Article Text

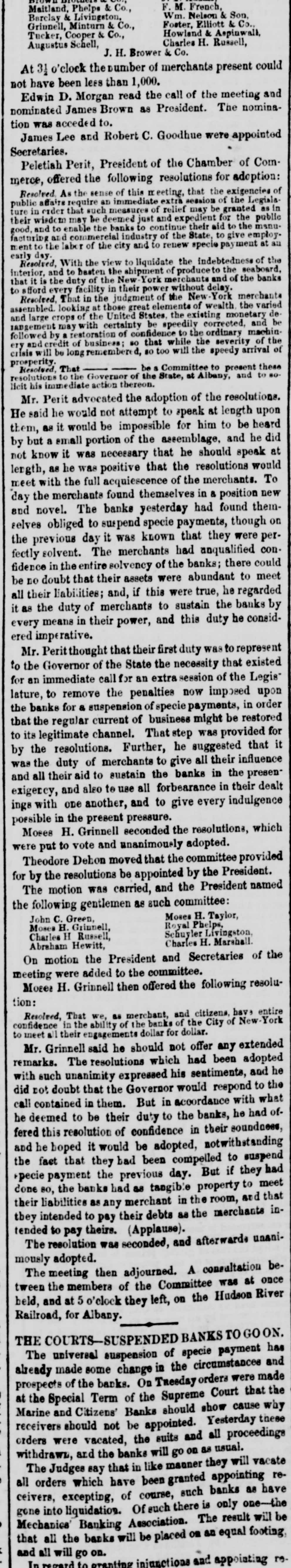

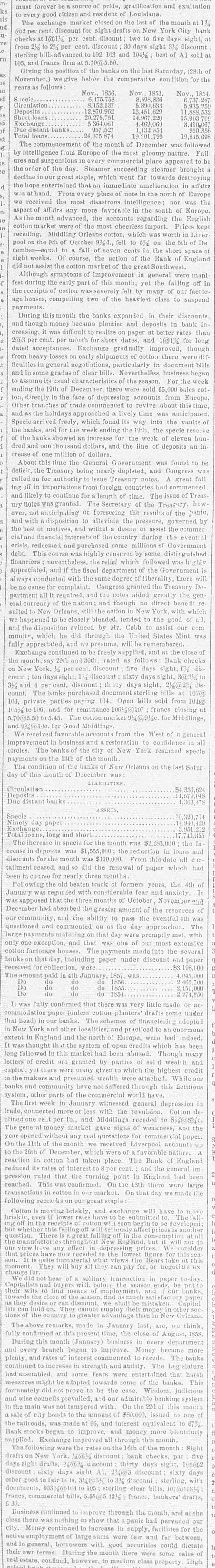

F. M. French, Maitland, Phelps & Co., Wm. Nelson & Son, Barclay & Livingston, Foster, Elliott & Co., Grinnell, Minturn & Co., Howland & Aspinwall, Tucker, Cooper & Co., Charles H. Russell, Augustus Schell, J. H. Brower & Co. At 3½ o'clock the number of merchants present could not have been less than 1,000. Edwin D. Morgan read the call of the meeting and nominated James Brown as President. The nomination was acceded to. James Lee and Robert C. Goodhue were appointed Secretaries. Peletiah Perit, President of the Chamber of Commerce, offered the following resolutions for adoption: Resolved As the sense of this eeting, that the exigencies of public affairs require an immediate extra session of the Legialature in order that such measures of relief may be granted as in their wisdom may be deemed just and expedient for the public good, and to enable the banks to continue their aid to the manufacturing and commercial industry of the State, to give employ. ment to the labor of the city and to renew specio pay ment at an early day. Resolved, With the view to liquidate the indebtedness of the interior, and to basten the shipment of produce to the seaboard, that it is the duty of the New York merchants and of the banks to afford every facility in their power without delay. Resolved, That in the judgment of the New York merchants assembled. looking at those great elements of wealth. the varied and large crops of the United States. the existing monetary de mangement may with certainty be speedily corrected, and be followed by a restoration of confidence to the ordinary machinery and credit of business; so that while the severity of the crisis will be long remembere d, so too will the speedy arrival of prosperity. be a Committee to present these Resolved, That resolutions to the Governor of the State, at Albany, and to solicit his immediate action thereon. Mr. Perit advocated the adoption of the resolutions. He said he would not attempt to speak at length upon them, as it would be impossible for him to be heard by but a small portion of the assemblage, and he did not know it was necessary that he should speak at length, as he was positive that the resolutions would meet with the full acquiescence of the merchants. To day the merchants found themselves in a position new and novel. The banks yesterday had found themselves obliged to suspend specie payments, though on the previous day it was known that they were perfectly solvent. The merchants had anqualified confidence in the entire solvency of the banks; there could be no doubt that their assets were abundant to meet all their liabilities; and, if this were true, he regarded it as the duty of merchants to sustain the banks by every means in their power, and this duty he considered imperative. Mr. Perit thought that their first duty was to represent to the Governor of the State the necessity that existed for an immediate call for an extra session of the Legis lature, to remove the penalties now imposed upon the banks for & suspension of specie payments, in order that the regular current of business might be restored to its legitimate channel. That step was provided for by the resolutions. Further, he suggested that it was the duty of merchants to give all their influence and all their aid to sustain the banks in the presenexigercy, and also to use all forbearance in their dealt ings with one another, and to give every indulgence possible in the present pressure. Moses H. Grinnell seconded the resolutions, which were put to vote and unanimously adopted. Theodore Dehon moved that the committee provided for by the resolutions be appointed by the President. The motion was carried, and the President named the following gentlemen as such committee: Moses H. Taylor, John C. Green, Royal Phelps, Moses H. Grinnell, Schuyler Livingston, Charles H Russell, Charles H. Marshall Abraham Hewitt, On motion the President and Secretaries of the meeting were added to the committee. Mores H. Grinnell then offered the following resolution: Resolved, That we, as merchant, and citizens, have entire confidence in the ability of the banks of the City of New York to meet all their engagements dollar for dollar. Mr. Grinnell said he should not offer any extended remarks. The resolutions which had been adopted with such unanimity expressed his sentiments, and he did not doubt that the Governor would respond to the call contained in them. But in accordance with what he deemed to be their duty to the banks, he had offered this resolution of confidence in their soundness, and he hoped it would be adopted, notwithstanding the fact that they bad been compelled to suspend pecie payment the previous day. But if they had done so, the banks had as tangible property to meet their liabilities as any merchant in the room, and that they intended to pay their debts as the merchants intended to pay theirs. (Applause). The resolution was seconded, and afterwards unanimously adopted. The meeting then adjourned. A consultation between the members of the Committee was at once held, and at 5 o'clock they left, on the Hudson River Railroad, for Albany. THE COURTS-SUSPENDED BANKS TO GO ON. The universal suspension of specie payment has already made some change in the circumstances and prospects of the banks. On Tuesday orders were made at the Special Term of the Supreme Court that the Marine and Citizens' Banks should show cause why receivers should not be appointed. Yesterday these orders were vacated, the suits and all proceedings withdrawn, and the banks will go on as usual. The Judges say that in like manner they will vacate all orders which have been granted appointing receivers, excepting, of course, such banks as have gone into liquidation. Of such there is only one-the Mechanics' Banking Association. The result will be that all the banks will be placed on an equal footing, and all will on. go enting ininnetions and appointing re-