Click image to open full size in new tab

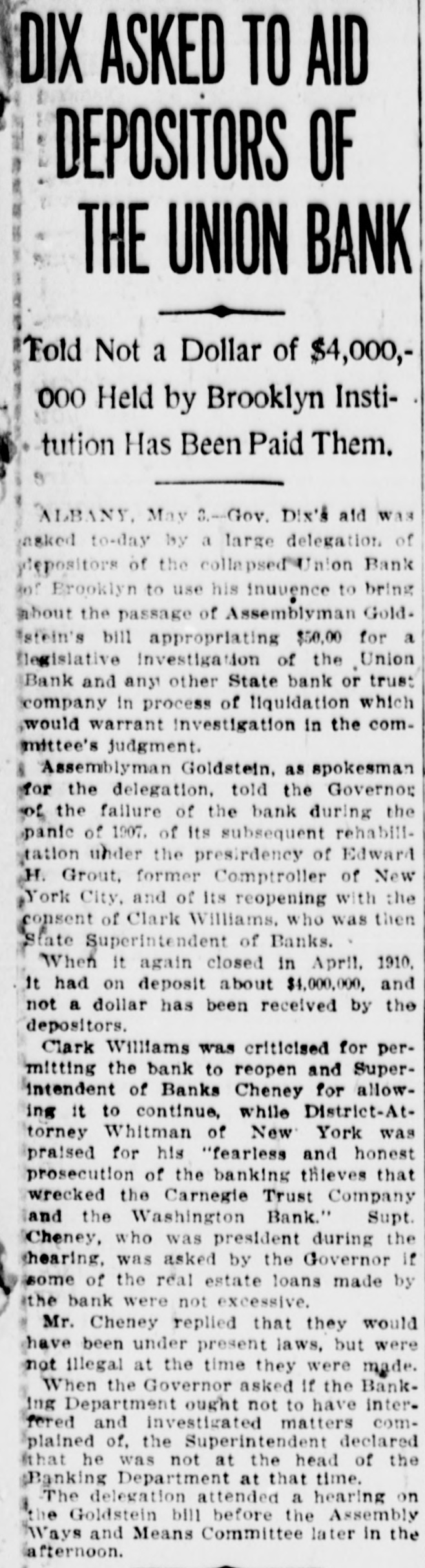

Article Text

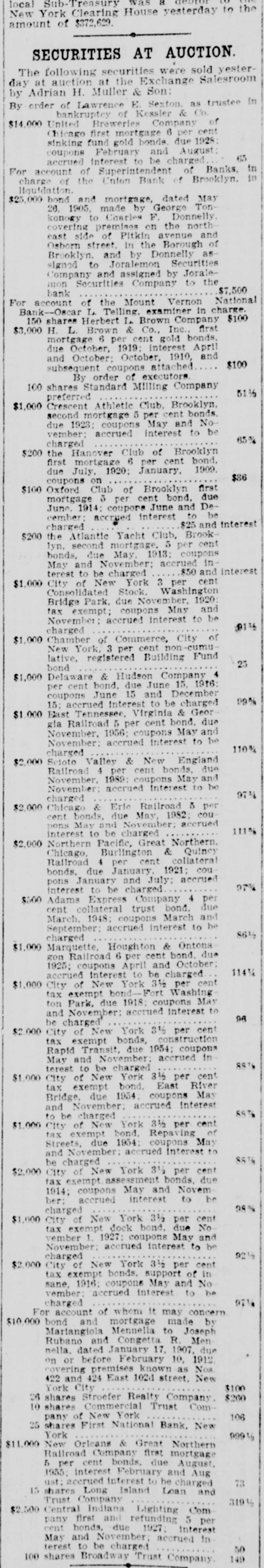

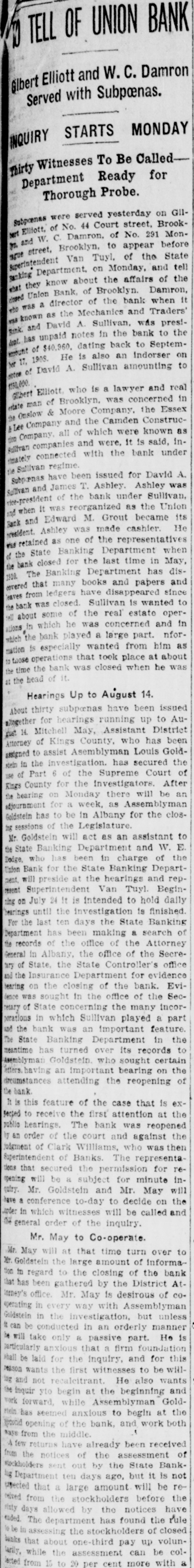

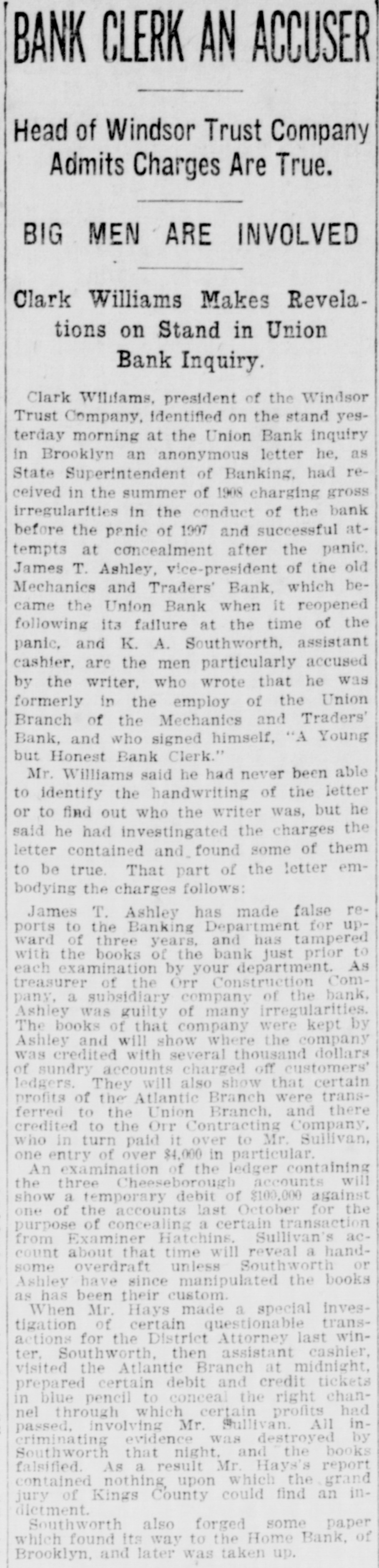

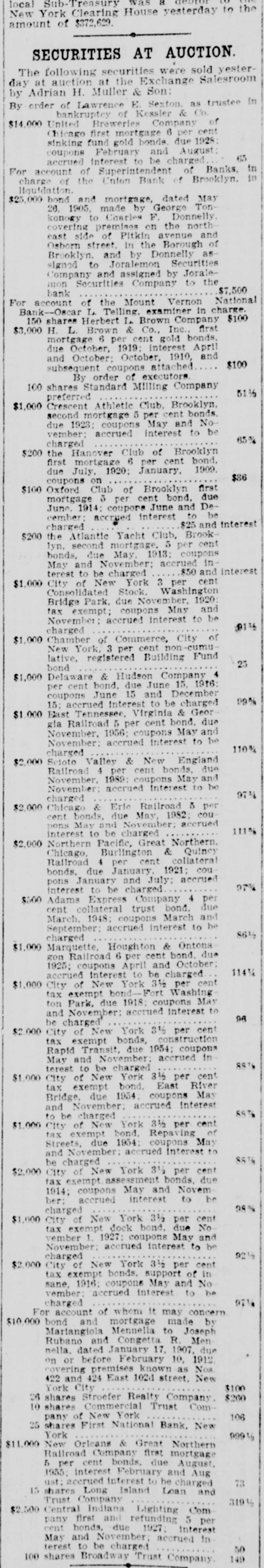

a local New York Sub Clearing Treasury House was yesterday to the amount of $372,629. SECURITIES AT AUCTION. The following securities were sold yesterday at auction at the Exchange Salesroom by Adrian H. Muller & Son: By order of Lawrence E. Sexton. as trustee in bankruptcy of Kessler & Co. $14,000 United Brewerles Company of Chicago first mortgage 6 per cent sinking fund gold bonds. due 1928: coupons February and August 65 accrued interest to be charged For account of Superintendent of Banks, in charge of the Union Bank of Brooklyn. in Hquidation. $25,000 bond and mortgage, dated May 26, 1905, made by George Tonkonogy to Charles F. Donnelly, covering premises on the northeast side of Pitkin avenue and Osborn street. in the Borough of Brooklyn, and by Donnelly assigned to Joralemon Securities Company and assigned by Joralemon Securities Company to the $7,500 For account bank of the Mount Vernon National Bank-Oscar L. Telling. examiner in charge. 150 shares Herbert L. Brown Company $100 $3,000 H. L. Brown & Co., Inc., first mortgage 6 per cent gold bonds, due October, 1919: interest April and October: October, 1910, and $100 subsequent coupons attached By order of executors. 100 shares Standard Milling Company 51½ $1,000 preferred Crescent Athletic Club, Brooklyn, second mortgage 5 per cent bonds, due 1923; coupons May and November; accrued interest to be 65% charged $200 the Hanover Club of Brooklyn first mortgage 6 per cent bond. due July. 1920: January, 1909, $86 coupons on $100 Oxford Club of Brooklyn first mortgage 5 per cent bond. due June. 1914: coupons June and December: accrued interest to be $25 and interest charged $200 the Atlantic Yacht Club, Brooklyn, second mortgage, 5 per cent bonds, due May, 1913: coupons May and November: accrued in terest to be charged $50 and interest $1,000 City of New York 3 per cent Consolidated Stock, Washington Bridge Park, due November, 1920 tax exempt; coupons May and November accrued interest to be 0116 charged $1,000 Chamber of Commerce, City of New York, 3 per cent non-cumu lative, registered Building Fund 25 bond $1,000 Delaware & Hudson Company 4 per cent bond, due June 15. 1916: coupons June 15 and December 99% 15: accrued interest to be charged $1,000 East Tennessee, Virginia & Geor gla Railroad 5 per cent bond. due November, 1956: coupons May and November: accrued interest to be 110% charged $2,000 Scioto Valley & New England Railroad 4 per cent bonds. due November, 1989: coupons May and November: accrued interest to be 97% charged $2,000 Chicago & Erle Railroad 5 per cent bonds, due May, 1982; cou pons May and November: accrued 111% interest to be charged $2,000 Northern Pacific, Great Northern. Chicago, Burlington & Quincy Railroad 4 per cent collateral bonds, due January, 1921: cou pons January and July; accrued 97% interest to be charged $500 Adams Express Company 4 per cent collateral trust bond. due March. 1948: coupons March and September: accrued interest to be 86½ charged $1,000 Marquette, Houghton & Ontona gon Railroad 6 per cent bond. due 1925: coupons April and October: 114% accrued interest to be charged $1,000 City of New York 3½ per cent tax exempt bond- Fort Washing ton Park, due 1918; coupons May and November: accrued interest to 96 be charged $2.000 City of New York 3½ per cent tax exempt bonds, construction Rapid Transit, due 1954; coupons May and November: accrued in 88% terest to be charged $1,000 City of New York 3½ per cent tax exempt bond, East River Bridge, due 1954 coupons May and November: accrued interest 88% to be charged $1,000 City of New York 3½ per cent tax exempt bond, Repaving of Streets, due 1954 coupons May and November: accrued interest to 88% be charged $2,000 City of New York 3½ per cent tax exempt assessment bonds, due 1914; coupons May and Novem ber: accrued interest to be 98% charged $1,000 City of New York 3½ per cent tax exempt dock bond, due No vember 1. 1927: coupons May and November: accrued interest to be 9216 charged $2,000 City of New York 3½ per cent tax exempt bonds. support of in sane, 1916; coupons May and No vember: accrued interest to be 97% charged For account of whom it may concern $10.000 bond and mortgage made by Mariangiola Mennella to Joseph Rubano and Congetta R Men nella, dated January 17, 1907. due on or before February 10, 1912 covering premises known as Nos 422 and 424 East 102d street, New $100 York City $260 26 shares Stroefer Realty Company. 10 shares Commercial Trust Com106 pany of New York 25 shares First National Bank, New York 99916 $11,000 New Orleans & Great Northern Railroad Company first mortgage 5 per cent bonds, due August, 1955; interest February and Aug 73 ust: accrued interest to be charged 15 shares Long Island Loan and Trust Company 319% $2,500 Central Indiana Lighting Com pany first and refunding 5 per cent bonds, due 1927: interest May and November; accrued in terest to be charged 50 149 100 shares Broadway Trust Company