Click image to open full size in new tab

Article Text

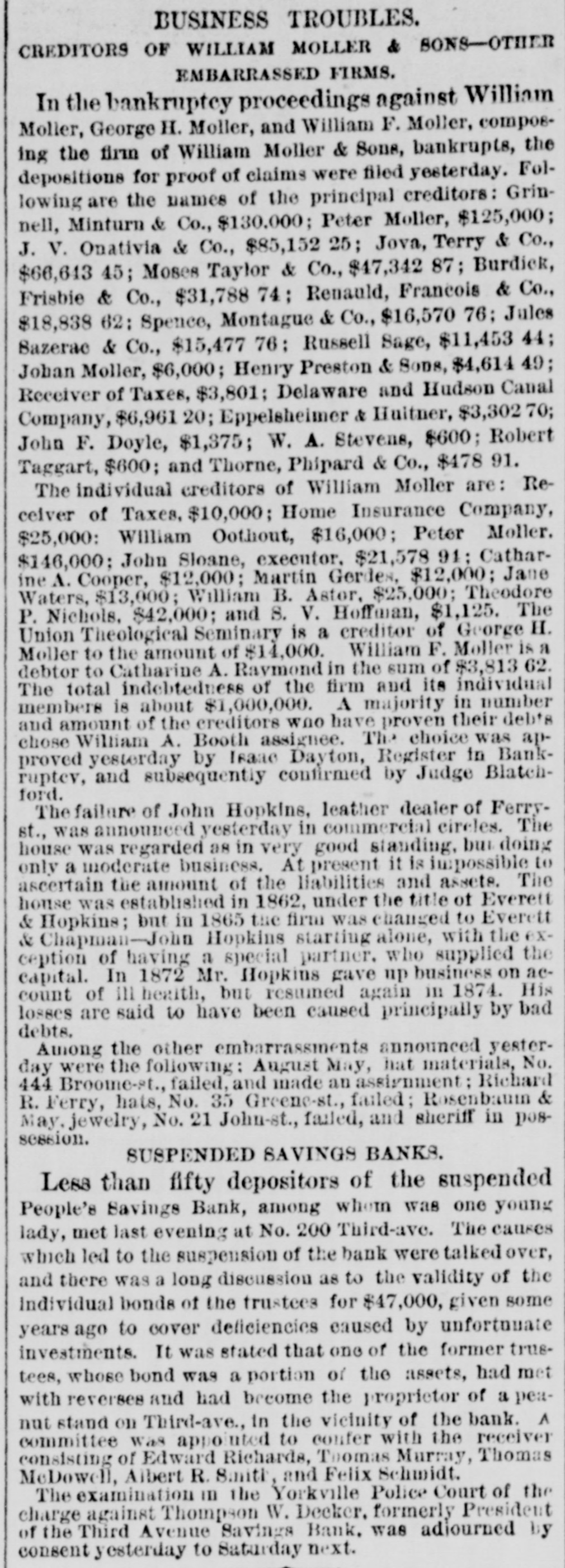

BUSINESS TROUBLES. CREDITORS OF WILLIAM MOLLER & SONS-OTHER embarrassed FIRMS. In the bankruptcy proceedings against William Moller, George H. Moller, and William F. Moller, composing the firm of William Moller & Sons, bankrupts, the depositions for proof of claims were filed yesterday. Following are the names of the principal creditors: Grinnell, Minturn & Co., $130.000; Peter Moller, $125,000; J. V. Onativia & Co., $85,152 25; Jova, Terry & Co., $66,643 45; Moses Taylor & Co., $47,342 87; Burdick, Frisbie & Co., $31,788 74; Renauld, Francois & Co., $18,838 62: Spence, Montague & Co., $16,570 76; Jules Sazerae & Co., $15,477 76; Russell Sage, $11,453 44; Johan Moller, $6,000; Henry Preston & Sons, $4,614 49; Receiver of Taxes, $3,801; Delaware and Hudson Canal Company, $6,961 20; Eppelsheimer & Huitner, $3,302 70; John F. Doyle, $1,375; W. A. Stevens, $600; Robert Taggart, $600; and Thorne, Phipard & Co., $478 91. The individual creditors of William Moller are: Receiver of Taxes, $10,000; Home Insurance Company, $25,000: William Oothout, $16,000; Peter Moller. $146,000; John Sloane, executor. $21,578 91; Catharine A. Cooper, $12,000; Martin Gerdes, $12,000; Jane Waters, $13,000; William B. Astor, $25,000; Theodore P. Nichols, $42,000; and S. V. Hoffman, $1,125. The Union Theological Seminary is a creditor of George H. Moller to the amount of $14,000. William F. Moller is a debtor to Catharine A. Ravmond in the sum of $3,813 62. The total indebtedness of the firm and its individual members is about $1,000,000. A majority in number and amount of the creditors who have proven their debts chose William A. Booth assignee. The choice was approved yesterday by Isaae Dayton, Register in Bankruptev, and subsequently confirmed by Judge Blatchford. The failure of John Hopkins, leather dealer of Ferryst., was announced yesterday in commercial circles. The house was regarded as in very good standing, but doing only a moderate business. At present it is impossible to ascertain the amount of the liabilities and assets. The house was established in 1862, under the title of Everett & Hopkins; but in 1865 the firm was changed to Everett & Chapman-John Hopkins starting alone, with the exception of having a special partner. who supplied the capital. In 1872 Mr. Hopkins gave up business on account of III health, but resumed again in 1874. His losses are said to have been caused principally by bad debts. Among the other embarrassments announced yesterday were the following: August May, hat materials, No. 444 Broome-st., failed, and made an assignment: Richard R. Ferry, hats, No. 35 Greene-st., failed; Rosenbaum & May, jewelry, No. 21 John-st., failed, and sheriff in possession. SUSPENDED SAVINGS BANKS. Less than fifty depositors of the suspended People's Savings Bank, among whom was one young lady, met last evening at No. 200 Third-ave. The causes which led to the suspension of the bank were talked over, and there was a long discussion as to the validity of the individual bonds of the trustees for $47,000, given some years ago to cover deficiencies caused by unfortuuate investments. It was stated that one of the former trustees, whose bond was a portion of the assets, had met with reverses and had become the proprietor of a peanut stand on Third-ave., In the vicinity of the bank. A committee was appointed to confer with the receiver consisting of Edward Richards, Toomas Murray, Thomas McDowell, Albert R. Smith, and Felix Schmidt. The examination in the Yorkville Police Court of the charge against Thompson W. Decker. formerly President of the Third Avenue Savings Bank, was adjourned by consent yesterday to Saturday next.