Click image to open full size in new tab

Article Text

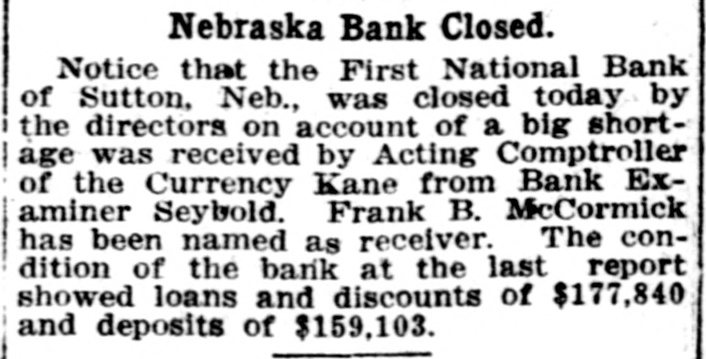

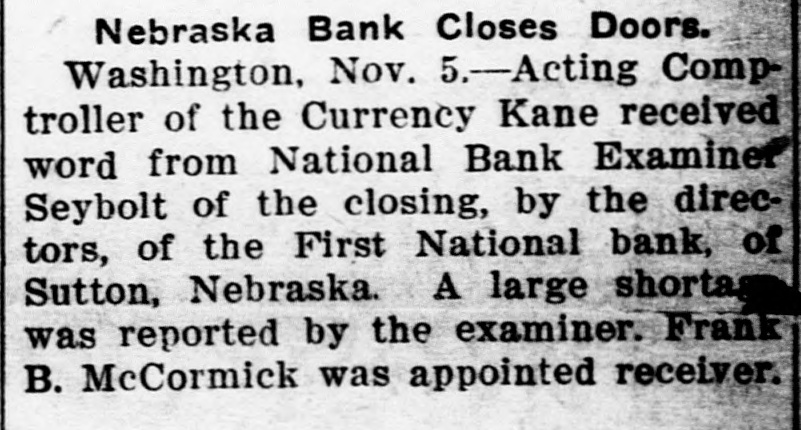

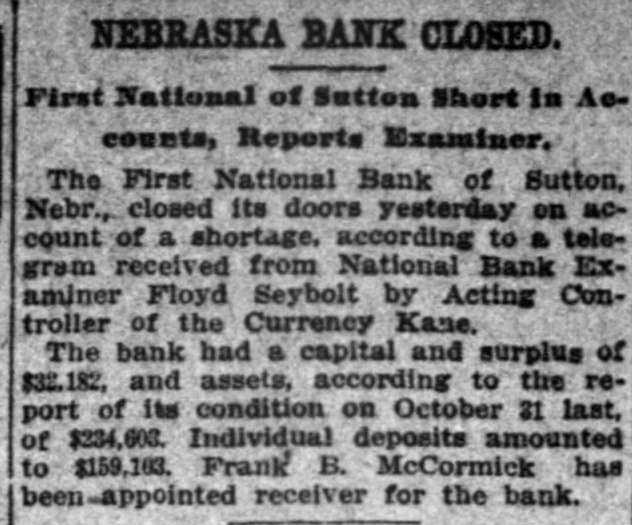

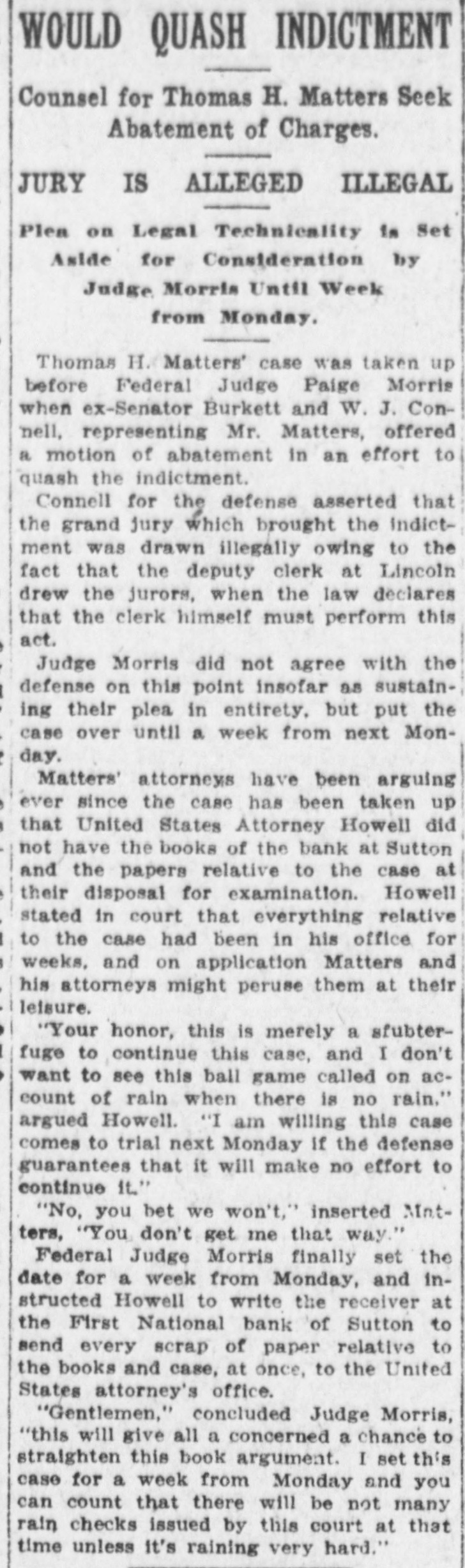

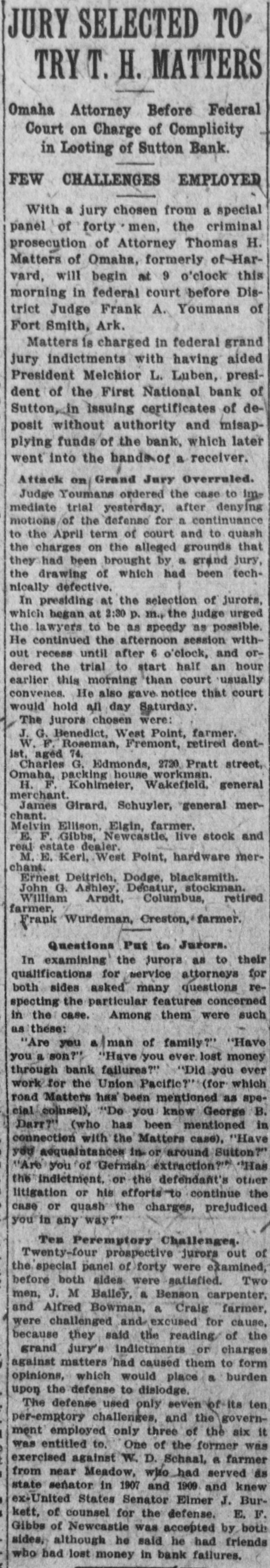

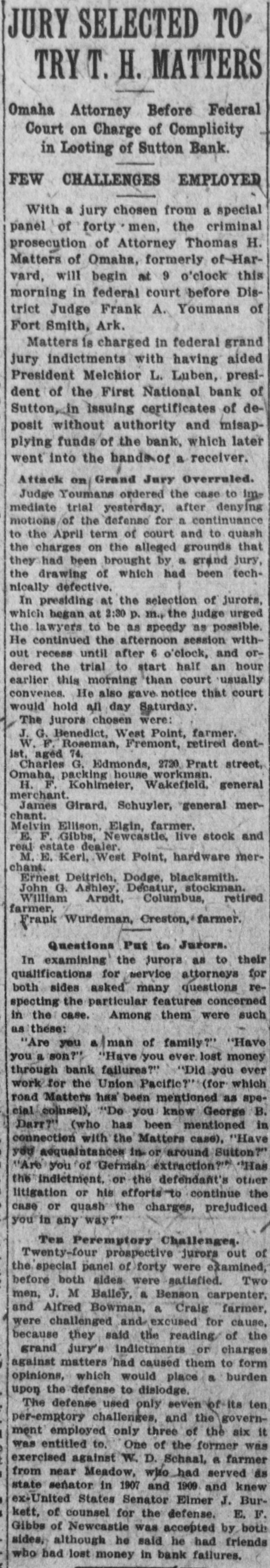

JURY SELECTED TO TRY T. H. MATTERS Omaha Attorney Before Federal Court on Charge of Complicity in Looting of Sutton Bank. FEW CHALLENGES EMPLOYED With a jury chosen from a special panel of forty men, the criminal prosecution of Attorney Thomas H. Matters of Omaha, formerly of Harvard, will begin at 9 o'clock this morning in federal court before District Judge Frank A. Youmans of Fort Smith, Ark. Matters is charged in federal grand jury indictments with having aided President Melchior L. Luben, president of the First National bank of Sutton, in Issuing certificates of dewithout authority and misapfunds of the posit plying bank, which later went into the hands.of a receiver. Grand Jury Overruled. case mediate Attack Judge Youmans trial on yesterday. ordered the after denying to im defense for a to term of court motions the April of the and continuance to quash that the charges on the alleged grounds they had been brought by a grand jury, the drawing of which had been technically defective. In presiding at the selection of jurors, which began at 2:30 p. m., the judge urged the lawyers to be as speedy as possible. He continued the afternoon session without recess until after 6 o'clock, and ordered the trial to start half an hour earlier this morning than court usually convenes. He also gave notice that court would hold all day Saturday. The jurors chosen were: J. G. Benedict, West Point, farmer. W. F. Roseman, Fremont, retired dentist, aged 74. Charles G. Edmonds, 2720 Pratt street, Omaha, packing house workman. H. F. Kohlmeler, Wakefield, general merchant. James Girard, Schuyler, general merchant. Melvin Ellison, Elgin, farmer. E. F. Gibbs, Newcastle, live stock and real estate dealer. M. E. Kerl, West Point, hardware merchant. Ernest Deitrich, Dodge, blacksmith. John G. Ashley, Decatur, stockman. William Arndt, Columbus, retired farmer, Frank Wurdeman, Creston, farmer. Questions Put to Jurors. In examining the jurora as to their qualifications for service attorneys for both sides asked many questions respecting the particular features concerned in the case. Among them were such as these: "Are you a/man of family? "Have you a son?' "Have /you ever lost money through bank failures?' Did you ever work for the Union Pacific? (for which road Matters has been mentioned as special/coinsel), "Do you know George B. Darr? (who has been mentioned in connection with the Matters case), "Have you adquaintances in or around Sutton?" "Are you of German extraction? Has the indictment, or the defendant's other litigation or his efforts continue the case or quash the charges, prejudiced you in any way? Ten Peremptory Challenges. Twenty-four prospective jurors out of the special panel of forty were examined, before both sides were satisfied. Two men, J. M Balley, a Benson carpenter, and Alfred Bowman, a Craig farmer, were challenged and excused for cause, because they said the reading of the grand jury's Indictments or charges against matters had caused them to form opinions, which would place a burden upon the defense to dislodge. The defense used only seven of its ten per-emptory challenges, and the government employed only three of the six it was entitled to. One of the former was exercised against W. D. Schaal, a farmer from near Meadow, who had served as state senator in 1907 and 1909 and knew ex-United States Senator Elmer J. Burkett, of counsel for the defense. E. F. Gibbs of Newcastle was accepted by both sides, although he said he had friends who had lost money in bank failures.