Article Text

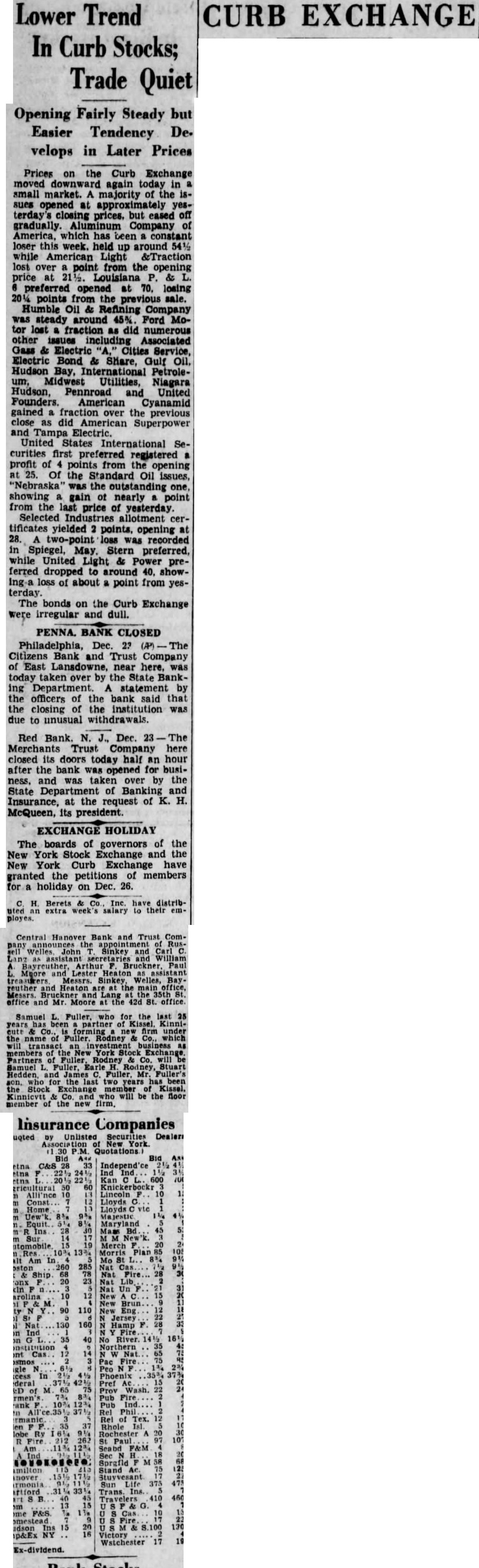

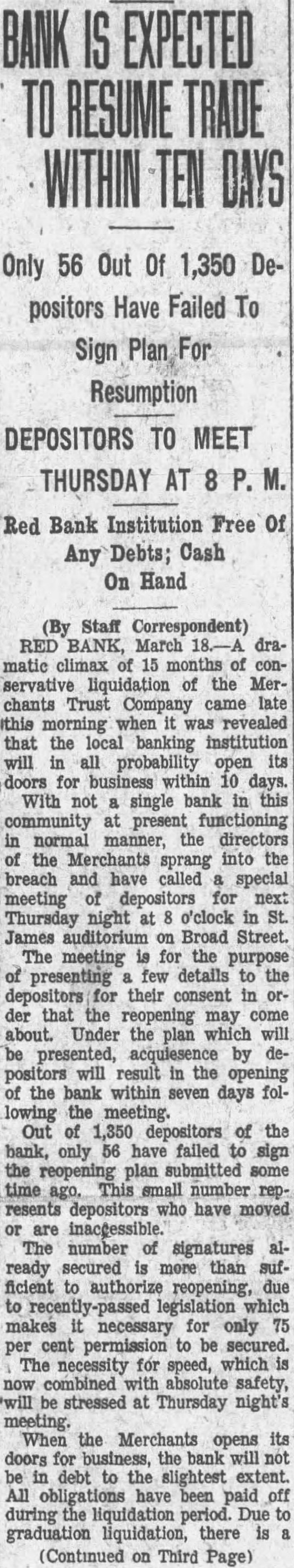

Lower Trend In Curb Stocks; Trade Quiet CURB EXCHANGE Opening Fairly Steady but Easier Tendency De. velops in Later Prices Prices on the Curb Exchange moved downward again today in small market. A majority of the issues opened at approximately yesterday's closing prices. but eased off gradually Aluminum Company of America, which has been constant loser this week. held up around 541/2 while American Light &Traction lost over point from the opening price at 21 Louisiana P. & L. preferred opened at 70. losing points from the previous sale. Humble Oil & Refining Company was steady around 45%. Ford Motor lost fraction as did numerous other issues including Associated Gass & Electric "A," Cities Service, Electric Bond & Share, Gulf Oil, Hudson Bay, International Petroleum, Midwest Utilities, Niagara Hudson, Pennroad and United Founders. American Cyanamid gained fraction over the previous close as did American Superpower and Tampa Electric. United States International Securities first preferred registered profit of points from the opening at Of the Standard Oil issues, "Nebraska" was the outstanding one showing gain of nearly a point from the last price of yesterday Selected Industries allotment certificates yielded points, opening at 28. two-point loss was recorded in Spiegel, May. Stern preferred, while United Light & Power preferred dropped to around 40, showIng loss of about a point from yesterday. The bonds on the Curb Exchange were irregular and dull. PENNA. BANK CLOSED Philadelphia, Dec. 23 (AP) The Citizens Bank and Trust Company of East Lansdowne, near here, was today taken over by the State Banking Department. A statement by the officers of the bank said that the closing the institution was due to unusual withdrawals. Red Bank. N. J., Dec. 23 The Merchants Trust Company here closed its doors today half an hour after the bank was opened for business, and was taken over by the State Department of Banking and Insurance, at the request of K. H. McQueen, its president. EXCHANGE HOLIDAY The boards of governors of the New York Stock Exchange and the New York Curb Exchange have granted the petitions of members for a holiday on Dec. 26. Berets Inc. distribextra em- Bank and Trust Sinkey Welles, reuther and Heaton the Samuel business Partners Stuart Hedden and last will the floor