Article Text

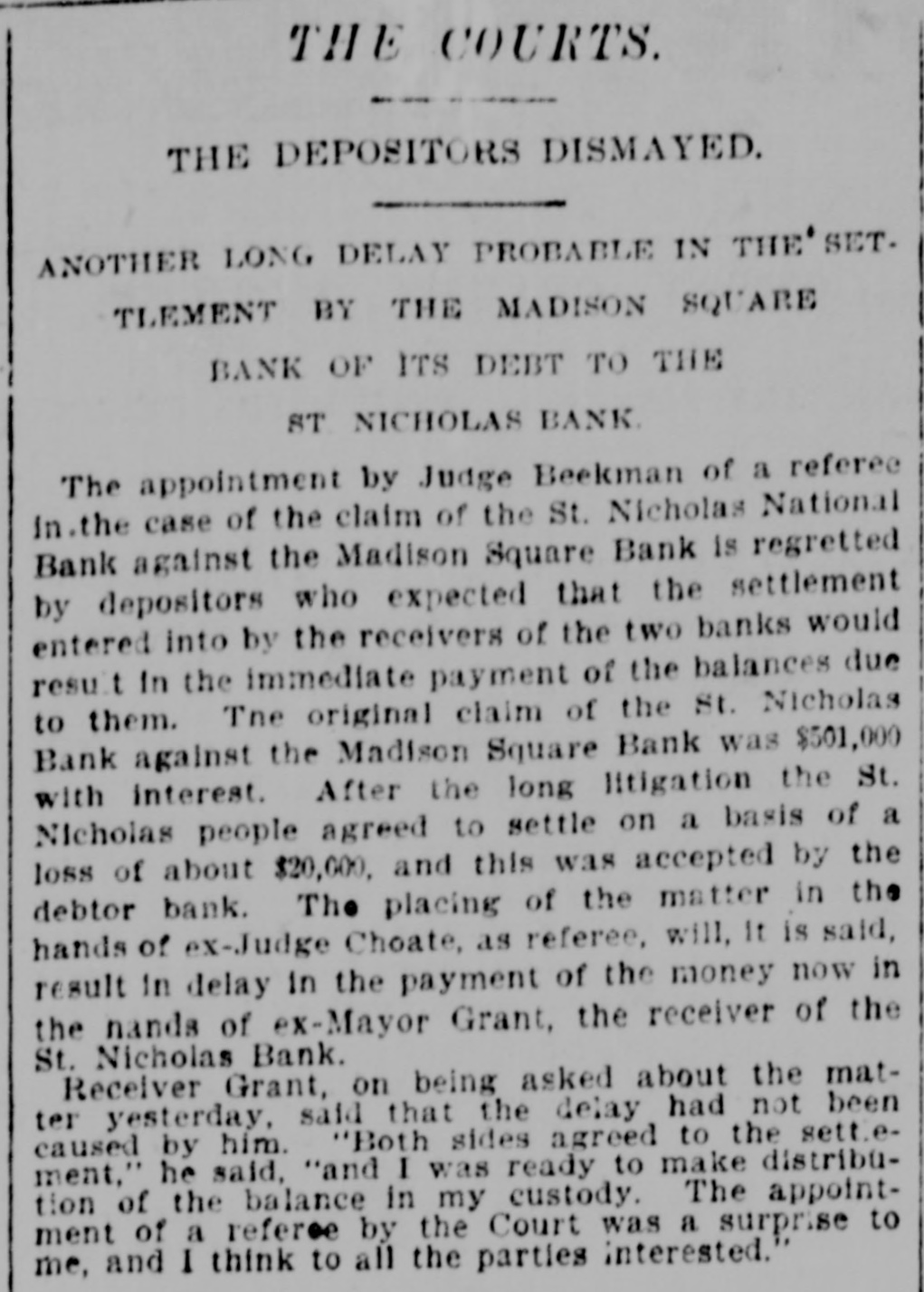

THE COURTS. THE DEPOSITORS DISMAYED. ANOTHER LONG DELAY PROBABLE IN THE SETTLEMENT BY THE MADISON SQUARE BANK OF ITS DEBT TO THE ST NICHOLAS BANK. The appointment by Judge Beekman of a referee in.the case of the claim of the St. Nicholas National Bank against the Madison Square Bank is regretted by depositors who expected that the settlement entered into by the receivers of the two banks would result In the immediate payment of the balances due to them. The original claim of the St. Nicholas Bank against the Madison Square Bank was $501,000 with interest. After the long litigation the St. Nicholas people agreed to settle on a basis of a loss of about $20,000, and this was accepted by the debtor bank. The placing of the matter in the hands of ex-Judge Choate, as referee, will, It is said, result in delay in the payment of the money now in the hands of ex-Mayor Grant, the receiver of the St. Nicholas Bank. Receiver Grant, on being asked about the matter yesterday, said that the delay had not been caused by him. "Both sides agreed to the settlement," he said, "and I was ready to make distribution of the balance in my custody. The appointment of a referee by the Court was a surprise to me, and I think to all the parties interested."