Article Text

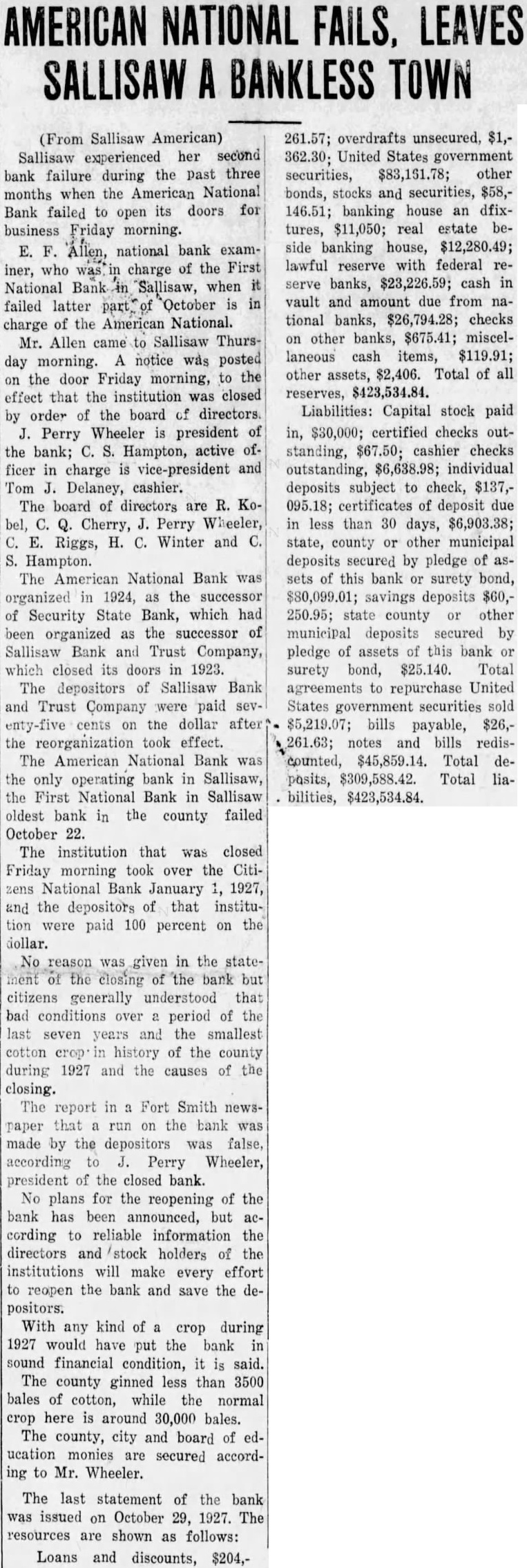

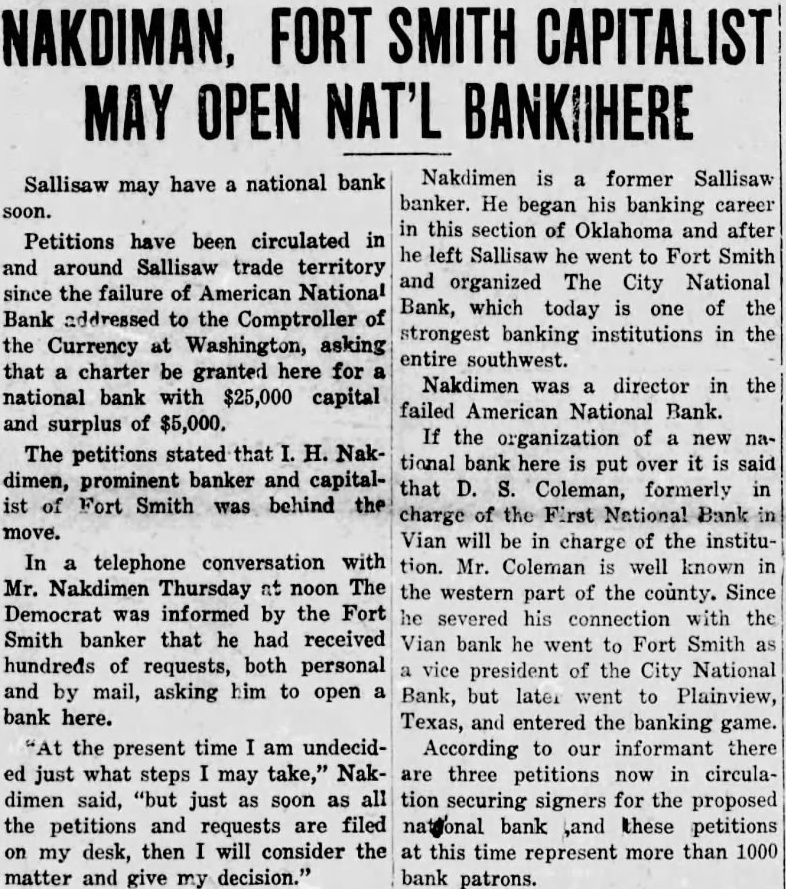

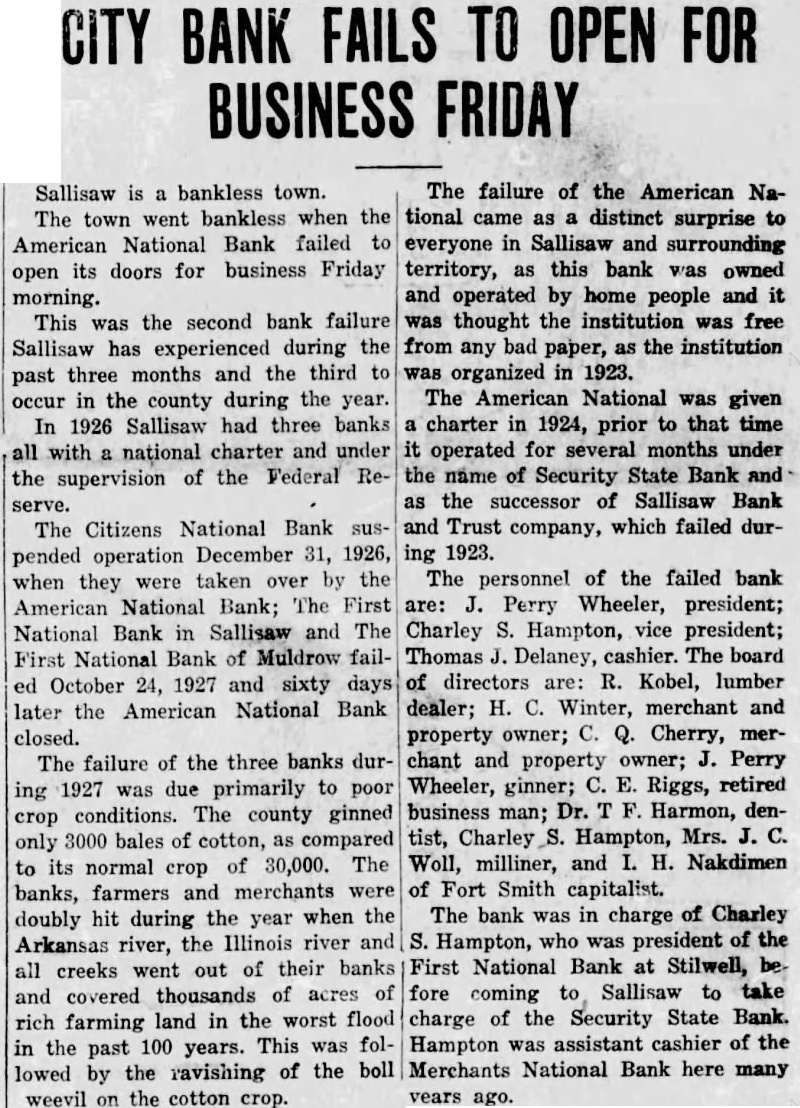

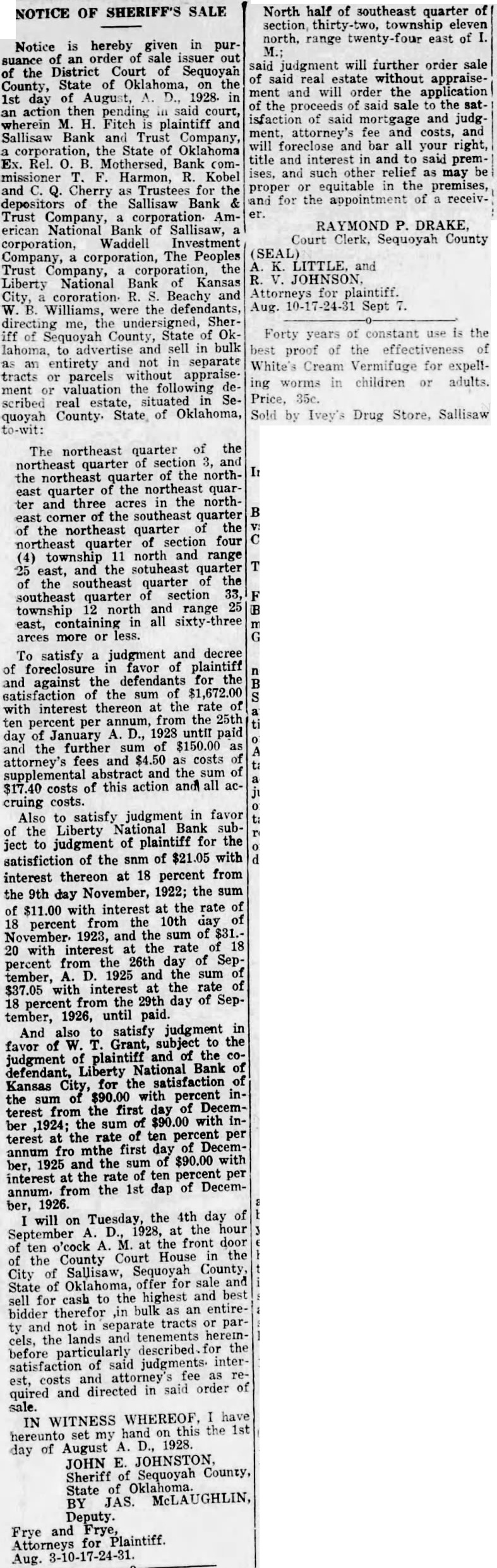

LOOKING OVER OKLAHOMA Labor Omnia Vincit HENRY COUPLE MARRIED 50 YEARS Oct. 27. Married 71. observed their golden wedding anniversary The here Tuesday quietly couple were married October 1877 at have the succeeded in staying out of debt all time and will be glad to live long as the Lord Mr said Clift When they came to Henryetta years as much as brick had been laid in the town. MAKE RECORD RUN TO GET FUNDS FOR BANK SALLISAW Oct. -When the First National bank of Sallisaw and the First National bank of Muldrow were both closed Monday by federal bank examiners. officers of the American National bank of Sallisaw dispatched Walter Hampton, motor dealer, and Ira Holder to Fort Smith to secure extra cash to withstand an expected run on the bank. The two men made the trip to Fort Smith and back of 54 miles, in minutes. and in this time must be included eight minutes spent in bank at Fort Smith. That is, the men rode faster than mile and minute But the money was not needed. No one withdrew dime PIONEER REFINERY TO BE SOLD AT AUCTION GUTHRIE Oct. Want to buy refinery? The Pioneer refinery mile north of Guthrie. will be sold at suction to the highest bidder November Frank Rinehart. chairman of the board of county commistoday The county secured the plant. which represents an of when delinquent taxes were not paid. ADA INTERESTED IN TULSA WEWOKA ROAD ADA. Oct. 27-Ada is watching with Interest being made on a new railway from Tulsa to Wewoka S. Hynds. secretary of the chamber of who accompanied the Tulsa Educational Special train: Ed Gwyn. O. E. Parker and W D.1 Little. members of the board of directors. have been working with interested men in Seminole and Wewoka. Hynds has been at work for several seeking to make Ada stop on the road. Orwig Wewoka, of the new railway company is optimistic that the commerc commission will grant the request for the new road DR. CLAXTON IN MUSKOGEE TODAY MUSKOGEE Oct. 27 Dr. Philander Claxton superintendent Tulsa schools and for eleven years United States commissioner of education, will deliver three addresses in Muskogee today. He will address the Men's Bible class of the Episcopal church. the Rotary club and the patrons of West High school. In company with C. K. Reiff. superintendent of schools, he will visit various city schools here. BANK FAILURE LEADS TO HUGOAN'S BANKRUPTCY HUGO. Oct 27.-To the failure of the Hugo National bank in May, 1925. is partly ascribed the bank ruptcy W. Webb, well known Hugo citizen and property owner. who filed petition in bankruptcy in federal court Muskogee listing liabilities at $359,793 and assets Liabilities consist principally of mortgages held by various banks and to which bank official, he affixed his signature. OKEMAH JUDGE IS HONORED BY BAR Oct 27. District Judge John L. Norman has been honored by the Oklahoma bar in being named secretary of the newly formed association of Oklahoma district and superior court judges Judge John B. Ogden of Ardmore is president and Judge Tom G. Chambers of Oklahoma City, vice president. WHAT THE CHURCHES SHOULD -WILLIAMS OKMULGEE Oct. What we need the money and the work of the churches, not for propaganda to bring congress to make more laws and more offenses, but to put men into office who will enforce the laws we already have," said federal Judge Robert Williams as he held federal The judge is former of Oklahoma. Continuing he said have sold many bottle of morphine for 50 cents back in the days when was not crime to do so, and am sorry for men who go to the penitentiary for the same things no