Article Text

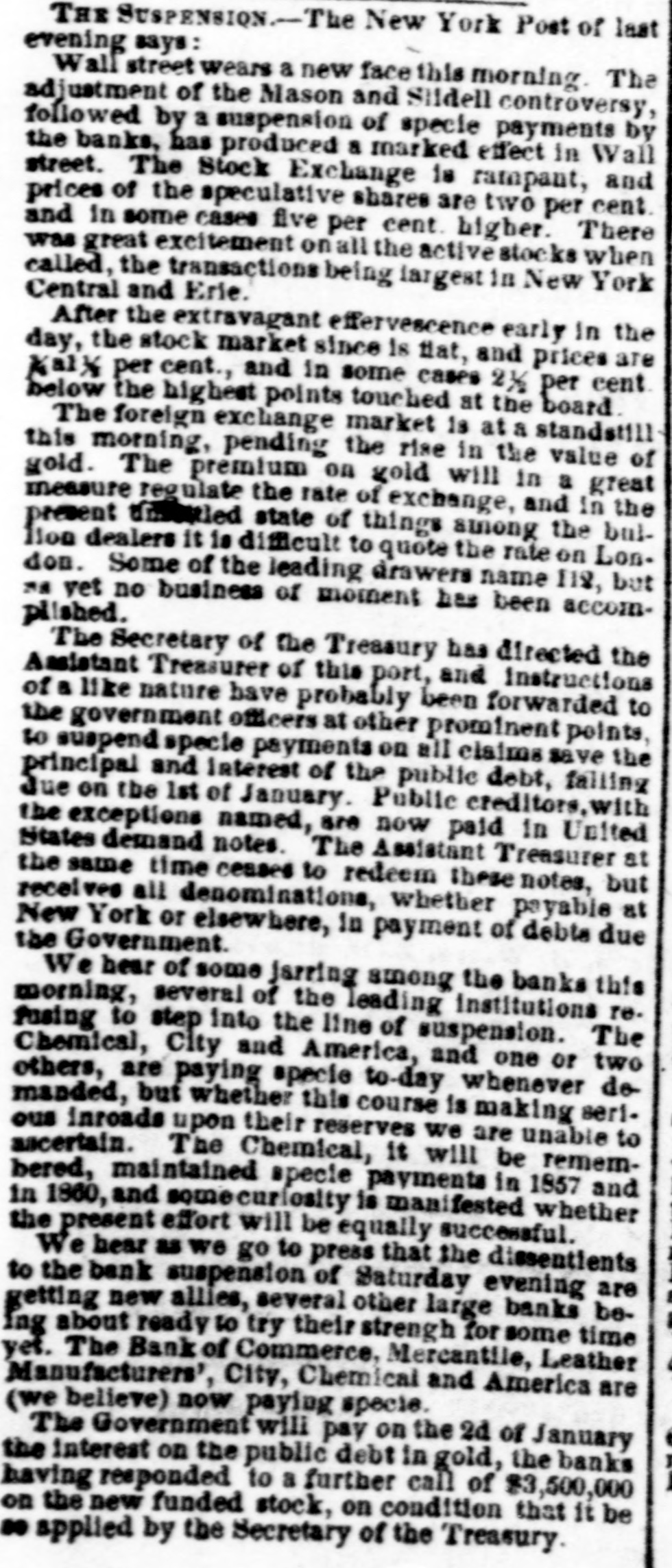

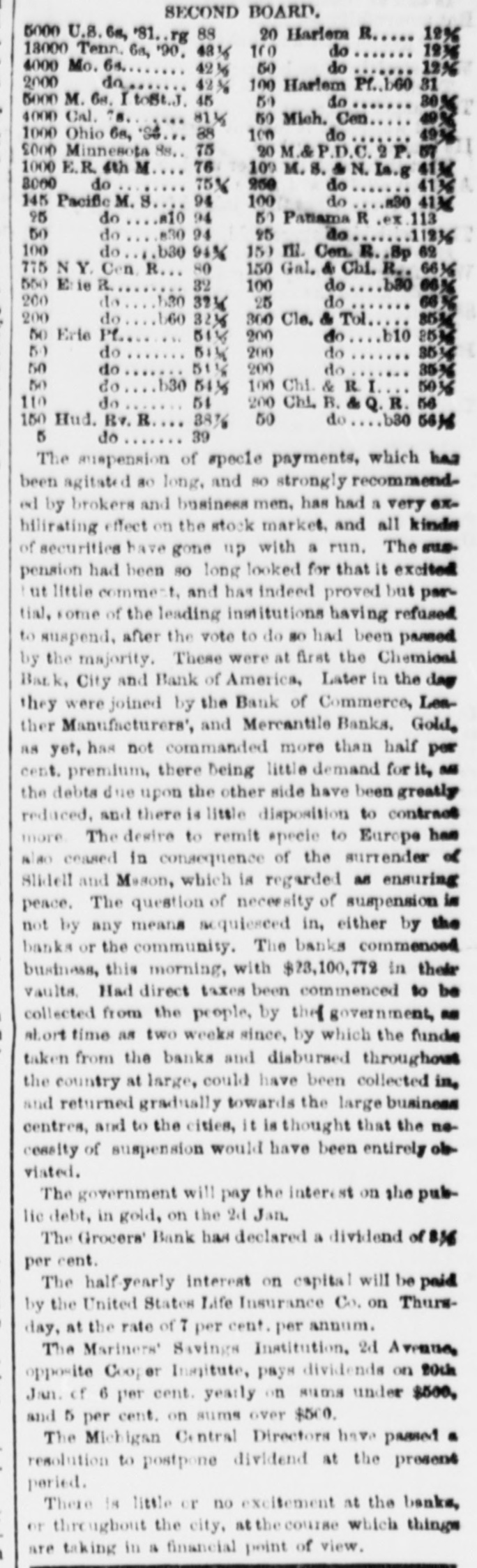

THE SUSPENSION.- The New York Post of last evening says: Wall street wears a new face this morning The adjustment of the Mason and Sildell controversy, followed by a suspension of specie payments by the banks, has produced a marked effect in Wall street. The Stock Exchange is rampant, and prices of the speculative shares are two per cent and in some cases five per cent higher. There was great excitement on all the active stocks when called, the transactions being largest in New York Central and Erie. After the extravagant effervescence early In the day, the stock market since is flat, and prices are Kaly per cent., and in some cases 21/2 per cent below the highest points touched at the board The foreign exchange market is at a standstill this morning, pending the rise in the value of gold. The premium on gold will in a great measure regulate the rate of exchange, and in the present transitied state of things among the butlion dealers it is difficult to quote the rate on Lon. don. Some of the leading drawers name 118, but as yet no business of moment has been accomplished. The Secretary of the Treasury has directed the Assistant Treasurer of this port, and instructions of a like nature have probably been forwarded to the government officers at other prominent points, to suspend specie payments on all claims save the principal and Interest of the public debt, failing Jue on the 1st of January. Public creditors, with the exceptions named, are now paid in United States demand notes. The Assistant Treasurer at the same time ceases to redeem these notes, but receives all denominations, whether payable at New York or elsewhere, in payment of debts due the Government. We hear of some Jarring among the banks this morning, several of the leading Institutions re. fusing to step into the line of suspension. The Chemical, City and America, and one or two others, are paying specie to-day whenever do manded, but whether this course is making seri. ous inroads upon their reserves we are unable to ascertain. The Chemical, it will be remembered, maintained specie payments in 1857 and in 1860, and somecuriosity is manifested whether the present effort will be equally successful. We hear as we go to press that the dissentients to the bank suspension of Saturday evening are getting new allies, several other large banks beIng about ready to try their strength for some time yes. The Bank of Commerce, Mercantile, Leather Manufacturers', City, Chemical and America are (we believe) now paying specie. The Government will pay on the 2d of January the interest on the public debt in gold, the banks having responded to a further call of $3,500,000 on the new funded stock, on condition that it be se applied by the Secretary of the Treasury.