Article Text

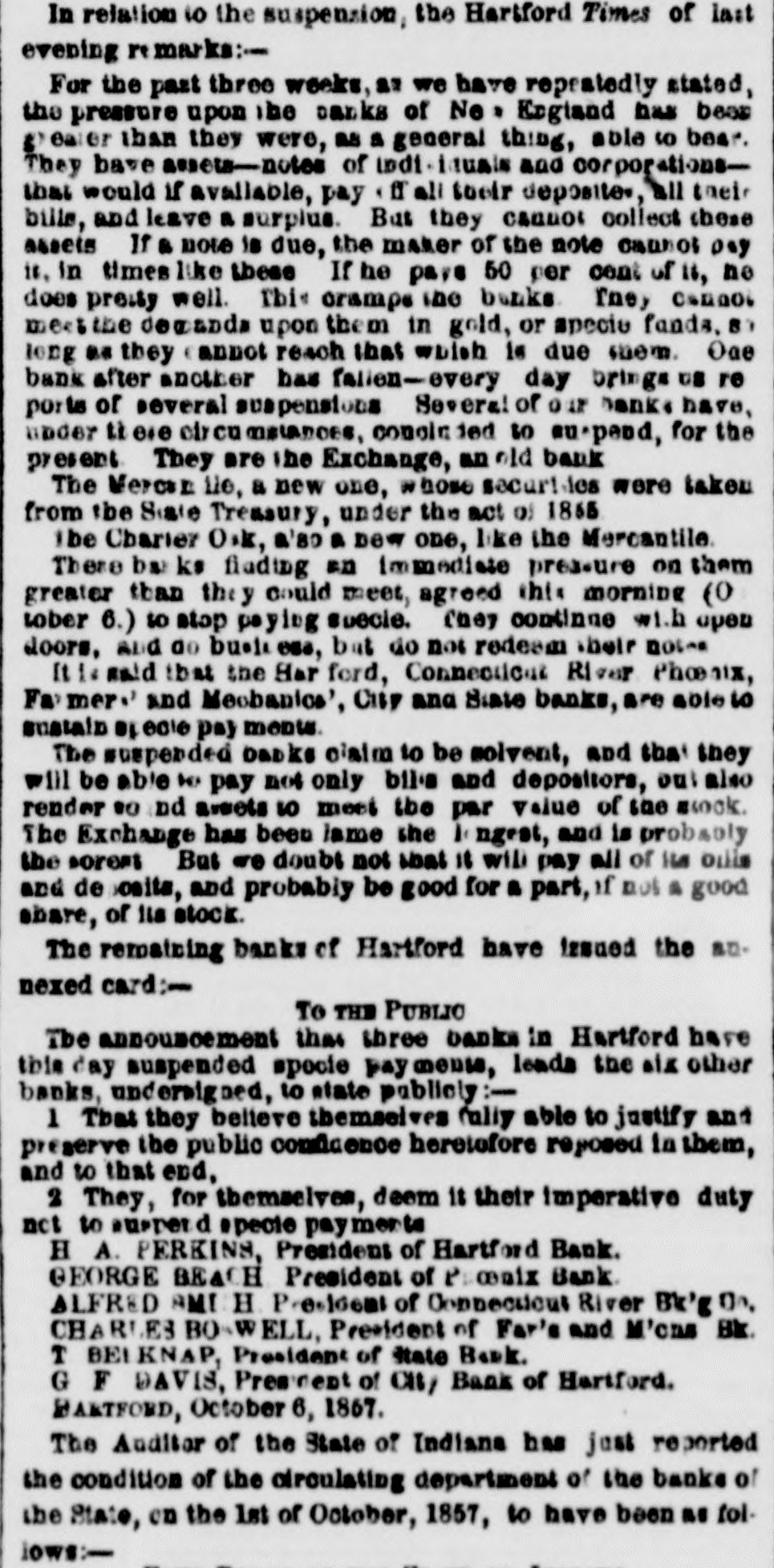

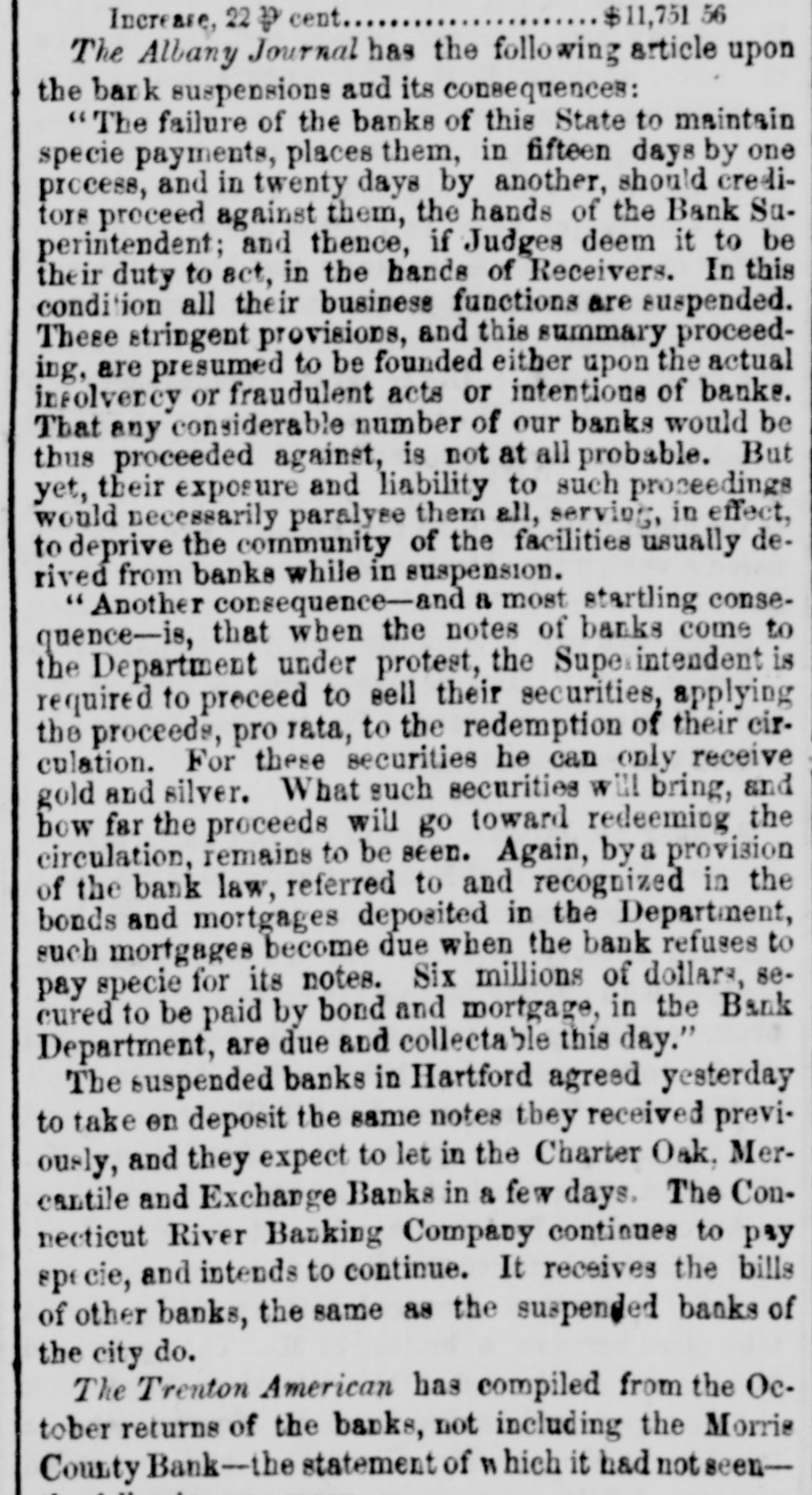

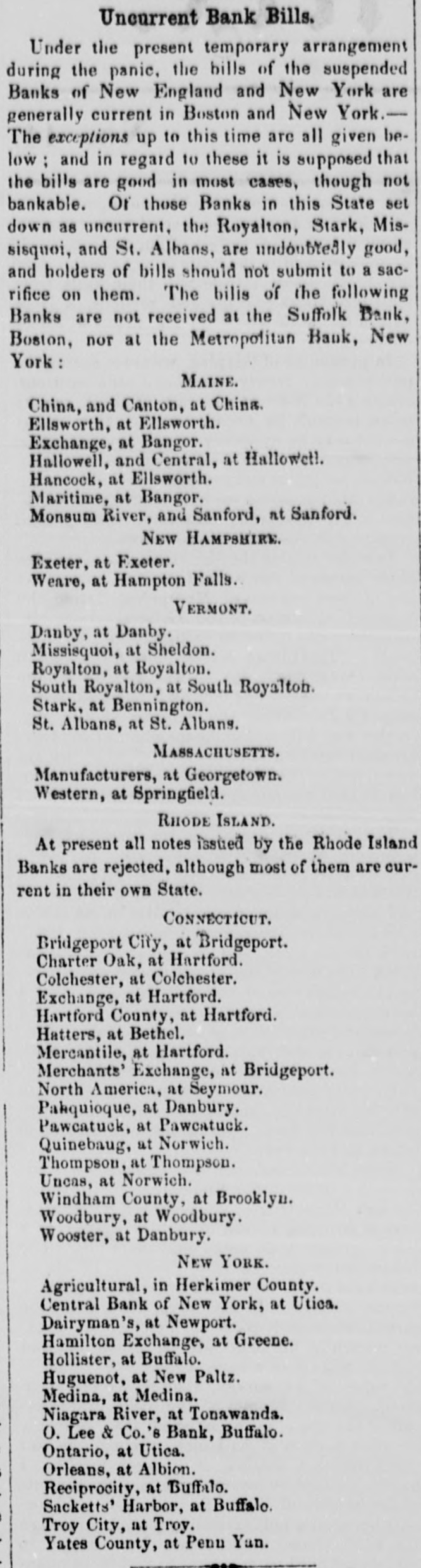

Financial Matters. We have to notice the suspension, in Boston, of Proc tor & Wood, wool and produce commission house, City wharf. We understand they lost very heavily in wool sales by the failure some weeks since of F. G. Swan, a large commission house in New York. The Boston Advertiser authoritatively contradicts the statement that Mr. John A. Lowell has suspended payment or made an assignment. The Charter Oak, Exchange, and Mercantile Banks of Hartford suspended payment on Tuesday. These bills are not received at the Suffolk. Judge Merrick Monday afternoon granted an injune tion against the Western Bank of Springfield, as asked by the Bank Commissioners. The ground of injunction is the utter insolvency of the bank. The Commercial Bank of Bath has not failed. The bank is perfectly sound. Its charter expired Oct. 1, and it has gone into liquidation on that account. The Lowell Courier states that the MiddlesexCompany have concluded to keep their works in operation for the present, and that they continue to employ their usual number of hands. The faiures announced in New York on Saturday even ing, were those of Gage, Dater, & Sloan, dry Goods job bers; L. Bauer & Co., hosiery dealers; and Livingston & Ballard. grocers. The suspension of the latter, it is said, will be only temporary. At Baltimore on Saturday, the money market was much excited. and more stringent. They discounted only to a limited extent. Good first class notes are quoted at 11 per cent a month; money on call 11 to 2 per cent. Exchange on the North command 8 to 10 per cent. premium, and gold sold at 7 to 10 per cent. premium. The Philadelphia Ledger says the opinion entertained by some that suspension would afford relief to the money market, and thus put a stop to further failuresi is fast dying out. Suspensions are of almost daily occurrance. and arelikely. to continue for some time yet.