Article Text

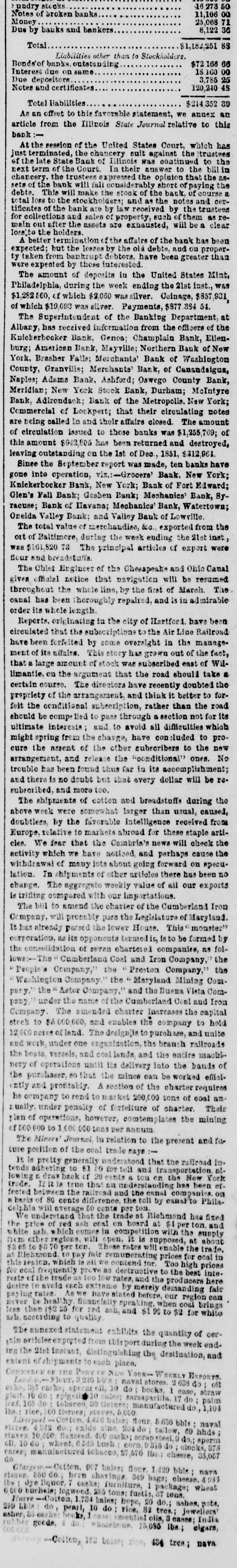

undry stocks 16 273 50 Notes of broken banks 11,106 00 Money 25,068 71 Due by banks and bankers 8,122 36 Total $1,184,251 88 Liabilities other than to Stockholders. Bonds'of banks, outstanding $72.166 66 Interest due on same 18.160 00 Due depositors 3,785 25 Notes and certificates 120,240 48 Total liabilities $214,352 89 As an offset to this favorable statement, we annex an article from the Illinois State Journal relative to this bank:- At the session of the United States Court, which has just terminated, the chancery suit against the trustees of the late State Bank of Illinois was continued to the next term of the Court. In their answer to the bill in chancery, the trustees expressed the opinion that the as- sets of the bank will fall considerably short of paying the debts. This will make the stock of the bank, of course a total loss to the stockholders; and as the notes and cer- tificates of the bank are by law received by the trustees for collections and sales of property, such of them as re- main out after the assets are exhausted, will be a clear loss to the holders. A better termination of the affairs of the bank has been expected; but the losses by the old debts, and on proper- ty taken from bankrupt debtors, have been greater than were expected by those interested. The amount of deposits in the United States Mint, Philadelphia, during the week ending the 21st inst., was $1,282 560, of which $2,060 was silver. Coinage, $857,931, of which $19,093 was silver. Payments, $877.394 54. The Superintendent of the Banking Department, at Albany, has received information from the officers of the Knickerbocker Bank, Genoa; Champlain Bank, Ellen- burg; American Bank, Mayville; Northern Bank of New York, Brasher Falls; Merchants' Bank of Washington County, Granville; Merchants' Bank, of Canandaigus, Naples; Adams Bank, Ashford; Oswego County Bank, Meridian; New York Stock Bank, Durham; McIntyre Bank, Adirondack; Bank of the Metropolis, New York; Commercial of Lockport; that their circulating notes are being called in and their affairs closed. The amount of circulation issued to those banks was $1,255,709; of this amount $942,805 has been returned and destroyed, leaving outstanding on the 1st of Dec., 1851, $312,961. Since the September report was made, ten banks have gone into operation, viz.:-Grocers' Bank, New York; Knickerbocker Bank, New York; Bank of Fort Edward; Glen's Fall Bank; Goshen Bank; Mechanics' Bank, Sy- racuse; Bank of Havana; Mechanics' Bank, Watertown; Oneida Valley Bank; and Valley Bank of Lowville. The total value of merchandise, &c., exported from the ort of Baltimore, during the week ending the 21st inst., was $161,820 78. The principal articles of export were flour and breadstuffs. The Chief Engineer of the Chesapeake and Ohio Canal gives official notice that navigation will be resumed throughout the whole line, by the first of March. The canal has been thoroughly repaired, and is in admirable order its whole length. Reports, originating in the city of Hartford, have been circulated that the subscriptions to the Air Line Railroad have been forfeited by some oversight in the manage- ment of its affairs. This story has grown out of the fact, that a large amount of stock was subscribed east of Wil- limantic, on the argument that the road should take a certain course. The directors have recently doubted the propriety of the arrangement, and think it better to for- feit the conditional subscription, rather than the road should be compelled to pass through a section not for its ultimate interests; and to avoid all difficulties which might spring from the change, have concluded to pro- cure the assent of the other subscribers to the new arrangement, and release the "conditional" ones. No trouble has been found thus far in its accomplishment; and there is no doubt but that every dollar will be re- subscribed, and more too. The shipments of cotton and breadstuffs during the above week were somewhat larger than usual, caused, doubtless, by the favorable intelligence received from Europe, relative to markets abroad for these staple arti- cles. We fear that the Cambria's news will check the activity which we have noticed, and perhaps cause the withdrawal of many lots about going forward on specu- lation. In shipments of other articles there has been no change. The aggregate weekly value of all our exports is trifling compared with our importations. The bill to amend the charter of the Cumberland Iron Company, will probably pass the Legislature of Maryland. It has already passed the lower House. This "monster" corporation, as its opponents termed it, is to be formed by the consolidation of seven chartered companies, as fol- lows: The Cumberland Coal and Iron Company," the "People's Company," the "Preston Company," the "Washington Company," the "Maryland Mining Com- pany," the "Astor Company," and the Buena Vista Com- pany," under the name of the Cumberland Coal and Iron Company. The amended charter increases the capital stock to $5,000,000, and enables the company to hold 12,000 acres of land. The design is to purchase, and unite and work, under one organization, the branch railroads the boats, vessels, and coal lands, and the entire machi- nery of operations until its delivery into the hands of the purchaser, so that the mines can be worked effici- ently and profitably. A section of the charter requires the company to send to market 200,000 tons of coal an- nually, under penalty of forfeiture of charter. Their plan of operations, however, contemplates the mining of 500,000 to 1,000,000 tons per annum. The Miners' Journal, in relation to the present and fu- ture position of the coal trade says:- It is pretty generally understood that the railroad in- tends adhering to $1 10 for toll and transportation, al- lowing a draw back of 20 cents a ton on the New York trade. If it is true that an understanding has been ef- fected between the railroad and the canal companies, on a basis of 80 cents difference, the toll by canal to Phila- delphia will average 50 cents per ton. We understand that the trade at Richmond has fixed the price of red ash coal on board at $1 per ton, and white ash, which comes in competition with the supply from other regions, will open, it is supposed, at about $3 65 to $3 70 per ton. These rates will enable the trade, at Richmond, to pay fair remunerating prices for coal in this region, which is all we contend for. Too high prices for coal frequently prove as destructive to the best inte- rests of the trade as too low rates, and the producers here desire to avoid each extreme by merely demanding fair paying rates. As we have stated before, our region can never be healthy, financially speaking, when coal brings less than $2 25 for red ash, and $1 90 to $2 for white ash, according to quality. The annexed statement exhibits the quantity of cer- tain articles exported from this port during the week end- ing the 21st instant, distinguishing the destination, and extent of shipments to each place. COMMERCE OF THE PORT OF NEW YORK WEEKLY EXPORTS. London.-Flour, 3,210 bbls; naval stores. 2638 do; oil cake, 367 casks; sperm oil, 10 do; books, 1 case, straw pleit. 10 do; spigelia 10 bales; sarsaparilla, 17 do; palm leaf, 165 do; tobacco, 30 tierces; manufactured do., 1,104 lbs.; rice, 160 tierces; staves, 5,000. Liverpool.-Cotton, 4466 bales; flour, 5.650 bbls; naval stores. 4.842 do.; oxide zinc, 204 do; tallow, 60 hhds; staves. 10,400; flaxseed. 400 casks; scrap steel, 9 do,; sperm oil, 10 do; wheat, 6545 bush; corn, 9316 do; clocks, 373 cases; manufactured tobacco, 27,670 lbs.: cheeze, 35,057 do Glasgow.-Cotton, 907 bales; flour, 1.429 bbls; naval stores, 250 do.; hern shavings. 349 bags; cheese, 4933 lbs; dye liquor, 7 casks; furniture, 1 package; wheat 6000 bushels; logwood, 285 tons; fustis, 37 tons. Havre.-Cotton, 1,734 bales; hope, 20 do.; ashes, pots, 289 bbls do, pearl, 10 do; rice, 82 tres; jewellers asher, 86 casks; books, 1 case; essential oils, 3 cases; India rubber goods, 4 do; whalebone, 15,085 lbs.; cigars, 400.000. Antwerp.-Cotton, 162 bales; rice, 434 tres; naval