Article Text

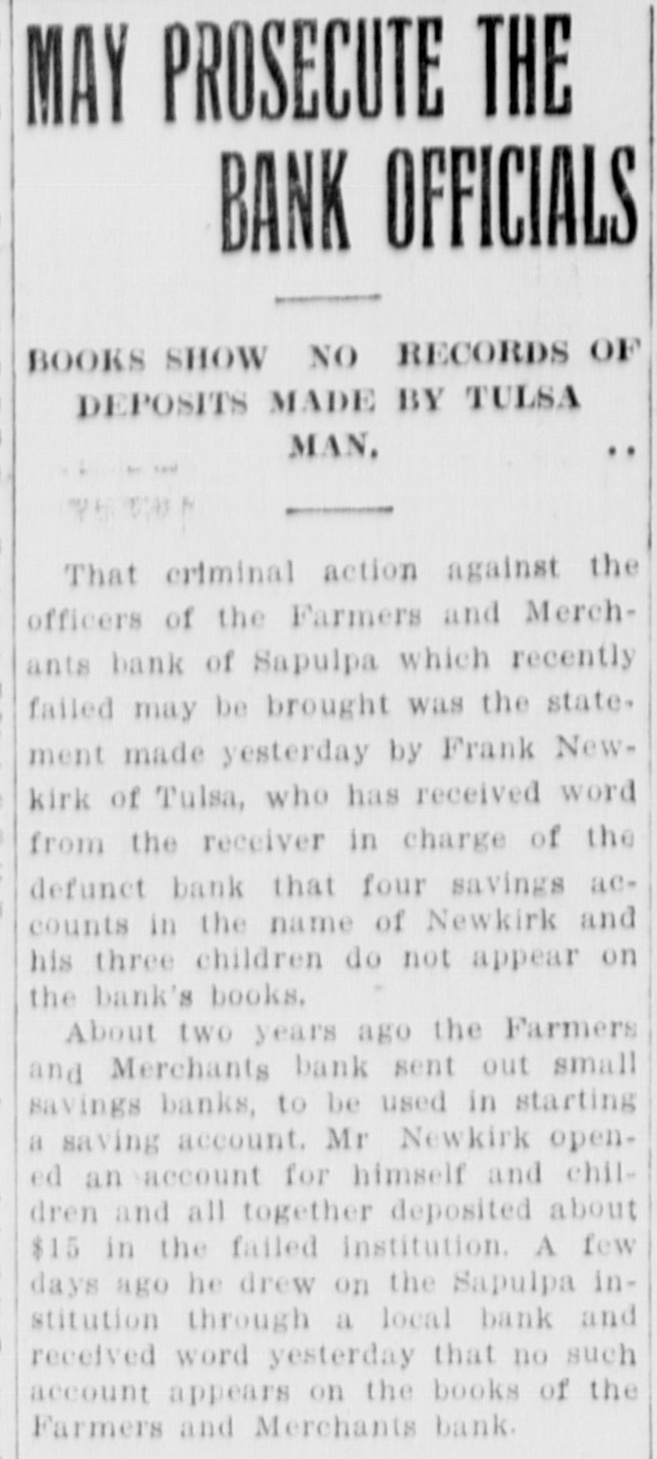

# MAY PROSECUTE THE BANK OFFICIALS BOOKS SHOW NO RECORDS OF DEPOSITS MADE BY TULSA MAN. That criminal action against the officers of the Farmers and Merchants bank of Sapulpa which recently failed may be brought was the statement made yesterday by Frank Newkirk of Tulsa, who has received word from the receiver in charge of the defunct bank that four savings accounts in the name of Newkirk and his three children do not appear on the bank's books. About two years ago the Farmers and Merchants bank sent out small savings banks, to be used in starting a saving account. Mr Newkirk opened an account for himself and children and all together deposited about $15 in the failed institution. A few days ago he drew on the Sapulpa institution through a local bank and received word yesterday that no such account appears on the books of the Farmers and Merchants bank.