Click image to open full size in new tab

Article Text

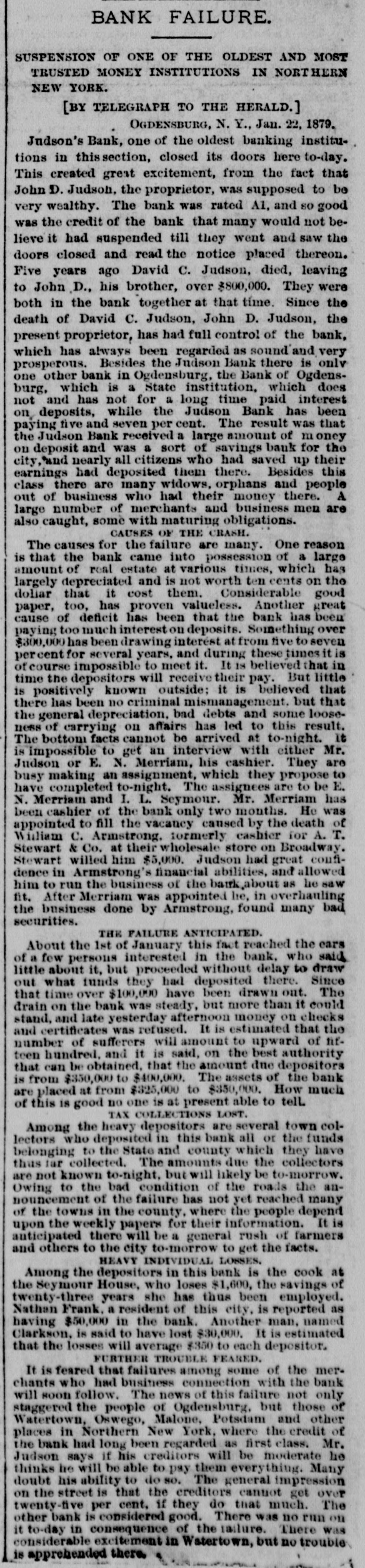

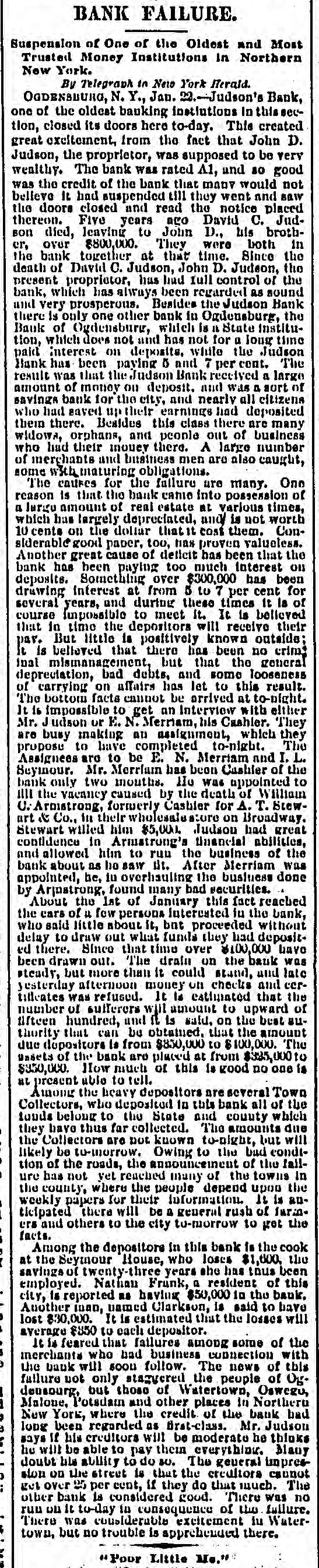

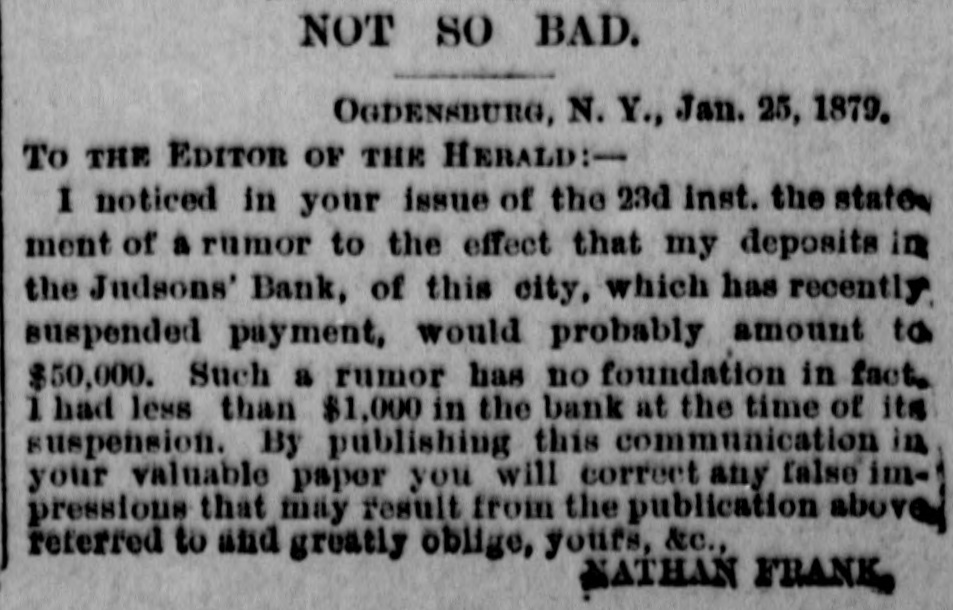

NEWS OF THE WEEK. Domestic. The President has signed the arrears of petision hill A $50,000 fire occurred in Warwick N Y. Janurry 25th The First National Bank of Granville, Ohto, has suspended Dr. Linderman. director of the mint. Philadelphia, died Jan. 27th. The Needham Savings Bank. Boston. has closed, owing to . lac k of business Jasper & Co.'s elevator at Quincy, III., burned on the night of Jan. 23d. Loss, $10,000. The Wagner House at Sparts, Wis., was burned Jan. 21st. Lose, $25,000; insurance, $18,000. Matt H. Carpenter has been elected United States Senator in Wisconsin to succeed Senator T. O. Howe. The Legislature of Arkansas has elected J. D. Walker, of Washington county, United States Senator. Gov. Hartranft has been appointed and confirmed as Major General of the Na tional Guards of Pennsylvania. One section of Armour & Co.'s warehouse, at the Union Stock yards, Chicago, burned Jan 35th Loss, 10,000. The National Marine Bank, Oswego, Y., will be closed because of the high rate of taxation and low rate of interest. The report of the Illinois Central Railroad for 1878, shows a gain in the net traf. fic of $468,000 over the preceding year. The Judson Bank, at Ogdensburg. N. elosed January 224. With moderation on the part of Its creditors It expects to pay in full. In Scranton. Pa. a few nights ago, Miss Davis and a one year old child were burned to death by the explosion of a kerosene lamp. The Irving mills, with two run of stones, burned at St. Paul, Mian., Jan. 23d. Lose on mill, $10,000. and on wheat, $1,500. Insurance, $6,900. Lochman's confectionery establishat Milton, Pa., burned January 24th. ment An explosion during the fire killed one man and injured several. R. L. T. Beal, Conservative, elected the Forty Sixth Congress. has been chosen to to fill the vacancy caused by the death of Rep resentative Douglass in Virginia At Mertville, Maine, Jan. 25th, John by McFarland, wife and daughter were killed maniac named Rowell, who was afterward shot a dead by a neighbor whom he had tacked. A fire in Elizabeth, N. J., January 21st, damaged the Arcade Block, belonging to ex-Congressman Clark, to the extett of $100,- of 000: Insurance, $60,000. The original cost the structure was $250,000. In tearing down the walls of a buildburned in Cincinnati. Jan. Sand, a of a wall crumbled away dist. ing portion recently cellar. suddenly, precipitating two men into the a ance of sixty feet, and both were killed. A collision of freight trains on the Central railroad near Tarrytown, N. Y., Jan. 25th resulted in the death of Byron Wright, conductor, and David Jones, freman, and the smashing of four cars, a locomotive and tender. On Sunday evening. January 26th. struck the town of Lockport, Texas forty houses, including churches, child demolishing a tornado hall. A the conrt house and Masonic hurt. was killed and several other persons badly An attempt to throw out some dynaat the Gua Water in January 21st, the mite Works, cartridges Baltimore, destruction Powder resulted of killing of two mea. the boiler the house, and the carrying of the boller some fifty feet. On the morning of January 27th a broke out in Turkey City. Clarion county, fire and the water-works being frozen, spread half rapidly Pa., in all directions, and in an hour ruins. of the best portion of the town was in Loss, about $30,000. A fire swept over the valley twenty north of Deadwood. Jan. 26th, burning miles 500 tons of hay and leveling several ranches of ground. The same day . heavy gale wind the prevailed doing much damage in Dead- trees wood Gulch, unroofing houses, uprooting and blowing down fences. At Meridian. Miss., Jan. 24th. three white named Alexander, and three the negroes named Gamblin, quarrelled about the nemen possession of some land. Afterward one ambushed the white men, killing returned groes and wounding another. The fire was The othand two of the negroes were killed. or ded. one The Dayton & Michigan Railroad with elevator B at Toledo, Ohio, of consisting of 100,000 by its ears, was entirely Company's grain, contents, mostly loss, destroyed bushels $85,000. January 25th Estimated the are buttaing was insured for $25,000, and to The for $40,000. The are is supposed grain have been caused by friction in the machinery. Dodd has returned four- the Agency to Ft. the Pine Lieut. Ridge Robinson from with in Sloux braves to act as scouts latest reof the fleeing Cheyennes. The escapture the field is that the Cheyennes news from in the night from Crow Ridge, their folcaped position, and the trail which is being the lowed last by Capt. Wessella, leads towards Spotted Tall Agency. Secretary Schurz has received infor- have that SILLING Bull with his people United mation crossed the Canadian line into the anxious and that they are exceedingly under the supervision States, to this country, and come dis to return of the Indian Bureau, and