Article Text

PREVIEWS BRIEF injuries; jurisDefendant was soliciting diction. also for insurance company, agent of accident dedefendant. At time returning from an fendant was for the Regional Agricultural spection Defendant, Credit corporation. ident of Furnas county, was served district court of Adams county, by being made joint insurance company defendant. Eleven jurors awarded Defendant obplaintiff damages. joint liability, jects to jurisdiction, and insists prejudice of jury. Copof plaintiff tributory negligence Law: Company not alleged also. of salesman liable for negligence working on commission, 124 Neb. Where instrumentality not furnished or directed by employhe not liable for negligent use 308 Pa. 117, 87 of same, cannot be sent 783. Summons where action other than one county joint demand pending unless Neb. 746. Lack of jurisshown, 124 be raised by special apdiction may 113 Neb. 235. and error, pearance Lee 29287 Neece Brief of appellant Life Ins. Co. ShelLee and burn Russell, Alma, attorneys. Abstracts of Plaintiff was awarded damages by district abstracter and bondsmen court from error in extendby reason of alleged two abstracts. Defendants of trial court alleging error peal, dismissing action against one defendto add ant, in allowing plaintiff issues had "Trustee" to name after been joined, and in not confining apto within dates that pellant's liability employed to extend abstracter was abstracts. Evidence shows defendant abstracter was employed to and did and extend abstracts "from examine 1926, to Jan. 1930, Sept. Plaintiff alleges error for taxes in 1920 abstract delinquent and 1921, land being sold at tax sale Nov. 1926. Law: Error in changname of plaintiff, Comp. St. 1929, 20-301. Error in dismissing action defendant, 117 Neb. 29, against one 219 580. Abstracter's liability measured by his employment and limited his 46 Neb. to Brief of appellants 29363 Marley, McCarthy et al. Harrington, attorney. Moratorium. Appellant objects to confirmation of sheriff's sale under Nebraska law (H. R. 600). EviMoratorium aence submitted shows loan has been granted from Federal Land bank which, together with other loans from friends and relatives, will able him to all indebtedness pay land. Law: Moratorium against laws held eonstitutional, 249 290 54 231, 78 334, Ed. 88, A. 1481; 253 701. Brief of 29216 Clark appellant Haas. Bartos, Bartos & Placek, Wilbur; Fred Komarek, Bruning, attorneys. Personal and conversion. Household goods were stored by plaintiff in defendant's warehouse in name of plaintiff's husband, against whom second defendant, Allied Mills, Inc., obtained judgment for money due. Attachment proceedings were taken in Municipal court and goods were sold, proceeds applied defendant's account against plaintiff's husband. Plaintiff was awarded dict in district court of $1,225 for loss of goods. Defendants appeal. Error is relied upon instructions which imply joint liability of defendants. Evidence shows goods worth not more than $150 and verdict alleged excessive. Law: Error in instruction intimating joint liability, 56 Neb. 590, 73. Where one of two parties suffer loss because of wrong of third person, superior equities determined from material circumstances, 37 Plaintiff and warehouse company estopped claim damages against Allied Mills Co., Allied Mills and warehouse company were not joint feasors, 31 454, Brief of appellants 29327 Sprague Allied and Gordon StorWarehouses. Morgan, Sutton Fromkin, Foster Yates. Omaha, attorneys.

(SYLLABUS) permitting or refusing amendments to pleadings is matter within the sound judicial discretion of the trial court, and unless it is made to clearly appear that he has abused this discretion, and has thereby been deprived the opportunity to make his case or defense, the court not supreme interfere." Omaha & R. V. R. Co. Moschel, 38 Neb. 281. 2. is not necessarily Tatal objection to proposed amendment that it is in fact an additional defense or an additional cause of acOmaha & R. Co. Moschel, 38 Neb. 281. 3. Evidence examined, and HELD ample to require the affirmance of the judgment of the district court on hearing here de novo.

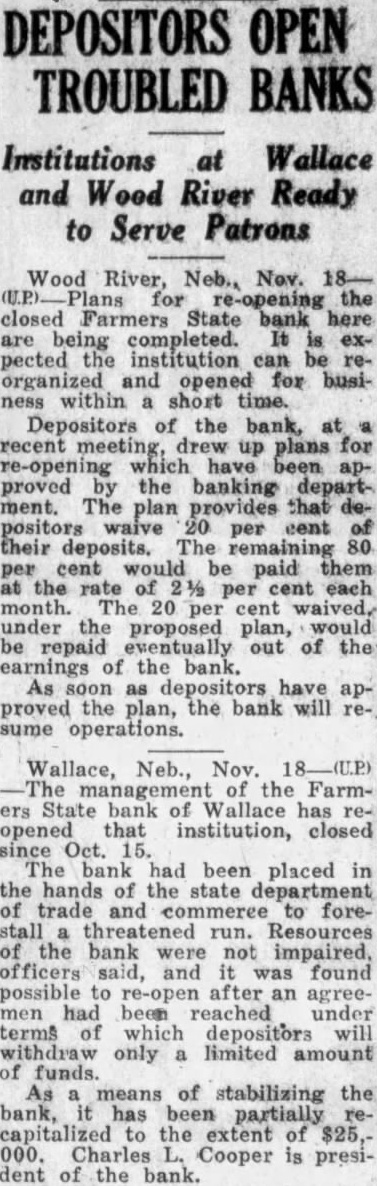

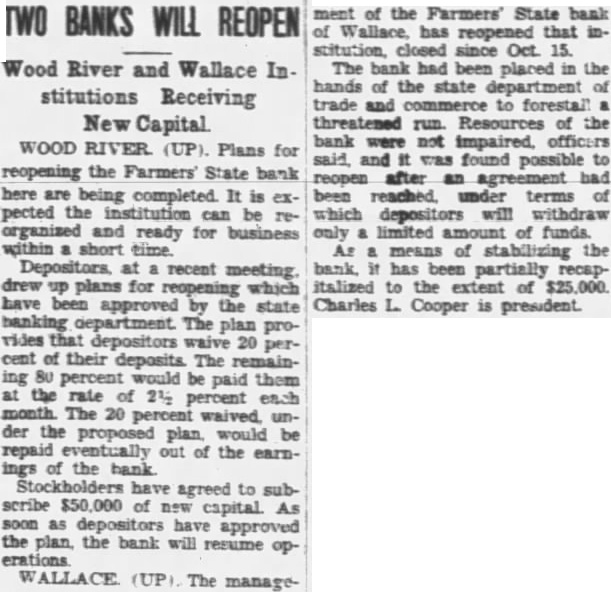

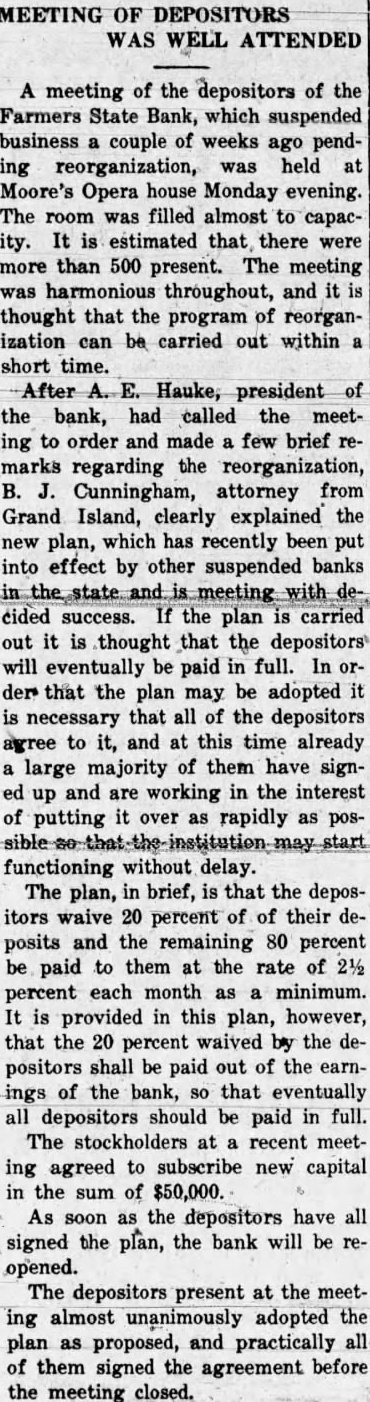

Heard before Goss, C. Rose, Good, Eberly, Day and Paine, and Landis, District Judge. EBERLY, The Farmers State Bank of Wood River, Nebraska, is an insolvent institution and in charge of receiver duly appointed. The appellant, Lyhane, herein designated as plaintiff, by petition of intervention filed in the receivership presented his claim for trust fund against the insolvent bank. His right thereto was challenged by the bank's receiver, hereinafter called the fendant, and issues were made up. hearing on the merits, plainclaim for trust fund was disallowed, and from the order of the trial court overruling his motion for new trial he appeals. This litigation finds its source in the following transactions: In the of 1929, Rudolph Durtschi, McDermott, Otha Oldfather, Maro Lyhane, Schooley, Hauke, A. Francis, and Miller, were the directors of the Farmers State Bank of Wood River, and the larger stockholders therein. The bank was in need of cash, not only because of the situation created by the failure of several nearby banks, but in order to supply the demand for live stock loans made upon it by "feeders" of the territory served. For this purpose five of the directors above named evidently their credit" to this bank in the following manner: McDermott, Oldfather, Hauke, Franand plaintiff, Lyhane, made up fund of $46,000, each contributing the of $10,000 excepting Francis who paid in the sum of $6,000. This $46,000 was paid over to the Farmers State Bank of Wood River to meet the situation confronting it. Substantially contemporaneous with this all the directors, including Lyhane but excepting Miller, entered into an agreement in writing day of November, 1929." contemplation of this transaction, wherein was expressly agreed, among other provisions, that each of said parties purchase from the Farmers State Bank of Wood River, Nebraska, notes, either secured unsecured, without recourse, and pay therefor the face value thereof to such an amount as each may determine for himself and to carry said note notes until such time as the said bank may, at its discretion, deto repurchase the same or to purchase renewal notes, if said notes should be renewed, and further agree to carry said notes until maturor for of period months. is further agreed and understood that the signing of this contract does not in any way obligate bind the Farmers State Bank of River to repurchase any said notes and the purpose of this agreement is that each of the parties signing the same will stand an divided of any and all loss which may be sustained by the parties of hereto through the purchase said notes. is agreed that said loss shall be determined within period of months from the date hereof, unless otherwise mutually agreed by the upon parties hereto." The record supports the inference that all the money thus contributed by except Lyhane was the proceeds of real estate loans made real estate by them severally owned. The contributed by Lyhane was borrowed at the Packers National Bank of Omaha, Nebraska, on individual note. As these were received by the bank there was withdrawn from the bank's bills reivable "good notes" of substantialequivalent amount and placed in envelope on which the contributor's name was inscribed. These notes were each indorsed without recourse in order that upon payment or renewal the indorsement could be erased so that the fact of its having been made could be concealed. Director Oldfather testifies that the notes thus placed separate pouches" were left at the bank for the cashier to look after, collect the interest and renew, or any of them were paid, to substitute equally as good notes (from the bank note as those paid. The evidence in the record indicates that the interest all loans made by the several on contributors was paid by the bank out of its own funds, but that the bank got the benefit of the interest accruing on the notes placed in the contributors' envelopes. This is certainly true as to the nonpayment of interest by the plaintiff. There seems to have been no interruption of the tended progress of this transaction until on April 10, 1930. that day plaintiff's note of $10,000 was in the possession of the Packers National Bank. In the envelope with his name inscribed thereon were notes substantially gregating the amount of his note. The state examination of the bank had just been completed the day previous, and the results thereof was that of the requirement bills receivable be "charged Plaintiff was admittedly present for part of the time while this examination being made. The eviwas dence for the defendant tends to establish that the matter of providing for the was submitted to him and he approved verbally substantially the following plan: That should be debited to undivided profits, and $18,460 should be taken out of the contributors' envelopes and returned to the bank. This was embodied in report to the state under date of April 10, 1930, over the signatures of all the directsave Lyhane. In this report are schedules of the notes contributed for the purpose of making up the $18,460. It discloses that $4,610 was received from Maro Lyhane in eight notes which are itemized by date, name of maker, and amount. A true copy of this report continued to be a part of the records of the bank, and was made part of the directors' minutes. The in notes was thereupon received and regularly entered up in the bills receivable as the property of the bank. Lyhane now denies all knowledge of this transaction. In his petition filed in the present case, plaintiff in substance alleges that he was on April 10, 1930, the owner of eight notes of the total value of $4,610, which he had previously purchased from the defendant bank, and which he had left with the bank for and payment; that the defendant bank without his knowledge or consent illegally converted said notes to its own use by substituting them for worthless notes of the bank which the bank examiner had directed to be eliminated from the assets of the bank; that the eight notes in suit were good and collectible, and augmented the assets of the bank in the sum of $4,610, all of which went into the possession of the receiver. Plaintiff admits total credit of $850, which the bank is entitled to, and prays judgment for and interest as a trust fund with priority of payment over all other creditors. The defendant's answer, in addition to general denial, alleged that on April 1930, plaintiff, intervener, contributed said notes to common pool for the purpose of eliminating certain "bad paper" from the assets of the bank, and accepted his share of such "bad and that he knew of this procedure and acquiesced therein. Certain other allegations were in the answer, to which plainfiled reply. Thereafter, during trial of the action to the court, suggestion of the trial judge, defendant amended his answer by in corporating therein allegations of estoppel. The cause was thereupon, application of plaintiff, continued for ten days to allow for filing an amended reply to the amended answer, with permission to withdraw rest. The amended reply was thereafter filed, and on the evidence received upon the issues thus made the trial court entered for judgment defendant, and dismissed plaintiff's action. Two errors are presented on this appeal. The first for our consideration is the charge that the trial court erred in permitting the defendant to amend his answer, after plaintiff had rested, by incorporating therein the allegations of estoppel. It will be noted that. the amendment having been the made, trial court, continued the hearing ten days permission to withdraw Conceding that estoppel, to be available be must pleaded (Salladin Mitchell. Neb. 859). still the action of the trial court in permitting the amendment complained is not erroneous. In Omaha Co. Moschel, 38 Neb. 281, we held: permitting or refusing amendments to pleadings is matter within the sound judicial discretion of the trial court; and unless it is made to clearly that he has abused appear this discretion, and party has thereby been deprived of the opportunity to make his case or defense, the preme court will not interfere. is not necessarily fatal objection to proposed amendment that is in fact an additional defense or an additional cause of action." See, also, Dunn Bozarth, 59 Neb. 244. In order to predicate error in allowing the amendment of pleadings by the trial court, at any stage of the trial, it must be shown affirmatively that the trial court abused its discretion. Blakeslee Van der Slice, 94 Neb. 153; Continental SupCo. Syndicate Trust Co., Dak. 209. Plaintiff's rights were amply protected, so far as disclosed by the record, by the continuance of the hearing for the period of ten days, "with permission to withdraw The district court therefore must be deemed to have proceeded within its discretion and without error. The second contention of plaintiff in effect, that the evidence is sufficient to support the judgment. Preliminary to a discussion of the evidence, it may be said that during all of the time occupied by the related transaction involved in this litigation plaintiff was an active and qualified director of the Farmers State Bank of Wood River. On related subject in Merchants Bank Rudolf, Neb. 527, 540, Lake, in delivering the opinion of this employed the following language: Morse on Banks end Banking, 90, 91, it is said that "The general control and government of all the af. fairs and transactions of the bank rest with the board of directors. For such purpose the board constitutes the corporation, and 'uniform usage imposes upon them the general superintendence and active management of the corporate concerns, They are bound to know what is done, beyond the merest matter of daily routine, and they are bound to know the system and rules arranged for doing.' Again, on 115: page 'Whatever knowledge director has, or ought to have, officially, he has, or will be conclusively presumed law to have, as private individual. In any transactions with the bank, either on his own separate account, or where others are so far jointly terested with him that his their knowledge, he and his joint contractors will be affected by this knowledge which he has or which he ought, if he had duly performed his official duties, to have acquired.' Ly. man United States Bank, 12 How. 225." The transaction in suit considered as an entirety contains peculiar features. In the fall of 1929 this bank wanted new cash in the amount of $46,000. Two resources were presumably open to it. It could borrow on its bills payable, or it could discount bills receivable. Either of these methods if adopted would quire appropriate entries on its books and the facts would be disclosed on its published statements. It does not clearly appear to what extent the bank had exercised these powers in November, 1929. But on July 10, 1930, after the demand for "feeder loans" was largely the record before us discloses that it had bills payable outstanding in the sum of rediscounts with the Federal Reserve, rediscounts with the Grand Island Clearance Association. $25,000, total of Its total amount of capital and surplus was then aggregate amount of the discounts and bills payable of any corporation transacting banking business in this state shall at no time exceed the amount of its paid-up capital and surplus. Provided, however, state bank beany coming member of the Federal Resystem, may have the same privileges as to redisounts and bills payable with the Federal Reserve banks and may incur liabilities to such banks to the same extent as national banks." St. Comp. 1929, 8-136. So, too, it is to be remembered in this connection that the total of bills payable and rediscounts appears in the published statements of banks and thus becomes in part the basis of its credit with those who deal with it. The necessary result of the transaction initiated in November, 1929, that the bank received This amount was covered by the directors' individual obligations to third persons, on which the bank the interest. The record establishes that the bank received the terest on the notes kept in the directtors individual pouches. It thus profited the extent of the difference between the interest paid and the interest so received. Identified by its results the transaction was identical with the rediscount of the $46,000 in notes. At least the entire deal was solely for the benefit of the bank, and in the transaction of its good notes was charged with the ultimate extinguishment of the constituting the source from which in cash was received. The situation suggests the query that, looking through form to substance should not this transaction have been reported to the state either as "bills payable" or as "rediscounts," and the further query, is not plaintiff's claim substantially within the words of inhibition contained in the statute last referred But, wholly aside from the questions suggested, while plaintiff oraltestified in the presence of the trial court that he at no time authorized the withdrawal of $4,610 in notes from the envelope inscribed with his name, this testimony was met with like positive oral evidence that, though he was not present when the formal action was taken of accepting these notes and incorporating them in the assets of the bank, plaintiff in substance approved this plan and fairly authorized the action taken. The trial court heard this evidence and observed the witnesses as they testified, and thus possessed advantages which this reviewing court does not have. Unquestionably the plaintiff, in general, knew of the bank examination of April to 9, 1930, and in general way knew the results, and necessarily must have known that steps were required of the board of directors to remedy the situation. What was actually done was itemized, and the notes claimed by plaintiff were scheduled by date, name of maker, and amount, and formally taken into the assets of the bank. The action taken was formally reported to the state. The records retained in the bank were full, detailed and explicit. Twice thereafter the receivable" of this bank were checked over by its directors as board of auditors with plaintiff present each time and participating. Twice the statements which included the notes now claimed by plaintiff formwere ally unanimously approved. Twice it was expressly certified in of the bank to the state, that reports the record of obligations of the bank, as contained Twice in these reports, was complete. as member of the board of directors, and subsequent to the taking over by the bank of the notes now claimed by plaintiff, plaintiff certified that no other outstanding obligations of the bank existed. And admittedly at both of these times obligations scheduled, of which plaintiff's certificate formed part, did not contain the claim now made by plaintiff. On the basis of these reports this bank was permitted to continue business by the state, on the basis of the published state- and ments required which may assume were made, depositors mitted their deposits to remain per- in the Under bank and also made new deposits. the situation thus this reviewing court, in presented, trial de novo, has reached the conclusion that the judgment of the trial court is in all respects correct, and the same