Article Text

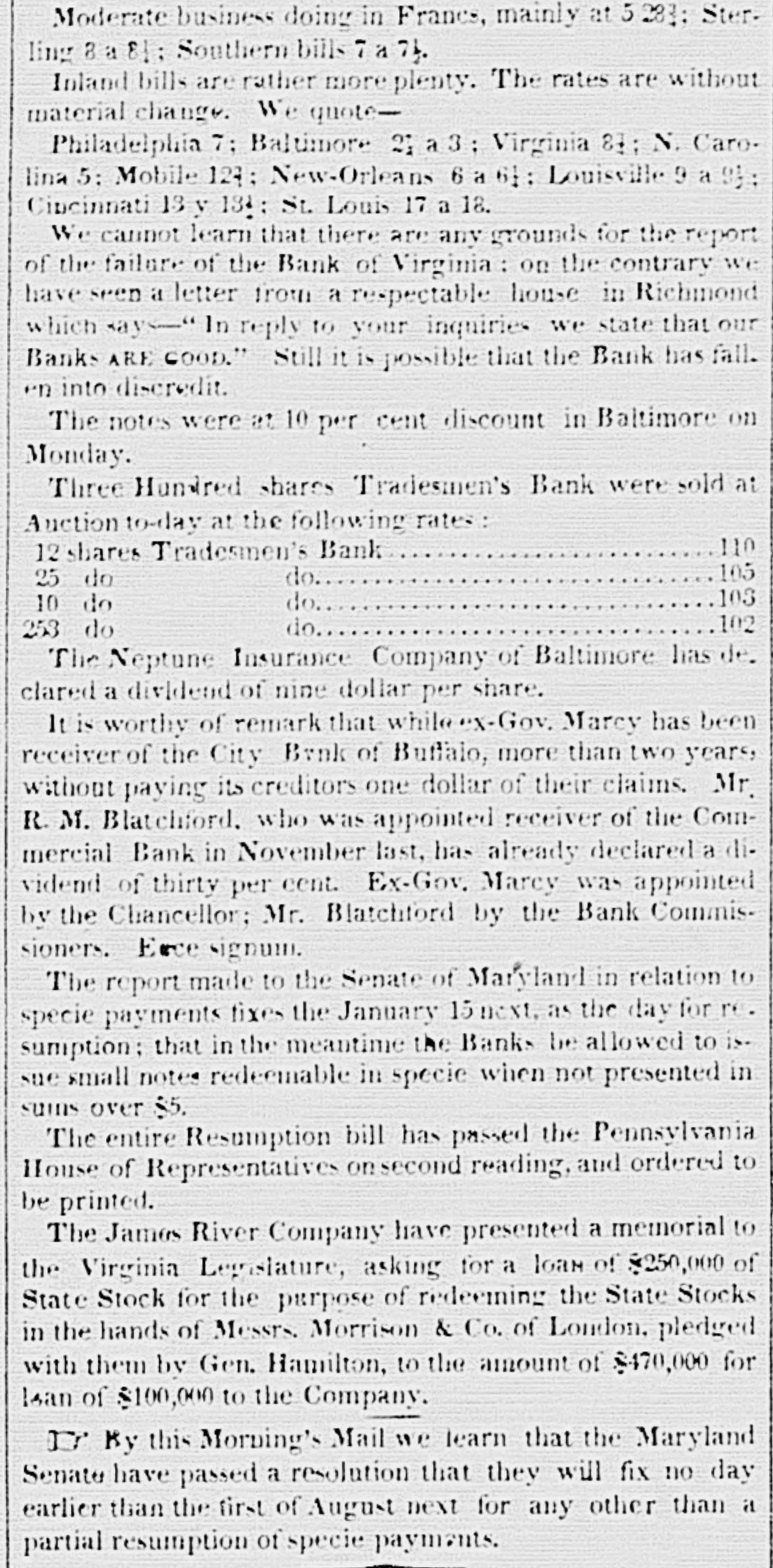

Moderate business doing in Francs, mainly at 5 283; Sterling 8 a 81; Southern bills 7 a 71. Inland bills are rather more plenty. The rates are without material change. We quote- Philadelphia 7; Baltimore 21 a 3; Virginia 81; N. Carolina 5: Mobile 124; New-Orleans 6 a 61; Louisville 9 a 95; Cincinnati 13 y 184: St. Louis 17 a 18. We cannot learn that there are any grounds for the report of the failure of the Bank of Virginia: on the contrary we have seen a letter from a respectable house in Richmond which says" In reply to your inquiries we state that our Banks ARE COoD." Still it is possible that the Bank has fallen into discredit. The notes were at 10 per cent discount in Baltimore on Monday. THREE HUNDRED SHARES TRADESMEN'S BANK WERE SOLD AT AUCTION TO-DAY AT THE FOLLOWING RATES: 12 shares Tradesmen's Bank 110 25 do do 105 10 do do 103 253 do do 102 The Neptune Insurance Company of Baltimore has declared a dividend of nine dollar per share. It is worthy of remark that while ex-Gov. Marcy has been receiver of the City Bank of Buffalo, more than two years, without paying its creditors one dollar of their claims. Mr. R. M. Blatchford, who was appointed receiver of the Commercial Bank in November last, has already declared a dividend of thirty per cent. Ex-Gov. Marcy was appointed by the Chancellor; Mr. Blatchford by the Bank Commissioners. Erce signum. The report made to the Senate of Maryland in relation to specie payments fixes the January 15 next, as the day for resumption; that in the meantime the Banks be allowed to issue small notes redeemable in specie when not presented in sums over $5. The entire Resumption bill has passed the Pennsylvania House of Representatives on second reading, and ordered to be printed. The James River Company have presented a memorial to the Virginia Legislature, asking for a loan of $250,000 of State Stock for the purpose of redeeming the State Stocks in the hands of Messrs. Morrison & Co. of London, pledged with them by Gen. Hamilton, to the amount of $470,000 for loan of $100,000 to the Company. By this Morning's Mail we learn that the Maryland Senate have passed a resolution that they will fix no day earlier than the first of August next for any other than a partial resumption of specie payments.