Article Text

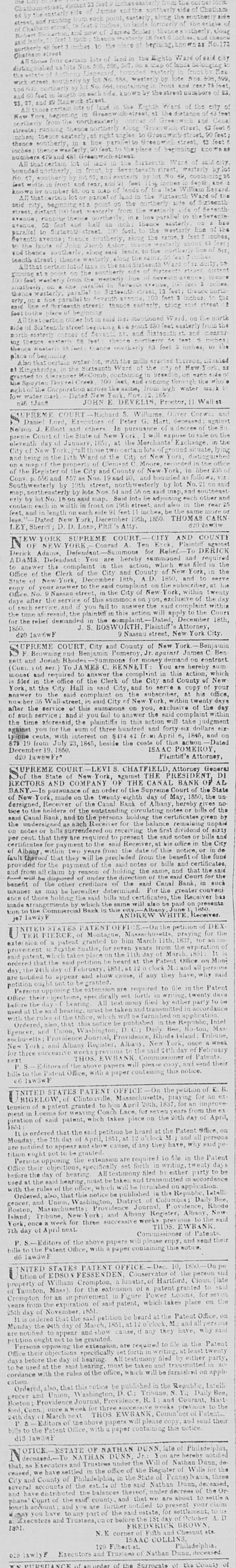

THOMAS December 18th 1850. relief deman S BOSWORTH Plaintiff Attorney York street New City Nassa d20 1aw6wF Beni REME COURT City County of New York James C USA F contract You TT MES hereby New of County filee Clerk of the City and Hall copy York office York City of the the this day after service the implaint and take the time the plaintiffe aforesaid, and three against 846 cents Mone action.-Dated 8.79 679 23 23, 1845. beside the coste ISAAC POMEROY December 19 1850. Plaintiff Attorney d20 law8wl SUURREME COURT - LEVIS CHATFIELD, Attorney Attorney NT Genera DI Suc the against inst THE PRESIDE RECTORS AND State COMP ANY OF THE CANAL Court of the State BANK or AL BANY order eighth day of May 1850 the t of New York, made on the twent dersigned Receive of the Bank of Albany hereby bills to the holders of the tice holdine given said Caual I Bank and to the person the each Graf the said bills that they are office the Albany the fund the Court for Bank, W HITE Receive Office send place Off notice N sts COLL E F IN 018