Article Text

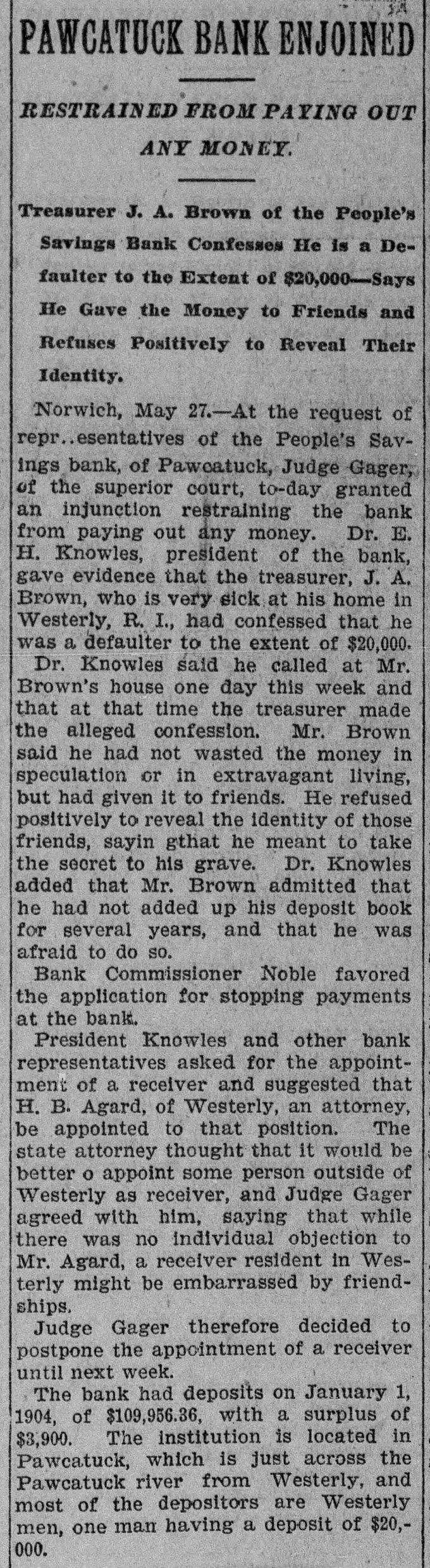

CONDENSED DISPATCHES. Notable Events of the Week Briefly Chronicled. Rear Admiral Robley D. Evans has sailed from Hongkong on his way home. The bubonic plague caused 40,527 deaths in India in the week ending March 19. The Vatican authorities ridicule the report of a threat against the life of Pope Pius X. A trolley car was burned up in a New York suburb before the firemen could reach it. It is reported in Alexandria, Egypt, that the khedive may visit the St. Louis exposition. The People's Savings bank of Pawcatuck, Conn., has suspended payment and will go into liquidation. The soldiers on Governors island, New York, may appeal to Secretary of War Taft because of severe discipline. Dowager Queen Margherita of Italy met Emperor William at sea off Gaeta and had lunch with him on his yacht, the Hohenzollern. The United States district court at St. Louis did not pass sentence upon Senator Burton of Kansas, convicted of having made improper use of his influence as a senator. Motion for arrest of judgment filed. Tuesday, March 29. The ameer of Afghanistan, reported poisoned, is alive and well at Kabul. Four workmen were killed in a tunnel near Brownsville, Pa., by a dynamite explosion. The Smoot case will reopen April 12 at Washington, with Mormon church officials as witnesses. The Passion play was given in Chicago for the first time by members of the Roman Catholic church. The Macedonian situation is better, and the sultan is believed to be about to accept Austro-Russian reforms. Governor Murphy has signed the child labor bill, which passed both houses of the New Jersey legislature. Charles M. Schwab at New York swore off an assessment of $100,000 on his personalty, but agreed to pay on $5,000. Parker Dexter, aged eleven, mysteriously shot at his home. Randolph, Mass., died without regaining consciousness. The Jones & Laughlin Steel company has been enjoined from SO operating its Pittsburg plant as to injure surrounding property by ore dust. The steamer Alliance, which has arrived at Marshfield, Ore., reports picking up a large boat belonging to the British ship La Morna of Greenock which is supposed to have foundered during a recent storm. Bankers and business men of Baltimore control a company incorporated in Massachusetts for the unique pur pose of furnishing classic and ragtime music to New England homes just as gas and water are supplied. The mu sic will be sent over wires by the tele phone method. The manuscript of Milton's "Para dise Lost," which was offered for sale at public auction in London, but which was withdrawn because the reserve d price of £5,000 was not offered, has now been sold to an American collect or whose name and the amount paid are not disclosed. The president has granted a ful ir pardon to Servillano Aquino, the brig adier general in the Philippine insur il gent army who was sentenced by : n military commission to a long term o of imprisonment for having ordered the summary execution of five America prisoners during the insurrection in the Philippines. at Monday, March 28. A cyclone in the island of Mauritiu has killed ninetri and dene