Click image to open full size in new tab

Article Text

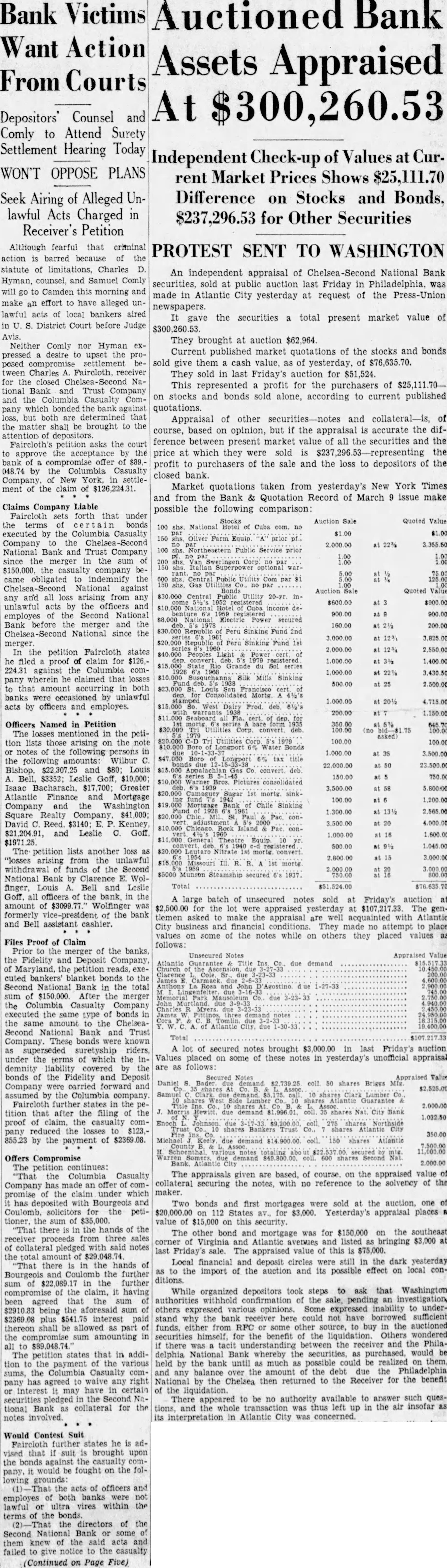

Bank Victims Want Action

Counsel and Depositors Comly to Attend Surety Settlement Hearing Today

WON'T OPPOSE PLANS

Seek Airing of Alleged Unlawful Acts Charged in Receiver's Petition

Although fearful that criminal action barred because of the statute of limitations, Charles D. Hyman, counsel, and Samuel Comly will to Camden this morning and make an effort have alleged unlawful acts of local bankers aired District Court before Judge Avis. Neither Comly nor Hyman pressed desire upset the posed tween Charles Faircloth, for closed National Bank Trust Company the Casualty Combank against but both are that the matter brought the petition the court approve acceptance bank compromise by the Casualty Company, New York. settlement of the claim of $126,224.31.

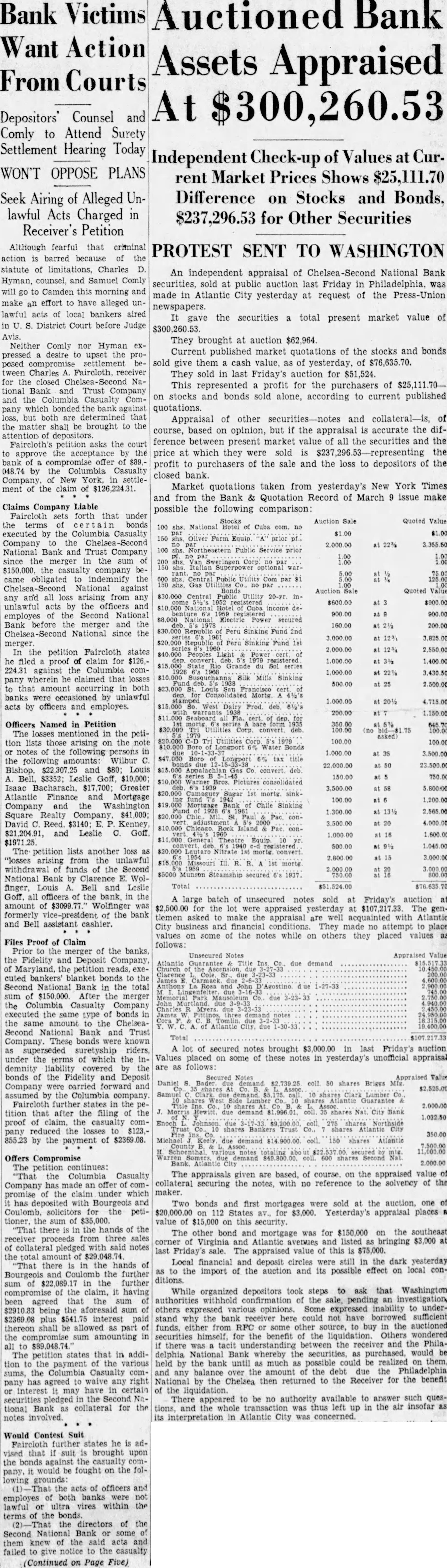

Claims Company Liable possible the following comparison: Faircloth forth that under Quoted the terms bonds 100 Cuba executed the Columbia Casualty $1.00 Company the 100 Service National Bank and Trust Company the $150,000. the casualty company indemnify the National against all loss arising from any unlawful officers employes Second National Bank before merger and the National since the 3,000.00 merger. Sinking 2,000.00 petition Faircloth states filed proof claim 1,000.00 against Columbia pany wherein claimed that 500.00 that amount banks occasioned unlawful 4,715.00 acts by officers and employes.

Officers Named in Petition The losses in the petition lists those arising the notes the persons the amounts: Louis $3352; 150.00 Isaac Bacharach, Greater 3,500.00 Atlantic Finance and Mortgage 100.00 Company Washington Square Realty David Kenney and Leslie The petition another loss "losses from the withdrawal funds of the Second secured National Bank by Wolfinger, Bell and Leslie Goff. all of the bank, in the large batch of unsecured notes sold Friday's amount for the were appraised yesterday The genformerly of the bank asked the appraisal are acquainted Atlantic and Bell assistant cashier. City They place

Files Proof Claim follows: the the the Fidelity and Deposit Maryland, the petition reads, cuted blanket bonds Second National Bank in the sum $150,000. After the the Columbia Casualty Company the bonds the the Second Bank and Trust These bonds known of secured notes brought last Friday's auction. riders, the which the Values placed on some of these notes in yesterday's unofficial appraisal under terms the follows: demnity liability bonds the Fidelity Deposit Company carried and assumed the Columbia tition that after the filing proof claim. the casualty the by the payment of

Offers Compromise continues: The appraisals given are based, the appraised value of "That the Columbia Casualty collateral securing the with no reference to the solvency of the made notes, Company under which maker. has and Two bonds and first mortgages were sold the auction, one for peti- 112 States for Yesterday's appraisal places tioner, $35,000. value of $15,000 this on security. "That the hands of the The other bond and mortgage for $150,000 the southeast receiver from three $3,000 corner Virginia and Atlantic avenues and listed bringing collateral pledged notes Friday's sale. The appraised value this $75,000. the Local financial and deposit circles were still the dark yesterday "That there the hands of to the import of the auction its possible effect on local Bourgeois the further ditions. the further While organized depositors took steps to that Washington compromise claim, having withhold the investigation, Some inability to underbeing the others opinions. stand the could not have sufficient plus interest either buy the auctioned thereon shall funds, RFC some for the benefit of the Others wondered the compromise amounting the and the Philathere in addi- Bank securities, purchased, would be The petition states that delphia whereby the the various the bank until much possible realized the payment by the the amount the debt the sums, any then returned the Receiver for the benefit pany has agreed waive any right the Chelsea interest may have certain the liquidation. the to be authority available to answer such quesThere no tional Bank collateral for tions, and was thus left the air insofar notes involved. its interpretation in Atlantic City

Would Contest Faircloth states he vised that brought upon bonds the would fought on the pany, grounds: acts of officers both banks employes lawful ultra vires within terms the bonds. the directors of the Second National them knew the failed to give notice to the casualty on Page Five)