Article Text

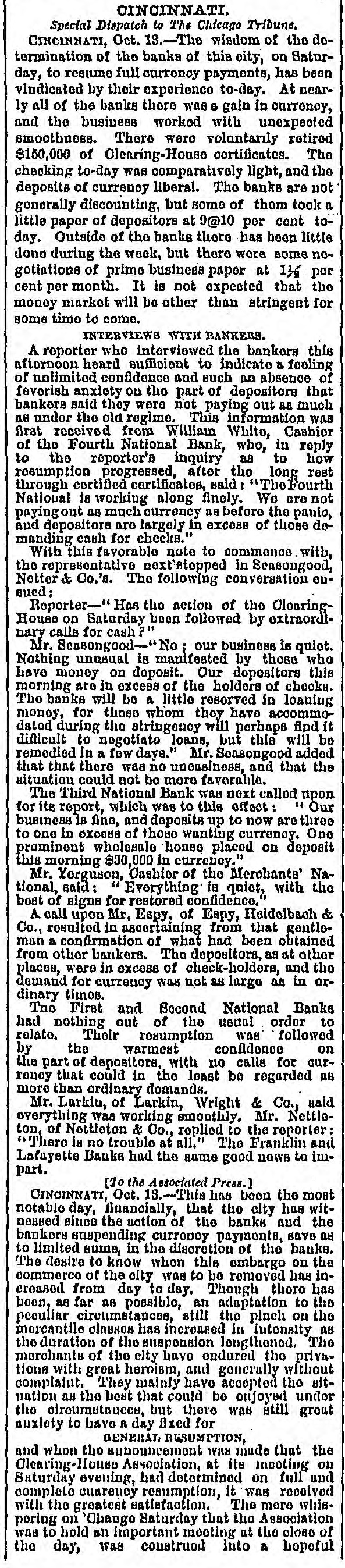

CINCINNATI. Special Dispatch to The Chicago Tribune. CINCINNATI, Oct. 13.-The wisdom of the dotermination of the banks of this city, on Saturday, to resumo full currency payments, has been vindicated by their experience to-day. At nearly all of the banks there was B gain in currency, and the business worked with unexpected smoothness. There were voluntarily retired $150,000 of Clearing-House certificates. The checking to-day was comparatively light, and the deposits of currency liberal. The banks are not generally discounting, but some of them took a little paper of depositora at @@10 per cont today. Outaldo of the banks there has been little done during the week, but there were some nogotiations of primo business paper at 11/4 por cent per month. It is not expected that the money market will be other than stringent for some time to come. INTERVIEWS WITH BANKERS. A reporter who interviewed the bankers this afternoon heard sufficient to indicate a feeling of unlimited confidence and such an absence of feverish anxiety on the part of depositors that bankers said they were not paying out as much as undor the old regime. This information was first received from William White, Cashier of the Fourth National Bank, who, in reply to the reporter's inquiry as to how resumption progressed, after the long rest through certified certificates, said: TheFourth National is working along finely. We are not paying out as much currency as before the panic, And depositors are largely in excess of those demanding cash for checks." With this favorable note to commence with, the representative 'stopped in Seasongood, Netter & Co.'s. The following conversation enBued Reporter-' Has the action of tho ClearingHouse on Saturday been followed by extraordlnary calls for cash Mr. Seasongood-" our business is quiet. Nothing unusual is manifested by those who have money on deposit. Our depositors this morning are in excess of the holders of checks. The banks will be a little reserved in loaning money, for those whom they have accommodated during the stringency will perhaps find it difficult to negotiato loans, but this will bo remodied in a few days." Mr. Seasongood added that that there was no uneasiness, and that the situation could not be more favorable. The Third National Bank was next called upon for its report, which was to this effect: Our business is fine, and deposits up to now are three to one in 0XC088 of those wanting currency. One prominent wholesale house placed on deposit this morning 830,000 in currency." Mr. Yerguson, Cashier of the Merchants' National, said: " Everything is quiet, with the best of signs for reatored confidence." A call upon Mr. Espy, of Eapy, Holdelbach & Co., resulted in ascertaining from that gentleman a confirmation of what had been obtained from other bankers. The depositors, as at other places, were in excess of check-holders, and the demand for currency was not as largo as in ordinary times. Tno First and Second National Banks had nothing out of the usual order to rolato, Their resumption was followed the confidence on warmest by the part of depositore, with no calls for aurronoy that could in the least be regarded as more than ordinary domands. Mr. Larkin, of Larkin, Wright & Co., Hald everything was working smoothly. Mr. Nettleton. of Nettleton & Co., replied to the reporter: There is no trouble at all. The Franklin and Lafayette Banks had the same good news to impart. [70 the Associated Press.] CINCINNATI, Oct. 13.-This has been the most notable day, financially, that the city has witnessed since the notion of the banks and the bankers suspending currency payments, save as to limited sums, in the discretion of the banks. The desiro to know when this embargo on the commerce of the city was to be removed has increased from day to day. Though thoro has been, as far as possible, an adaptation to the peouliar circumstances, still the pinch on the moreantile classes has increased in intensity as the duration of the suspension longthened. The merchants of the city have endured the privatious with great heroism, and generally without complaint. They mainly have accepted the situation as the best that could be onjoyed undor the circumstances, but there was still groat auxiety to have A day fixed for GENERAL RESUMPTION, and whon the announcement WAS made that the Clearing-House Association, at its meeting on Saturday evening, had determined on full and completo cuarency resumption, It was received whiswith the greatest satisfaction. The more pering on Change Saturday that the Association was to hold an important meeting at the close of the day, was construed into a hopeful