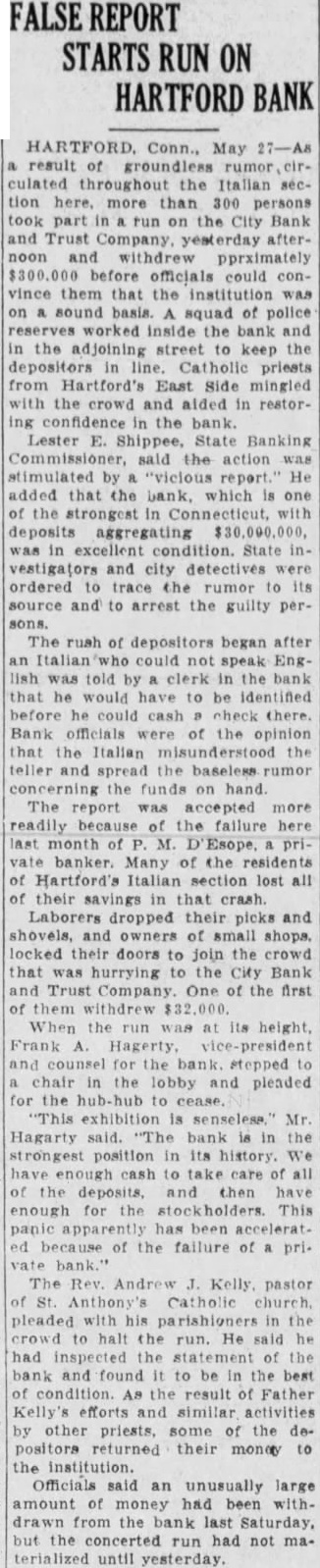

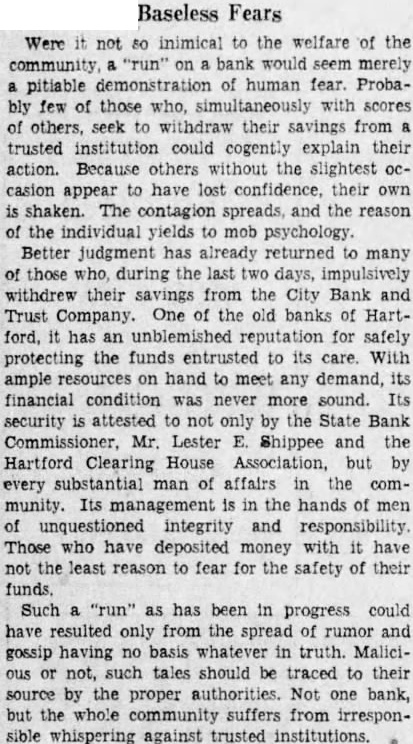

Firsthand dramatic experiences of two large banks which recently dealt successfully with the crises of "runs" made up a large part of the closing session of the eastern regional savings conference held in New York City under the auspices of the Savings Bank Division, American Bankers Association. Officers of the affected institutions gave details as to what a bank should do in case of a "run" and made some practical suggestions us to the prime importance of maintaining at all times the quick liquidity of a bank's assets. Lucius H. Holt, Vice Chairman of the board of the City Bank and Trust Company, Hartford, Connecticut, told of the genesis of a "run" on his bank in the failure of a large unrelated private bank of the Italian quarter which was in a ferment of excitement. As was to be expected, he said, Italian depositors next turned their attention to his institution which had large savings deposis, but was above suspicion. Two incidents, which at the time appeared trifling in themselves, said Mr. Holt, precipitated the run. First, an Italian woman presented her husband's passbook and asked for the balance of about $3,000, but had no written order from him and was told courteously that she would have to have one. She returned to the Italian quarter and spread the report that the bank would not let her have the money. The same morning an Italian man presented a $340 check at the commercial department of the bank, but as he was entirely unknown he was asked to identify himself. He did not understand and rushed out highly excited, also going to the Italian quarter and spreading the report that the bank would not pay him out money on the check. The run started that evening which was a Saturday when normal gains of from $5,000 to $20,000 in deposits, said Mr. Holt, switched to withdrawals of over $56,000. The frightened depositors would not accept checks, but demanded cash, Mr. Holt said. and although with the tremendous resources of the bank there was never the slightest fear of not being able to meet all obligations, there was a practical difficulty in finding enough actual currency to make payments at the rate demanded. Realizing that there was not sufficient on hand even in the other Hartford banks, where the institution had large credits, to meet the situation the bank communicated with its correspondents in New York and Boston. In response an amored automobile with $500,000 in currency arrived from New York and another from Boston with $250,000 Monday morning. The bank also drew from other banks in Hartford as much cash as they could spare and before noon had more than $1,000,000 in actual currency stacked on tables behind the tellers in full view of the depositors under guard of special police. A panicky crowd developed as expected and by the end of the day $557,741 had been withdrawn while deposits had been only $8,459.

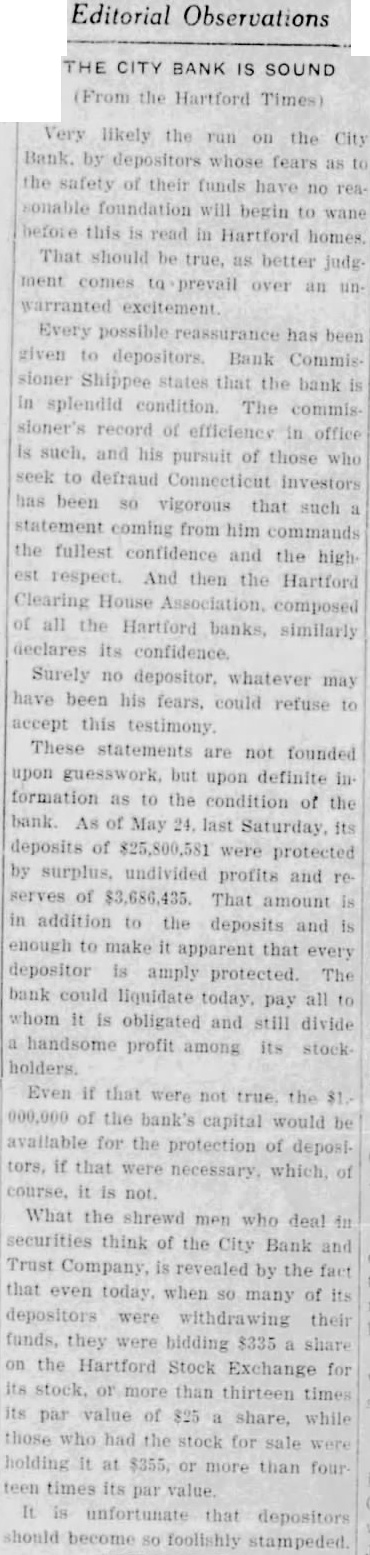

Mr. Holt told how, as news of the unjustified "run" became public, the better informed elements of the city voluntarily declared their faith in the soundness of the institution. Public statements of confidence were issued by the State Bank Commissioner and the Hartford Clearing House Association, which, in a half-page newspaper advertisement, pledged the resources of other member banks to aid the beleaguered bank. The head of a big New York City bank voluntarily sent up $250,000 for deposit and some of the large insurance companies in Hartford sent word that they were ready to assist in any practical manner while many individuals of large means came to the bank with offers of aid. The bank, however, did not have to ask aid of anyone, said Mr. Holt.

"Our own resources were ample and in such liquid form that they could be made available at short notice," he said. "We never even considered the possibility of any use of the 30-day clause. Every depositor had the right to have his money on demand and we prepared to give it to him." The run continued the next day, said Mr. Holt, but the attitude of the bank commissioner, Clearing House Association and many individuals of influence who came and talked with depositors singly and in groups, together with editorials in the daily press and the action of a local radio station that voluntarily interrupted its program several times to broadcast a message of confidence in the bank all served in allaying the fears of the depositors. By closing time that day the line had disappeared from the street, traffic was reopened and even the lobby of the bank was almost clear, he said. The point of first importance, Mr. Holt told the conference, is to keep savings department investments always liquid enough to meet abnormal demands. His institution planned. he said, to have at all times between 40 and 50 per cent of deposits in such a way that they can be realized on immediately. At the time of the "run" it had savings deposits of about $18,000,000 and was in position to realize more than $8,000,000 on bonds and bank stocks within twenty-four hours. On the two days of the "run," he said, it actually needed but little over $1,000,000. Mr. Holt placed second in importance for a bank the acquisition of a circle of good friends, whether clients or not, as illustrated by the effect the friendship of important elements in the community had in restoring confidence in his institution. Also during the "run" it was specially impressed upon the tellers that they must maintain the same spirit of friendliness and courtesy which they maintain during normal times to cheer up worried depositors. One conclusion Mr. Holt drew from his experience was that the liquidation of mortgages in case of necessity is one of the most serious problems confronting banks, declaring that many a bank has failed, not through mismanagement, but through inability to liquidate mortgages. The solution might be through organization of great bank mortgage securities companies, he said, or through a warrantable extension of insurance business. Mr. Holt said well-managed and sound institutions are too