Article Text

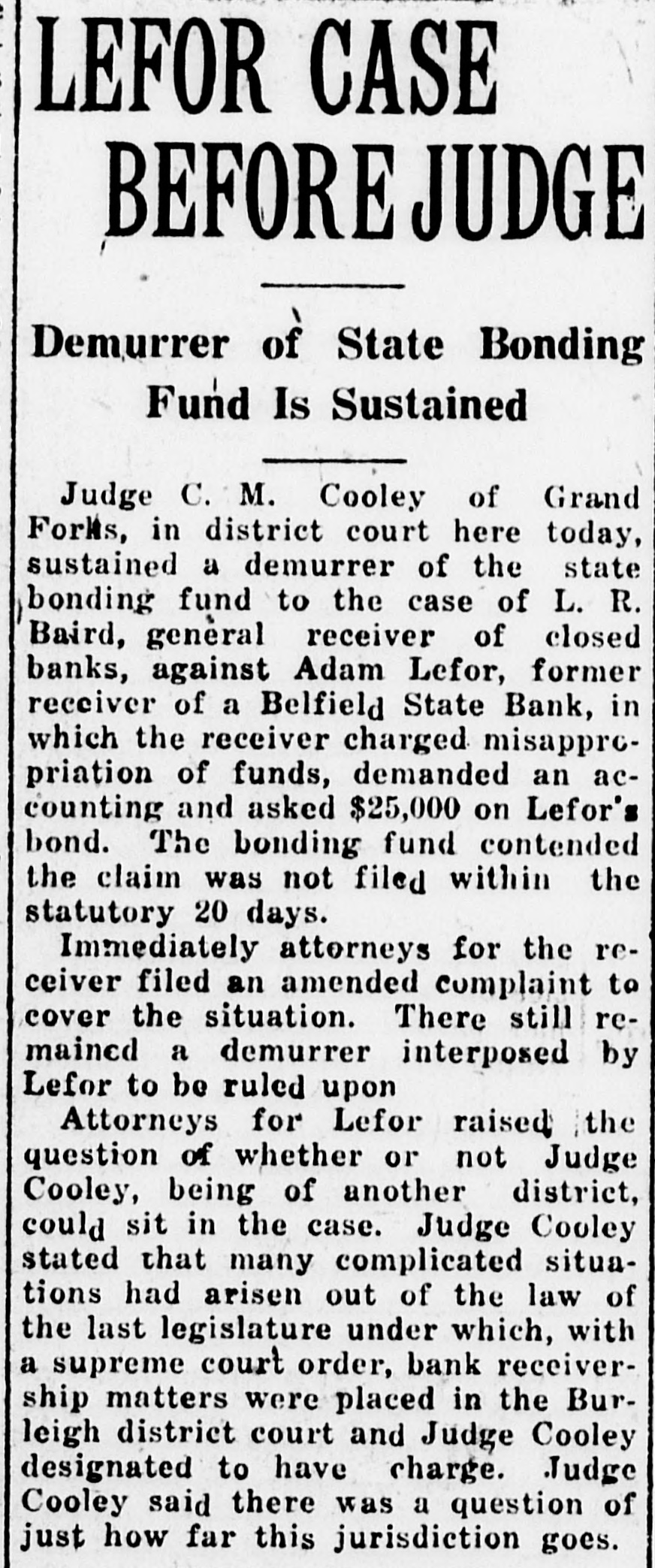

LEFOR CASE BEFORE JUDGE Demurrer of State Bonding Fund Is Sustained Judge C. M. Cooley of Grand Forks, in district court here today, sustained a demurrer of the state bonding fund to the case of L. R. Baird, general receiver of closed banks, against Adam Lefor, former receiver of a Belfield State Bank, in which the receiver charged misapprcpriation of funds, demanded an accounting and asked $25,000 on Lefor's bond. The bonding fund contended the claim was not filed within the statutory 20 days. Immediately attorneys for the receiver filed an amended complaint to cover the situation. There still remained a demurrer interposed by Lefor to be ruled upon Attorneys for Lefor raised the question of whether or not Judge Cooley, being of another district, could sit in the case. Judge Cooley stated that many complicated situations had arisen out of the law of the last legislature under which, with a supreme court order, bank receivership matters were placed in the Burleigh district court and Judge Cooley designated to have charge. Judge Cooley said there was a question of just how far this jurisdiction goes.