Article Text

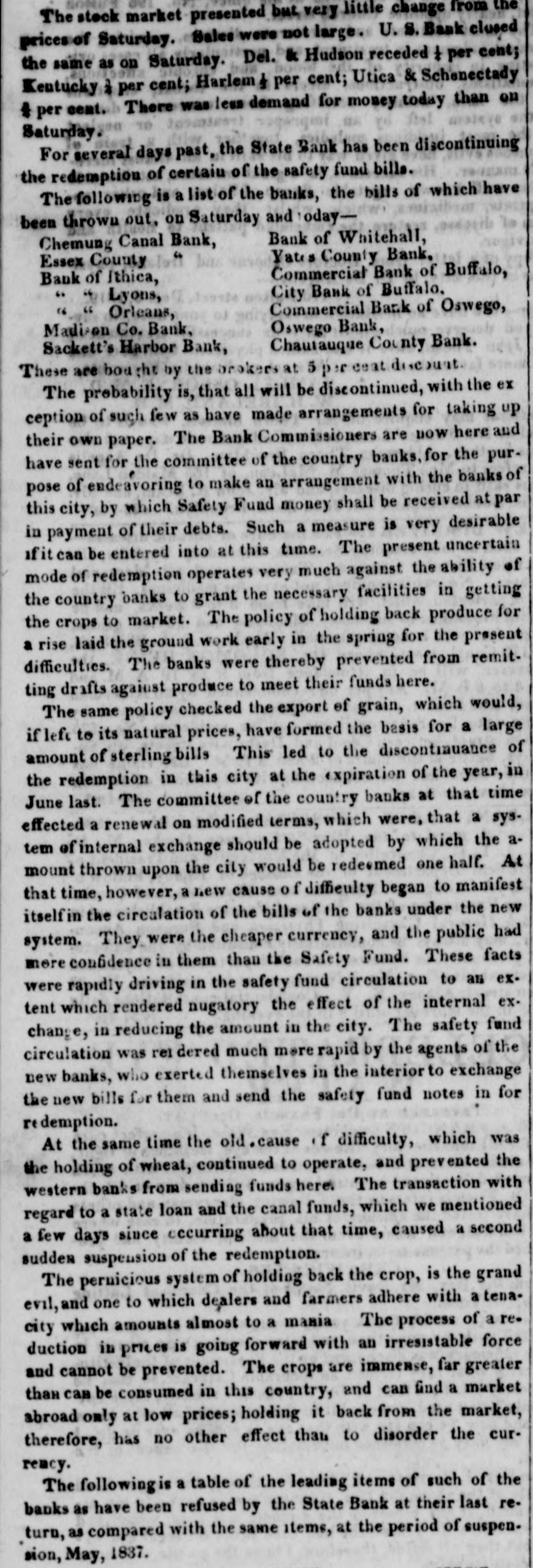

e Decrease, at this sea*on that the demand for exchange commences at Nashville, from the dry goods men, who begin to travel east for their fall supplies; the loans, therefore show a decrease ou bills of exchange and an increase on notes, making an aggregate increase of $90.000 part of which has been returned upon the banks for exchange and specie, leaving an increased circulation of 25,984, and a decrease of specie to the amount of $20,000 The rate of exchange at Nashville, on the 15th, was 3 per cent at sight, and 2 per cent at 60 days. The Long Island Bank has declared semi-annual dividend of six per cent, payable 31st lust. The following is from an Oswego paper:" We understand that there has been a run upon the Com. mercial Bank in this village for the last few days, and that an officer of the bank has given notice that unless the run IS discontinued soon, the bank will avail itself of the ten days al. lowed by law for the redemption of its bills. There can be no occasion for public alarm, as the bill holder is probably rendered secure by the fund pledged for the redemption of the safety fund notes." This statement indicates the progress of that crisis to which we have steadily looked forward, notwithstanding the bolster. ing of speculators and their Wall street organs. The finan. cial and commercial world is now rapidly fre ing itself from the wreck of 1636, and by throwing off the forced action of speculative banks, prices are becoming healthily equalizedThe process which developes itself in the fall of prices, in a stagnant season of business, does not create any panie among the working classes, because the results are beneficial to them. There is no less work this year than last; nor are price. of labor yet affected. To the lewer and middling classes, therefore, the only apparent change is a decrease in their expenses of living. To this cause may be ascribed the total absence of any domestie demand for specie which has characterized the progress of the present revulsion. The revulsion has, then, hith erto, been confined to that speculative class of dealers and banks whose nominal fortunes and assets are dependant upon the falalment of contracts made in a season of inflation, and to whose interests the continuance of a fall in prices will be fatal. A natural train of causes growing out of the political and agricultural state of England and the continent, have combined to render gold dearer upen the continent than in Eng land, the result of which has been a constant drain upon the bank until she is on the verge of bankruptcy. The English pub. "ic have been situated precisely similar to our own, with regard to falling prices, and no domestic panic has been engendered. A continued calmness was all that was necessary, and prices would soon have reached points at which investments would have been profitable in England from the continent, and our own staples would have recovered themselves before a healthy manufacturing demand. Possibly a larger or smaller amount of spc. cie would have left us in the process, to return with the current of trade; but this would have created no uneasiness. This natural and smooth process would, however, have car. ried down many large speculative individuals and corporations, in beth countries. This class of persons have, therefore, exerted themselves to the utmost to check the natural order of things, in order to sustain themselves at the expense of the community. Wall street has been full of nostrums of every description, to effect this object; circular after circular has made its appearance, having for its object the coercion of high cotton prices from the English spinners. The ingenuity and substance of every financier and bank director has been taxed discover the " elixir vitre' of commercial life, and every remedy has been applied, but the simple one of temperance and industry, and each fails in succession. The southern nostrums do not suit northern constitutions, nor is southern health benefitted by northern applications. The project of uniting the whole south in one great cotton house, has excited but little interest here, where the netable project of sending specie to England on speculation, in order to avoid its being sent in the natural course of trade, has been started and attempted to be carried into effect. Today Mr. James G King, of the firm of Prime, Ward & King, has, OR behalf of that firm and some other houses, been round to all the banks to solicit a subscription of $1,000,000 to send to Eng land, in order to ease the market there. This was the same house and the same gentleman who, one year since, kindly un dertook to regulate this country and the course of trade generally. by importing $5,000,000 from England. They NOW wish to regulate the Bank of England and the commerce of Europe by sending them $1,600,000 back to help them along.,' The practical sult of this ridiculous project will be to arouse the now sleeping fears of the community here, and cause a panic drain similar to that of the Oswego bank, which will clean out the banks in a few days. The whole movement is founded on the fallacy that, because gold has left England in it must necessarily be dearer however, the fact. The rates of exchange large ry is, quantities, there. show The that contra- at on the continent, gold was dearer than So as this is the case. it will continue to leave ery long point England, in England. did we send there every dollar we have. If the mere fact of sending specie into England would turn the course of trade, how easy it would be for the directors of the Bank to procure the necessary amount from the Bank of France, in which institution the amount on the 1st of July, was 460,000,000 francs, or $87,500.000 more money than there is in the whole United States. The evil is, however, not the particular location of a certain amount of specie, but the inflation of the currency. and the forced and unhealthy maintenance of prices; and so long as the bolstering system is continued, so long will the difficulties last. Sales at the stock Exchange. 14 shares Manhattan Bank 125-30 Leather Bank 116-57 N Am 76g, 791600-18 Bkg 1021-50 Del&