Article Text

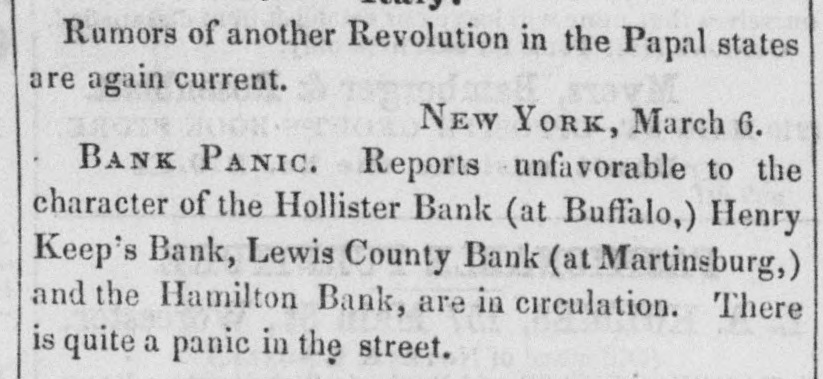

Rumors of another Revolution in the Papal states are again current. NEW York, March 6. BANK PANIC. Reports unfavorable to the character of the Hollister Bank (at Buffalo,) Henry Keep's Bank, Lewis County Bank (at Martinsburg,) and the Hamilton Bank, are in circulation. There is quite a panic in the street.