Article Text

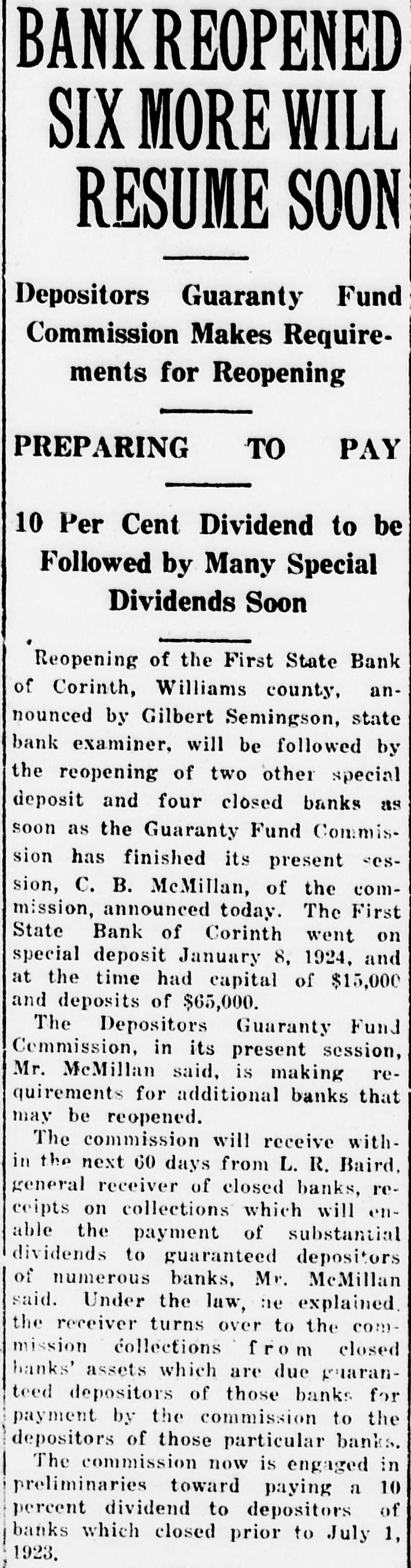

BANK REOPENED SIX MORE WILL RESUME SOON Depositors Guaranty Fund Commission Makes Requirements for Reopening PREPARING TO PAY 10 Per Cent Dividend to be Followed by Many Special Dividends Soon Reopening of the First State Bank of Corinth, Williams county, announced by Gilbert Semingson, state bank examiner, will be followed by the reopening of two other special deposit and four closed banks as soon as the Guaranty Fund Commission has finished its present session, C. B. McMillan, of the commission, announced today. The First State Bank of Corinth went on special deposit January 8, 1924, and at the time had capital of $15,000 and deposits of $65,000. The Depositors Guaranty Fund Commission, in its present session, Mr. McMillan said, is making requirements for additional banks that may be reopened. The commission will receive within the next 60 days from L. R. Baird. general receiver of closed banks, reccipts on collections which will enable the payment of substantial dividends to guaranteed depositors of numerous banks, Mr. McMillan said. Under the law, ne explained the receiver turns over to the commission collections from closed banks' assets which are due guaranteed depositors of those banks for payment by the commission to the depositors of those particular banks. The commission now is engaged in preliminaries toward paying a 10 percent dividend to depositors of banks which closed prior to July 1, 1923,