Click image to open full size in new tab

Article Text

Merger Follows Closing of Three Youngstown Banks

Industrial and Commercial Establishments Unite to Aid

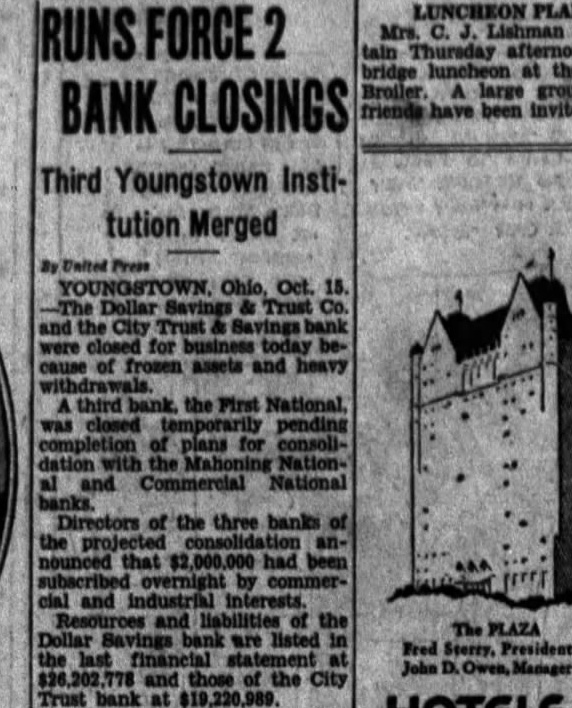

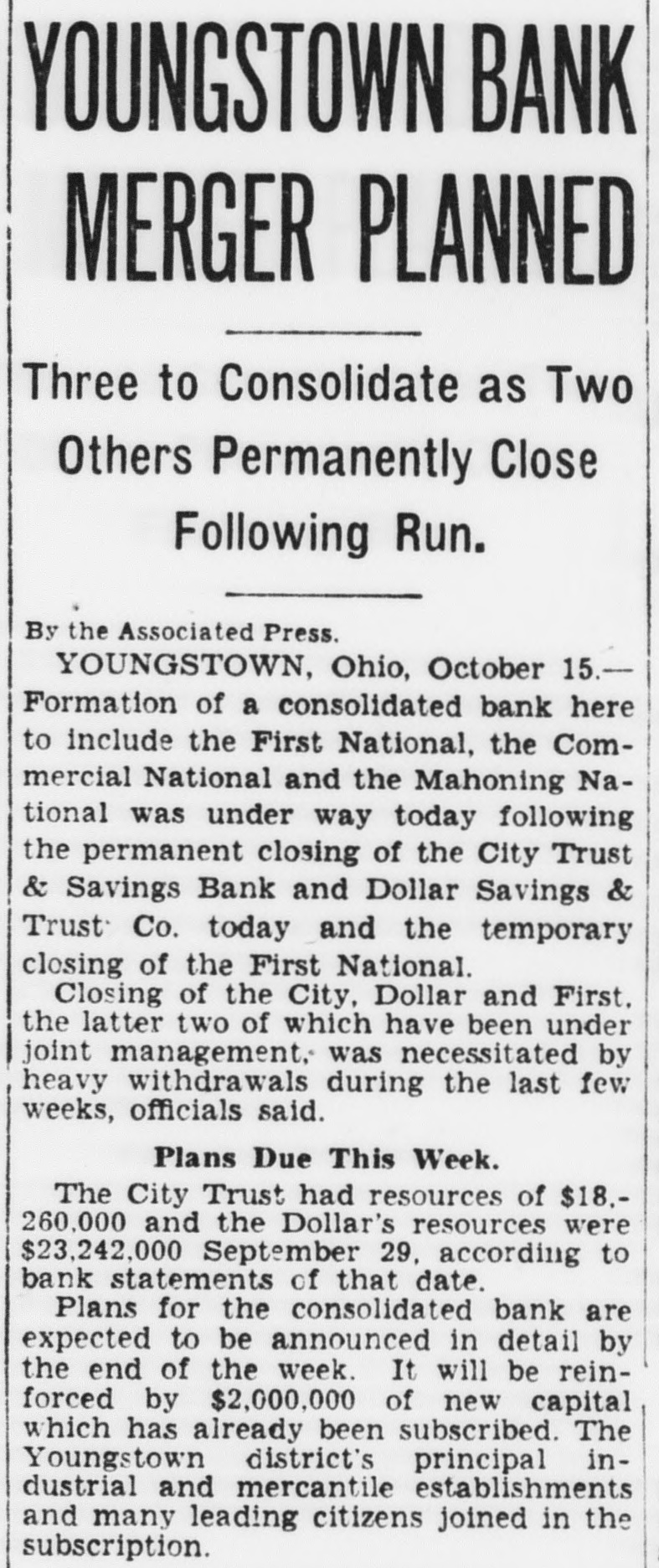

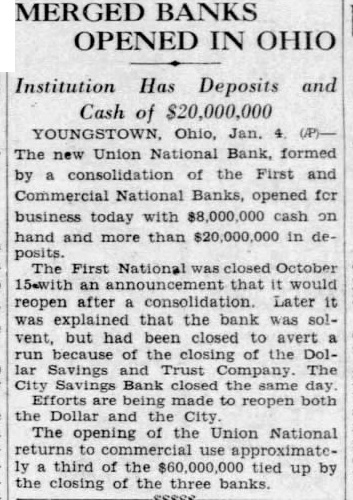

Youngstown, O., Oct. 15 (P)-Formation of a consolidated bank here to include the First National, the Commercial National and the Mahoning National was under way today following the permanent closing of the City Trust and Savings Bank and Dollar Savings and Trust Company today and the temporary closing of the First National. Closing of the City, Dollar and First, the latter two of which have been under joint management, was necessitated by heavy withdrawals during the last few weeks, officials said. The City Trust had resources of $18,260,000 and the Dollar's resources were $23,242,000 Sept. 29, according to bank statements of that Plans for the consolidated banks are expected to be announced in detail by the end of the week It will be reinforced by $2,000,000 of new capital which has already been subscribed. The Youngstown dis trict's principal and mercantile establishments and many leading citizens joined in the subThe First National will remain closee for two or three days. it was announced. until details of the consolidation worked out. Meanwhile the Commercial National and Mahoning National remain open. As soon as the consolidation plan is completed. all three will continue business under one roof. The Mahoning Savings & Trust Company. affiliated with the Mahoning National. will continue as a separate institution. Resources of the merging banks as of Sept. 29 were given follows: First National. $22,782,000: Mahoning National $7,925,000; Commercial. $9,284,000. Resources of the Mahoning Trust were given as $3,181,000.

Jersey Bank Closed Toms River. N. J., Oct. 15 (AP)The Toms River Trust Company did not open its doors today. The notice of the bank's suspension was made public at midnight last night by President A. M. Then who said the heavy withdrawals of State and municipal funds forced the closing. The claims of depositors, President Then declared. would be paid in full.

Pennsylvania Bank Fails West Newton, Pa., Oct. 15 (P)The Farmers & Merchants Bank of West Newton was placed in, the hands of the State Banking Department today. John D. Swigart, chief examiner of the department, said the bank was closed because of heavy withdrawa and to protect depositors. He said deposits totaled about $900,000 and were approximately $1,400,000.

Small Banks Closed Trenton, N. J., Oct. 15 (P)-G. H. Markley. Deputy Commissioner of Banking and Insurance. announced today the Toms River Trust Company and the Wildwood Trust & Title Company had been taken over by his The Wildwood institution held deposits of $761,141 and the Toms River concern $163,591.

Savings Bank Taken Over Tarentum Savings Trust Company was closed today and taken over by the State Banking Department. Examiner John D. Swigart seid the bank had deposits of about $1,800,000 and of $2,300,000. Harrisburg Failure Commercial Trust Company, one of Harrisburg's banks, was taken over today by the State Banking In its last statement the bank listed total resources of $1,606,000 and deposits of $686,000.

12 Southern Failures Columbia. S. C., Oct. 15 (A)Twelve in southwestern South Carolina failed to open their doors today. Albert S. Fant, State Bank Examiner, announced. The banks are the Bank of Western Carolina of Aiken and its nine branches North Augusta, BatesBarnwell, Blackville Lexington and Ellenton and the Bank of Williston and the Bank of Graniteville Assets of the Western Carolina Bank and its branches were placed by Mr Fant at $3,000,000. the Bank of Williston at $350.000 and the Bank of Graniteville at $150,000. Mr. Fant said collections in the banks had been anything but good' and that he advised last night that they not open today.

Closing Stock Prices High High. Low High High. High. Close. 38% Fox Film Purity 1700 Un Freeport Tex 313000 Volume to 2:10 000.000 Yesterday's Sales Radio 9300 Gab Snub Low. High. Low. Close. Radio GenAsphalt Abitibi Baking Raybes 1.60 71% Adams Ex 600 Bronze Reading 22% Adams 100 Cigar Real 26 Wabash Rumely Elec Rem Rand 109% 2100 spl 60 Mot Walworth 10% Foods 10600 Ward Alaska 40 10900 GG&E 1800 Warner 2400 GG&E Reyn Met Warren Alleg Mills Reynolds WarrenF&P Allied Ch 9300 Mot ReynoldsTB 3814 Wesson Oil Allis Chalm 103% Mot Richfield West Amal Leather. 1200 Dairy Amerada 29% Western Pac AmBkNote GenR&U Rutland West Pac West Union C&Fdy Gillette Safeway WestghseAB Tiling Gimbel 30% Westgh AmEurope GimbelBr Weston E1 Glidden WestvacoCh Gobel Adolf Southw. Wheel AmHide&L GoldDust Schulte White Goodrich Seabd A WhiteRk Internat Goodyear Goodyr 2½ Wilson AmM&F Gould Nat In Wilson Co Servel Inc Woolwth Grand-Sil Worthington 24 AmP&L Grand Shatt 80% 50% Wrigley Grant Shell Un GtNorth Shubert Thea Am Republics 3% Yellow Truck. 600 6% 1% Grigsby Gru. Simmons 78 19 Youngstown 100 22 22 22 Simms Pet Saf Hackn Sinclair 1% 14 Zonite Pr 1300 Helme SkelO Smelt Sales later edition Hershey Hollnd Dividend. Ex-Rights. And Extras. And Extras AmSol&C Homestake7.80 able Stock. Including Payable Cash Stock Paid year Houdail-H rate. Lows close. South Dividend and Ex Rights deducted carried from net change. HouseF Houston Howe Snd Spaiding Hudson Spencer DAILY MARKET MOVEMENT 13½ 3½ Hupp Mot Spicer 132 112 Spiegel 1/2 ON N. Y. STOCK EXCHANGE 80% 10000 89 Central 1300 1/2 79 Std Indian Ref Wool Indust 1/2 The following table shows the number of advances, 8% 2% StdOCal Ingersoll 50 12% Anaconda StdOExp declines 1931 and the issues unchanged. together with new Inland Stl highs 36 2.40 and lows: Anchor Inspiration Archer Un- New New Sterling Armour Gain Loss changed Total Sterling High 2% Armour Oct. 21% Stewart 84 409 92 585 Interlake 14 29% Asso Stone&Web 98 AssoDG Studebak Oct. 10 203% Atchison Carrier 40% Superht Atchison IntHarvst 23% Oct. 9½ 2% Tenn Corp Powd IntMatch Texas Corp AuburnAut IntNickCa 193 Aviation Paper Tex Paper 27% Baldwin Third Balt 410400 10500 ThirdN1 Barnsdall 398 Interst 81 Beatrice 326 Investors Eq 100 Timken BeatriceCr pf7 181/2 18 Transam 80% Trans 36 Jewel Tea 30 29 29 Bendix Tri-Cont Johns-Man 12600 Tri-Cont 88 Trico 86 123% Kan City Knox 64 728 33% 3½ Twin 20% Kaufm Borden Kayser Ulen 30% 9% Kelly 3% Botany Mills. Kelsey 206 22% Kelvinator 155 24½ Briggs 10 Kennecott 190 69% Kinney Kresge 12(S) 27% 9300 UnTKCar 15 3% Bruns Balke. KrogerGroe 115 BrunsTerRy UnAir&T 20% Bucyrus 91 Biscuit Bucyrus Sept. Carbon Budd Mfg Lenigh 45 Lehigh UnitedCor Sept. 15% Bulova Lehman UnitedCor Sept. 15% Butte LigMyers 18 Butte Sup. Loco (S)202 69% 12% Byers Co Liquid Carb Inc Loose-W 11% 3½ Hec US&ForS Lorillard 16% Camplw&C USGypsm Lorillard 45 CanadaDry Lou-Nash (S) Can Pac Alcohol. 19 Ludlum su

Case 36700 USPipe 36 McCallCor 25% CentAgur 51% McCrory 100 Rubber. Century McKspt USSmelting Cerro Cop McKess Cert McK&R Checker Cab. McLellan St 150 114 700 1231/2 Ches & O Mack Truck Chesap Macy Co British Reserve MarshallF ChiMSP&P Mathieson Store Shows Increase Maytag 35 Maytag 50 Melville London. Oct. 15 (A)-The weekly Miami Cop statement of the Bank of England City Stores Cont Pet. 22% Squip Minn M P. shows the following changes in Kan pounds: Pacific Total reserve increased 2,794,000: Pac circulation decreased 2,615,000; bulMonsan Mont Ward lion increased 179,000: other securities decreased 1,760,000: public deCarbon posits increased 3,847,000; other deMotor Prod ComCred Motor Wh posits decreased 9,329,000; notes re35% 20 Mullins 10 serve increased 2,734,000; govern34 Munsingwr 18% Murray Cor ment securities decreased 6,500,000. The proportion of the bank's re100% Com&So Nash 40% Mot 20 19 serve to liability is percent 14% 37% 20 Consol compared with 36.96 last week. Rate Bis 3% Cons of discount percent. NatCasnR 109% Consol Pr 107 Consol Dept French Bank Statement 15% Cons Distill 20 Parts, Oct. 15 The weekly 1% Radiator statement of the Bank of France 30 Steel shows the following changes in 3% Supply francs: 40 Cont Surety sellers Gold increased 726,000,000 sight Nevada Cp balances abroad increased 898,000.NYCentral 000; bills discounted home increased 778,000,000 bills bought Cont Motors. NYNH&H abroad increased 153,000,000 adCont NYNH&H Cont vances decreased 72,000,000: circulaOnt 86% tion increased 334,000,000 current 18 Coty Noranda 1200 20 Rate of discount 2% percent. 34% 25 CrC&C 217 Crucible Am 100 Curtis Am Grain and Provisions 118% CurtisPu pf Am 5% Curtiss Pacific 60% CHICAGO BOARD OF TRADE Curties Previous Ohio on 1400 Open. High Low. Close Close 23 Davison 5% Wheat Oliver 13% Deere Omnibus Dec 49% 50% 49% 50% 50% 93 Hud Otis DelLack&W Mch 52% 53 102 Steel 45% Den&RioG May 55 53% 54% 54% Detroit Corn Match Light 34% 35 35 6% Dome Mines Packard 37 36% 24 37% Dresser May 39 39% Dresser Oats 78% 42% Drug Parmelee Tr. Duluth 22% 21% 21% Pathe Dunhill Int. May 24% 24% 25 Pathe Dupont 26500 Patino Mines Rye 124% 109 Dupont db 110 Penick Dec. 38% 38% 39 38% May 41% 42 41% 41% 185% 93 Eastman 5600 108 103 Dix 21% Eaton Lard 69 149 Dec. 6.55 6.55 6.47 6.50 6.47 20 Auto 1% Co Phelps Phillips Pet Produce Exchange Stocks 66 Pierce 60% 16% 12900 High Pierce Pet 45% Admir Alas Pillsbury Pitts Coal Juneau 35% 18% EquitBldg Coal 39% 10% Erie Come Cumulative Engle Bird 49% 26 FedL&T Prairie Motor 7% Prairie Mining 30 FedWatS Imperial 63 = 2½ 10214 Tire Serv Western Tel PullmanCor TOTAL 18 FourthNI Oil 700 Stocks