Article Text

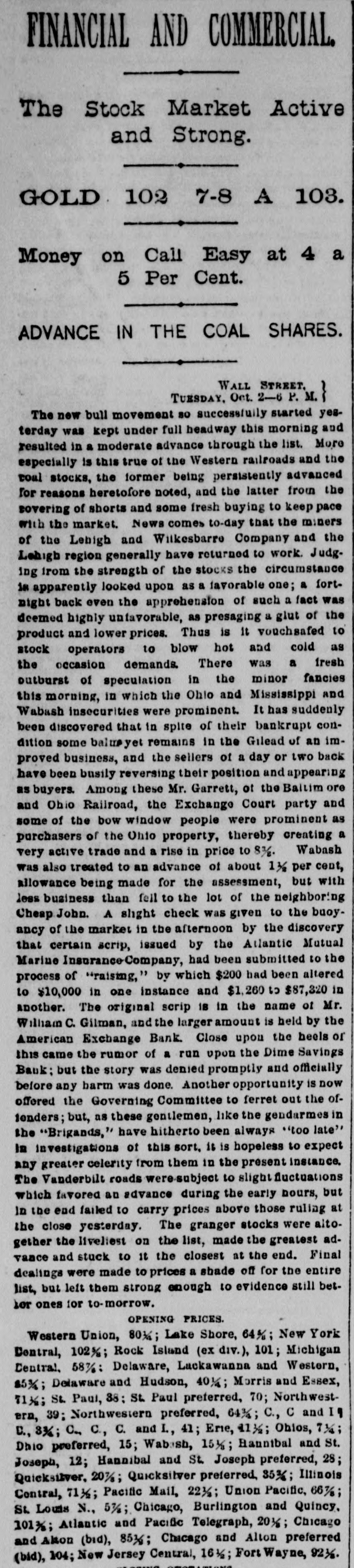

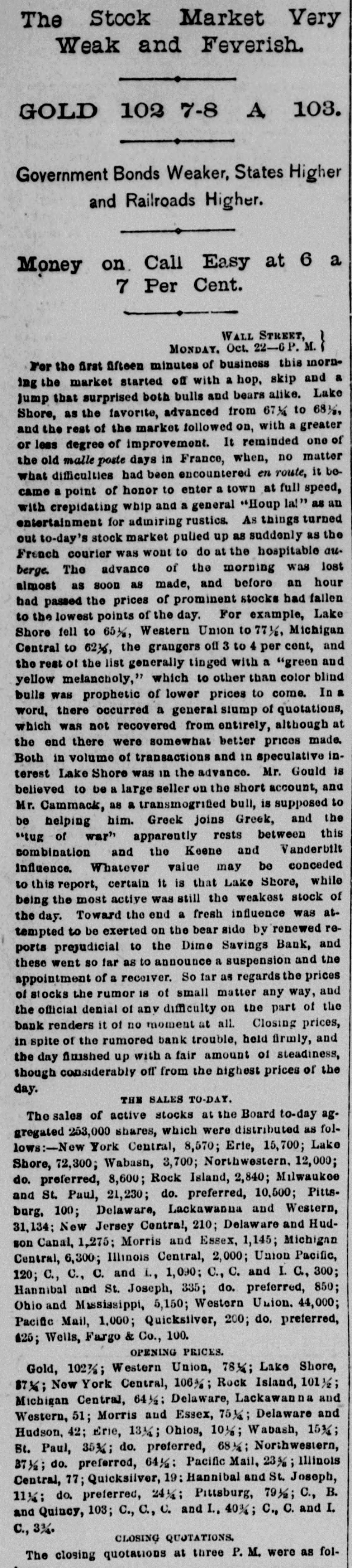

FINANCIAL AND COMMERCIAL. The Stock Market Active and Strong. GOLD 102 7-8 A 103. on Call Easy at 4 a Money 5 Per Cent. ADVANCE IN THE COAL SHARES. WALL STREET. TUESDAY, Oct. 2-6 P. M. The new bull movement so successfully started yesterday was kept under full headway this morning and resulted in a moderate advance through the list. More especially is this true of the Western railroads and the roal stocks, the former being persistently advanced for reasons heretofore noted, and the latter from the covering of shorts and some fresh buying to keep pace with the market. News comes to-day that the miners of the Lehigh and Wilkesbarro Company and the Lehigh region generally have returned to work. Judging from the strength of the stocks the circumstance is apparently looked upon as a favorable one; a fort. night back even the apprehension of such a fact was deemed highly unfavorable, as presaging a glut of the product and lower prices. Thus is it vouchsafed to stock operators to blow hot and cold as the occasion demands. There was a fresh outburst of speculation in the minor fancies this morning, in which the Ohio and Mississippi and Wabash insecurities were prominent. It has suddenly been discovered that in spite of their bankrupt condition some balue yet remains in the Gilead of an improved business, and the sellers of a day or two back have been busily reversing their position and appearing as buyers. Among these Mr. Garrett, ot the Ballim ore and Ohio Railroad, the Exchange Court party and some of the bow window people were prominent as purchasers of the Ohio property, thereby creating a very active trade and a rise in price to 83/8. Wabash was also treated to an advance of about 1 1/2 per cent, allowance being made for the assessment, but with less business than fell to the lot of the neighboring Cheap John A slight check was given to the buoyancy of the market in the afternoon by the discovery that certain scrip, issued by the Atlantic Mutual Marine Insurance-Company had been submitted to the process of "raising," by which $200 had been altered to $10,000 in one instance and $1,260 to $87,320 in another. The original scrip 18 in the name of Mr. William C. Gilman, and the larger amount is held by the American Exchange Bank. Close upon the heels or this came the rumor of a run upon the Dime Savings Bauk: but the story was denied promptly and officially before any harm was done. Another opportunity is now offered the Governing Committee to ferret out the oftenders; but, as these gentlemen, like the gendarmes in the "Brigands," have hitherto been always "too late" In investigations of this sort. it is hopeless to expect any greater celerity from them in the present instance. The Vanderbilt roads were-subject to slight fluctuations which favored an advance during the early hours, but In the end failed to carry prices above those ruling at the close yesterday. The granger stocks were altogether the liveliest on the list, made the greatest ad. vance and stuck to it the closest at the end. Final dealings were made to prices a shade off for the entire list, but left them strong enough to evidence still betfor ones for to-morrow. OPENING PRICES. Western Union, 801/4; Lake Shore, 64%; New York Central, 102%; Rock Island (ex div.), 101; Michigan Central. 58% Delaware, Lackawanna and Western, 85% Delaware and Hudson, 4014; Morris and Essex, 1; St. Paul, 38: St. Paul preferred, 70; Northwestern, 39; Northwestern preferred, 643/; C., C and II C., 33/4; C., c., C. and I., 41; Erie, 11 1/2; Ohios, 734 Dhio preferred, 15; Wabash, 151/2; Hauntbal and St. Joseph, 12; Hannibal and St. Joseph preferred, 28; Qaickstiver, 20% Quicksilver preferred, 35% Illinois Contral, 711/2; Pacific Mail, 221/2; Union Pacific, 66% St. Louis N., 53/2; Chicago, Burlington and Quincy. 101%; Atlantic and Pacific Telegraph, 201/;; Chicago and Akton (bid), 851/2; Chicago and Alton preferred (bid), 104; New Jersey Central, 16 1/2; Fort Wayne, 921/6.