Article Text

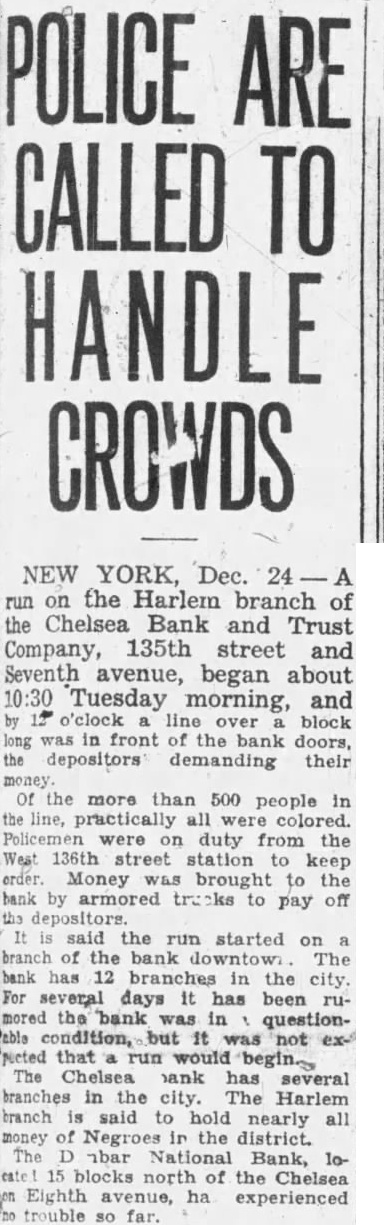

POLICE ARE CALLED TO HANDLE CROWDS NEW YORK, Dec. 24 run on the Harlem branch of the Chelsea Bank and Trust Company, 135th street and Seventh avenue, began about 10:30 Tuesday morning, and by 12 o'clock line over a block long was in front of the bank doors, the depositors demanding their money. Of the more than 500 people in the line, practically all were colored. Policemen were on duty from the West 136th street station to keep order. Money was brought to the bank by armored trucks to pay off the depositors. It is said the run started on a branch of the bank downtown The bank has 12 branches in the city. For several days It has been rumored the bank was in questionable condition, but it was not expicted that a run would begin. The Chelsea bank has several branches in the city. The Harlem branch is said to hold nearly all money of Negroes in the district. The D nbar National Bank, locate! 15 blocks north of the Chelsea Eighth avenue, ha experienced trouble so far.