Article Text

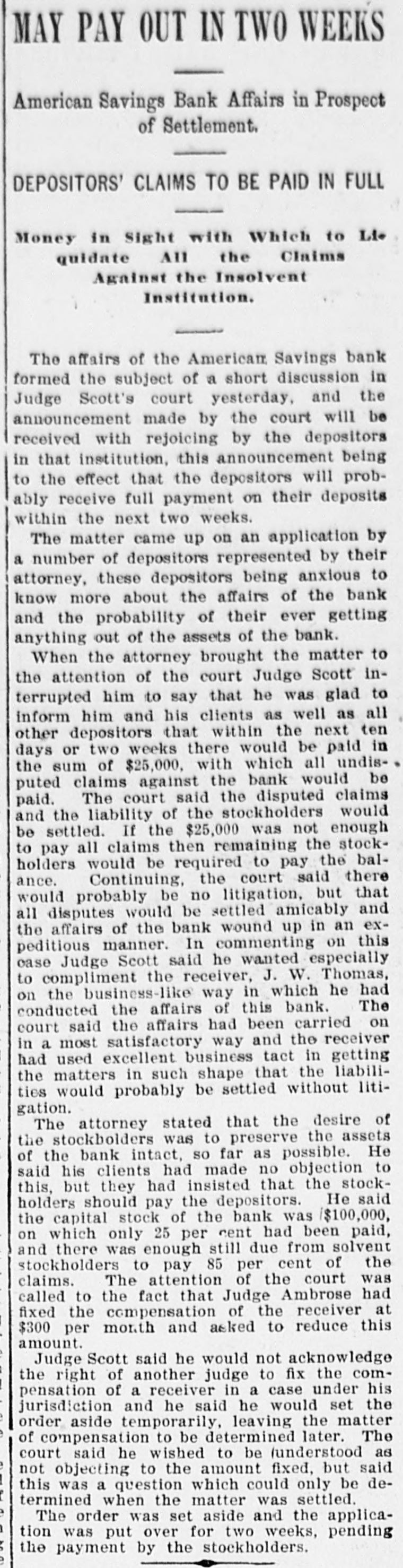

MAY PAY OUT IN TWO WEEKS American Savings Bank Affairs in Prospect of Settlement. DEPOSITORS' CLAIMS TO BE PAID IN FULL Money in Sight with Which to Lie quidate All the Claims Against the Insolvent Institution. The affairs of the American Savings bank formed the subject of a short discussion in Judge Scott's court yesterday, and the announcement made by the court will be received with rejoicing by the depositors in that institution, this announcement being to the effect that the depositors will probably receive full payment on their deposits within the next two weeks. The matter came up on an application by a number of depositors represented by their attorney, these depositors being anxious to know more about the affairs of the bank and the probability of their ever getting anything out of the assets of the bank. When the attorney brought the matter to the attention of the court Judge Scott interrupted him to say that he was glad to inform him and his clients as well as all other depositors that within the next ten days or two weeks there would be paid in the sum of $25,000, with which all undisputed claims against the bank would be paid. The court said the disputed claims and the liability of the stockholders would be settled. If the $25,000 was not enough to pay all claims then remaining the stockholders would be required to pay the balance. Continuing, the court said there would probably be no litigation, but that all disputes would be settled amicably and the affairs of the bank wound up in an expeditious manner. In commenting on this case Judge Scott said he wanted especially to compliment the receiver, J. W. Thomas, on the business-like way in which he had conducted the affairs of this bank. The court said the affairs had been carried on in a most satisfactory way and the receiver had used excellent business tact in getting the matters in such shape that the liabilities would probably be settled without litigation. The attorney stated that the desire of the stockbolders was to preserve the assets of the bank intact, so far as possible. He said his clients had made no objection to this, but they had insisted that the stockholders should pay the depositors. He said the capital stock of the bank was /$100,000, on which only 25 per cent had been paid, and there was enough still due from solvent stockholders to pay 85 per cent of the claims. The attention of the court was called to the fact that Judge Ambrose had fixed the compensation of the receiver at $300 per month and asked to reduce this amount. Judge Scott said he would not acknowledge the right of another judge to fix the compensation of a receiver in a case under his jurisdiction and he said he would set the order aside temporarily, leaving the matter of compensation to be determined later. The court said he wished to be (understood as not objecting to the amount fixed, but said this was a question which could only be determined when the matter was settled. The order was set aside and the application was put over for two weeks, pending the payment by the stockholders.