Article Text

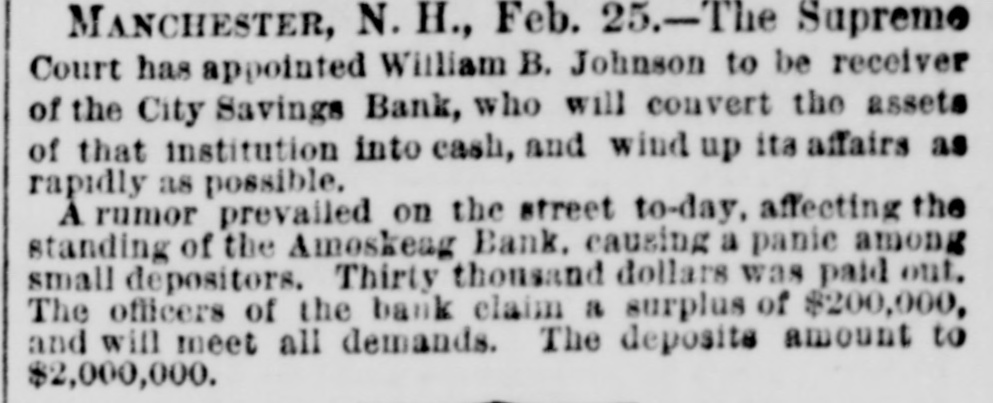

AN INSOLVENT SAVINGS BANK. Condition of Its Affairs. MANCHESTER. June 9. Rumors are circulating this morning as to the solvency of the City Savings Bank. The commissioners came here yesterday, at the request of the trustees, and upon an order issued by the supreme court as required by law, and have been making a thorough investigation. The facts drawn from the bank authorities are as follows: In 1867, the savings bank advanced on notes on account of R. S. and H. Webster about $40,000, secured by one-fourth interest in seventy-five thousand acres of land located in Clinton county, New York, upon which there is said to be one of the most prolific iron mines in the country. Taxes have not been paid and the interest has accumulated since 1867. It was believed the bank would realize enough to pay the whole amount of their indebtedness, but owing to the general depression nothing has been realized. After a severe struggle to carry this dead weight, which had amounted to nearly $70,000. the trustees became satisfied the bank would be unable to continue business without reduction. Upon examination by the trustees and bank commissioners, the deposits were reduced twenty-one per cent., and no interest. The amount of deposits affected is about $411,000. Depositors will receive seventy-nine per cent. with a prospect of future dividends if the New York security can be made available. The commissioners say no blame whatever attaches to the officers or trustees of the bank. The bank is now left in a perfectly sound and solvent condition. No disposition IS manifested to create a run on the bank, though small depositors feel the loss keenly of the twenty-one per cent. Later.-Nothing new has transpired in relation to the City Savings Bank, though the loss of $82. 000 to the depositors is the universal topic of conversation. The bank organized in 1859, and was managed by Capt. E. Warrington, until his death last July. Dividends ranging from tive to seven per cent. were always paid until the present. In 1863 the deposits amounted to $600,000, and have since been gradually falling off to the present amount, $411,000. It is believed that the bank will realize something on their depreciated securities, so that the loss to the depositors will amount to from ten to fifteen per cent. instead of twentyone.