Click image to open full size in new tab

Article Text

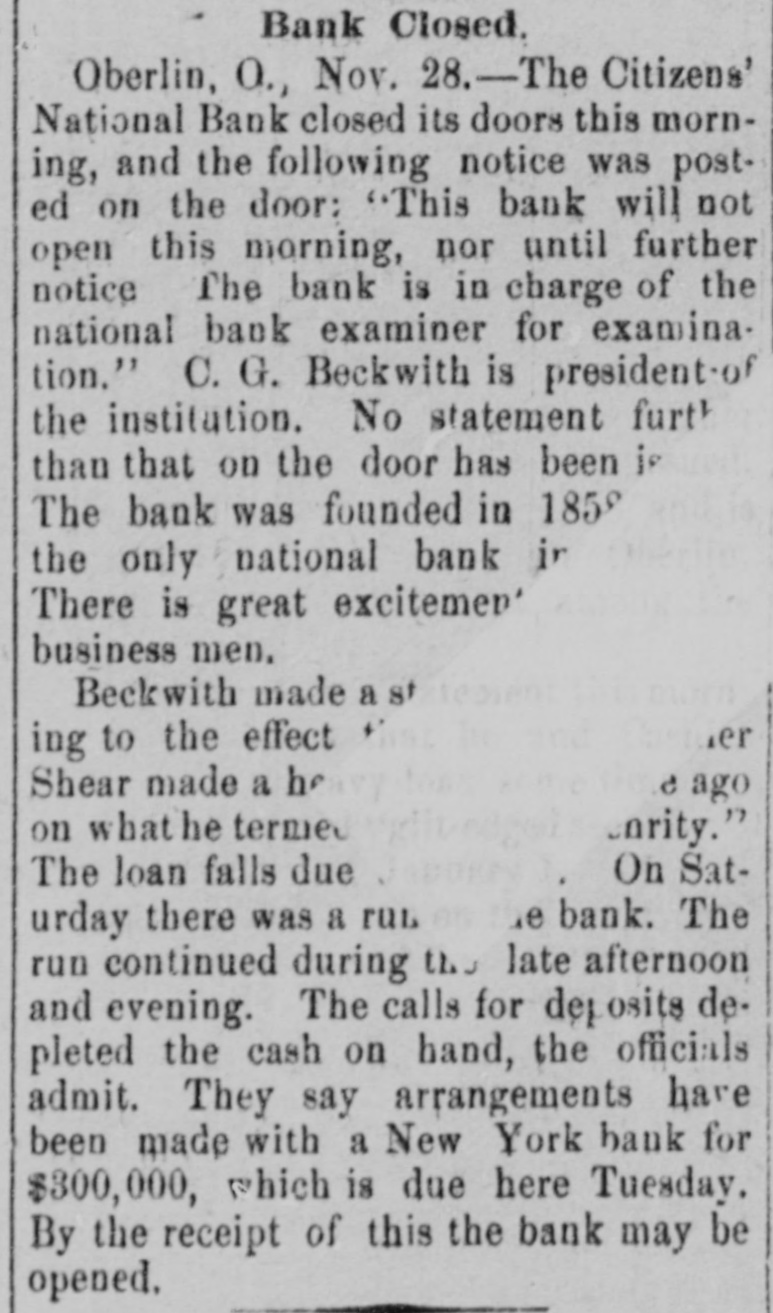

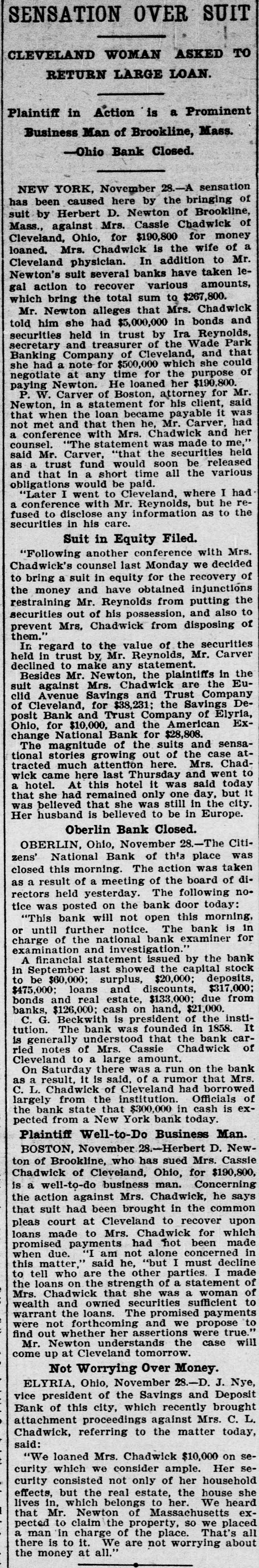

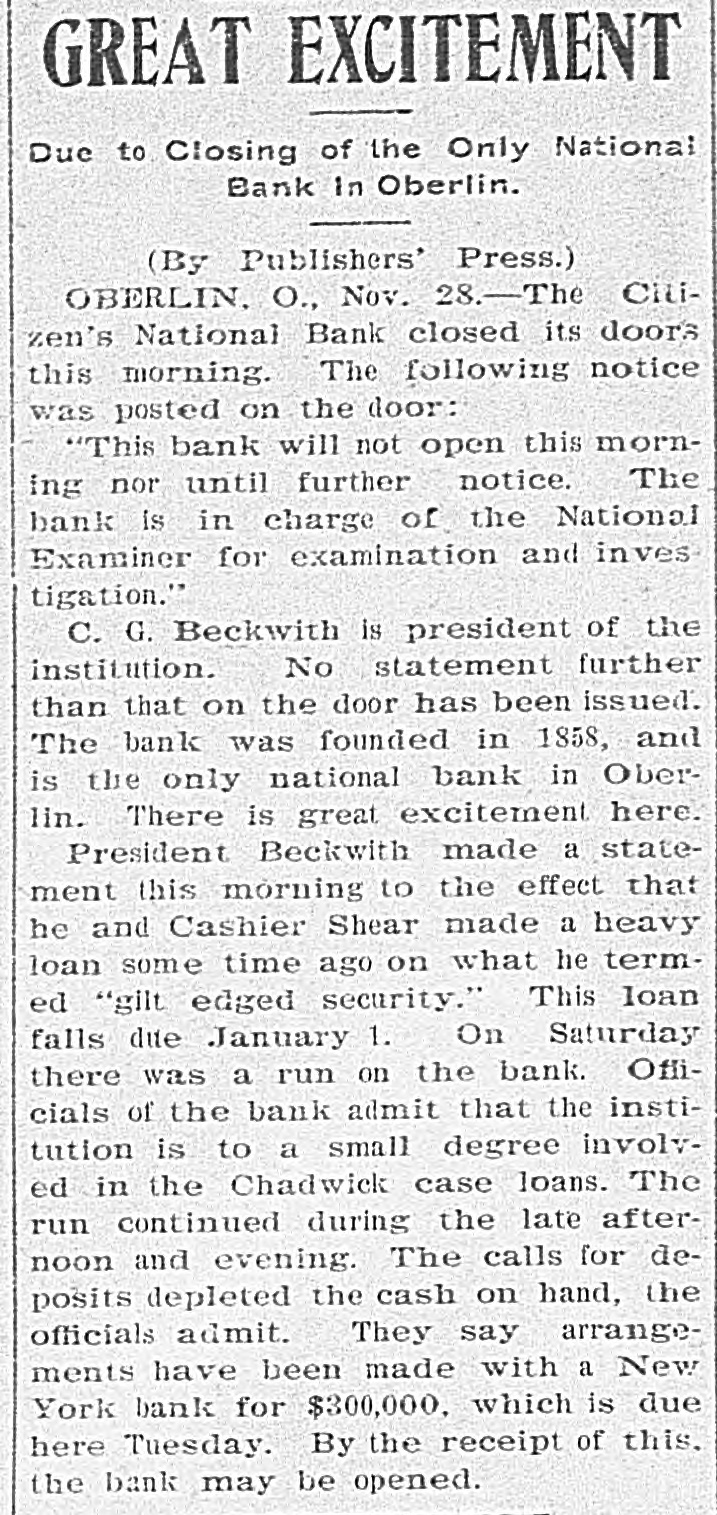

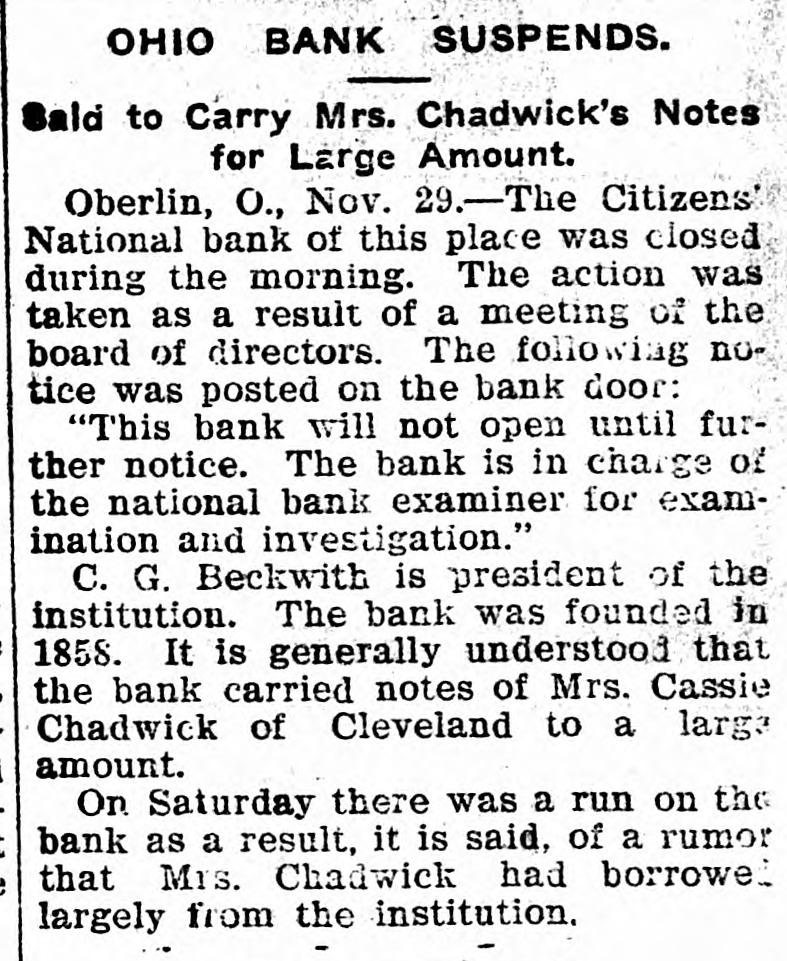

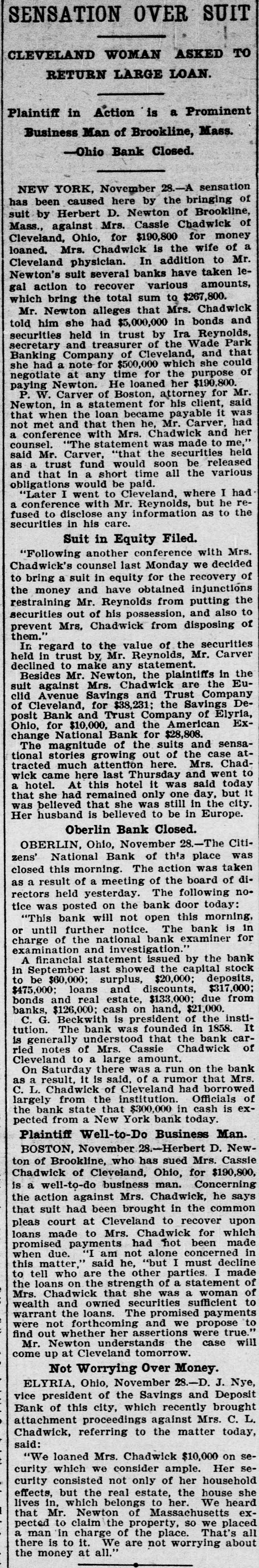

SENSATION OVER SUIT CLEVELAND WOMAN ASKED TO RETURN LARGE LOAN. Plaintiff in Action is a Prominent Business Man of Brookline, Mass. -Ohio Bank Closed. NEW YORK, November 28.-A sensation has been caused here by the bringing of suit by Herbert D. Newton of Brookline, Mass., against Mrs. Cassie Chadwick of Cleveland, Ohio, for $190,800 for money loaned. Mrs. Chadwick is the wife of a Cleveland physician. In addition to Mr. Newton's suit several banks have taken legal action to recover various amounts, which bring the total sum to $267,800. Mr. Newton alleges that Mrs. Chadwick told him she had $5,000,000 in bonds and securities held in trust by Ira Reynolds, secretary and treasurer of the Wade Park Banking Company of Cleveland, and that she had a note for $500,000 which she could negotiate at any time for the purpose of paying Newton. He loaned her $190,800. P. W. Carver of Boston, attorney for Mr. Newton, in a statement for his client, said that when the loan became payable it was not met and that then he, Mr. Carver, had a conference with Mrs. Chadwick and her counsel. "The statement was made to me," said Mr. Carver, "that the securities held as a trust fund would soon be released and that in a short time all the various obligations would be paid. "Later I went to Cleveland, where I had a conference with Mr. Reynolds, but he refused to disclose any information as to the securities in his care. Suit in Equity Filed. "Following another conference with Mrs. Chadwick's counsel last Monday we decided to bring a suit in equity for the recovery of the money and have obtained injunctions restraining Mr. Reynolds from putting the securities out of his possession, and also to prevent Mrs. Chadwick from disposing of them." In regard to the value of the securities held in trust by Mr. Reynolds, Mr. Carver declined to make any statement. Besides Mr. Newton, the plaintiffs in the suit against Mrs. Chadwick are the Euclid Avenue Savings and Trust Company of Cleveland, for $38,231; the Savings Deposit Bank and Trust Company of Elyria, Ohio, for $10,000, and the American Exchange National Bank for $28,808. The magnitude of the suits and sensational stories growing out of the case attracted much attention here. Mrs. Chadwick came here last Thursday and went to a hotel. At this hotel it was said today that she had remained only one day, but it was believed that she was still in the city. Her husband is believed to be in Europe. Oberlin Bank Closed. OBERLIN, Ohio, November 28.-The Citizens' National Bank of this place was closed this morning. The action was taken as a result of a meeting of the board of directors held yesterday. The following notice was posted on the bank door today: "This bank will not open this morning, or until further notice. The bank is in charge of the national bank examiner for examination and investigation." A financial statement issued by the bank in September last showed the capital stock to be $60,000; surplus, $20,000; deposits, $475,000; loans and discounts, $317,000; bonds and real estate, $133,000; due from banks, $126,000; cash on hand, $21,000. C. G. Beckwith is president of the institution. The bank was founded in 1858. It is generally understood that the bank carried notes of Mrs. Cassie Chadwick of Cleveland to a large amount. On Saturday there was a run on the bank as a result, it is said, of a rumor that Mrs. C. L. Chadwick of Cleveland had borrowed largely from the institution. Officials of the bank state that $300,000 in cash is expected from a New York bank today. Plaintiff Well-to-Do Business Man. BOSTON, November 28.-Herbert D. Newton of Brookline, who has sued Mrs. Cassie Chadwick of Cleveland, Ohio, for $190,800, is a well-to-do business man. Concerning the action against Mrs. Chadwick, he says that suit had been brought in the common pleas court at Cleveland to recover upon loans made to Mrs. Chadwick for which promised payments had not been made when due. "I am not alone concerned in this matter," said he, "but I must decline to tell who are the other parties. I made the loans on the strength of a statement of Mrs. Chadwick that she was a woman of wealth and owned securities sufficient to warrant the loans. The promised payments were not forthcoming and we propose to find out whether her assertions were true." Mr. Newton understands the case will come up at Cleveland tomorrow. Not Worrying Over Money. ELYRIA, Ohio, November 28.-D. J. Nye, vice president of the Savings and Deposit Bank of this city, which recently brought attachment proceedings against Mrs. C. L. Chadwick, referring to the matter today, said: "We loaned Mrs. Chadwick $10,000 on security which we consider ample. Her security consisted not only of her household effects, but the real estate, the house she lives in, which belongs to her. We heard that Mr Newton of