Article Text

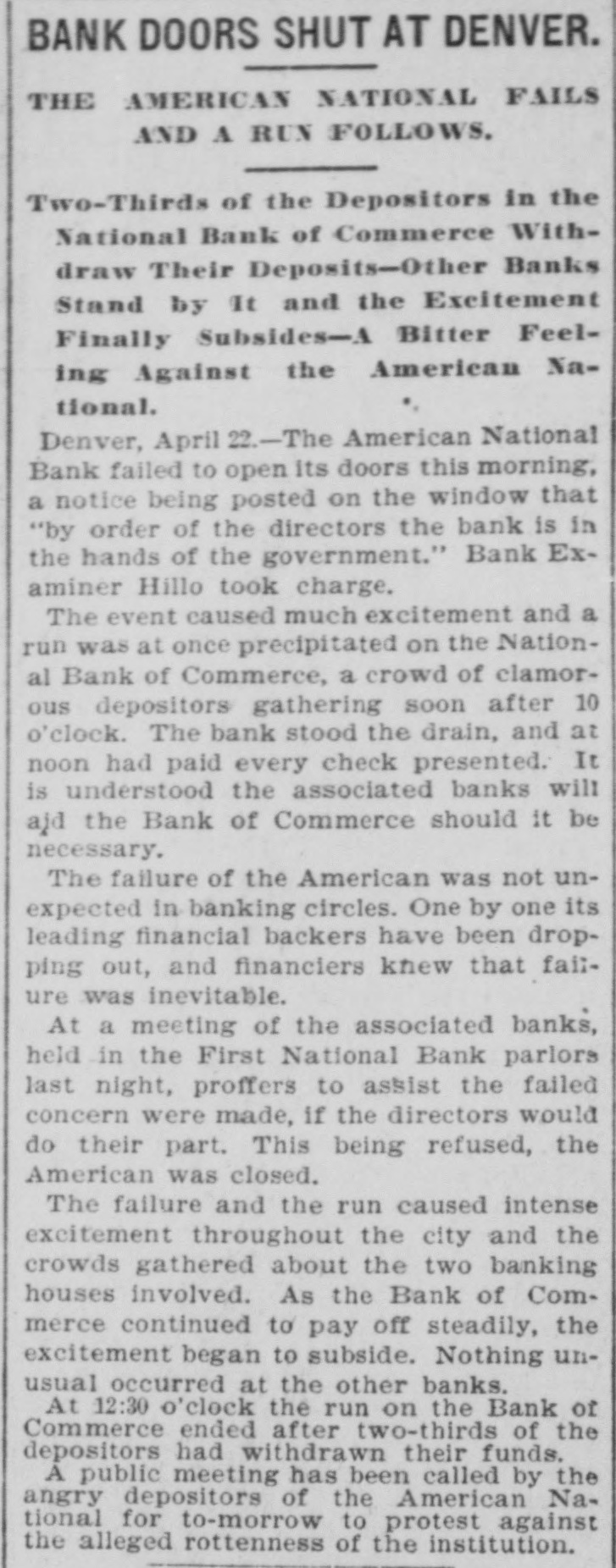

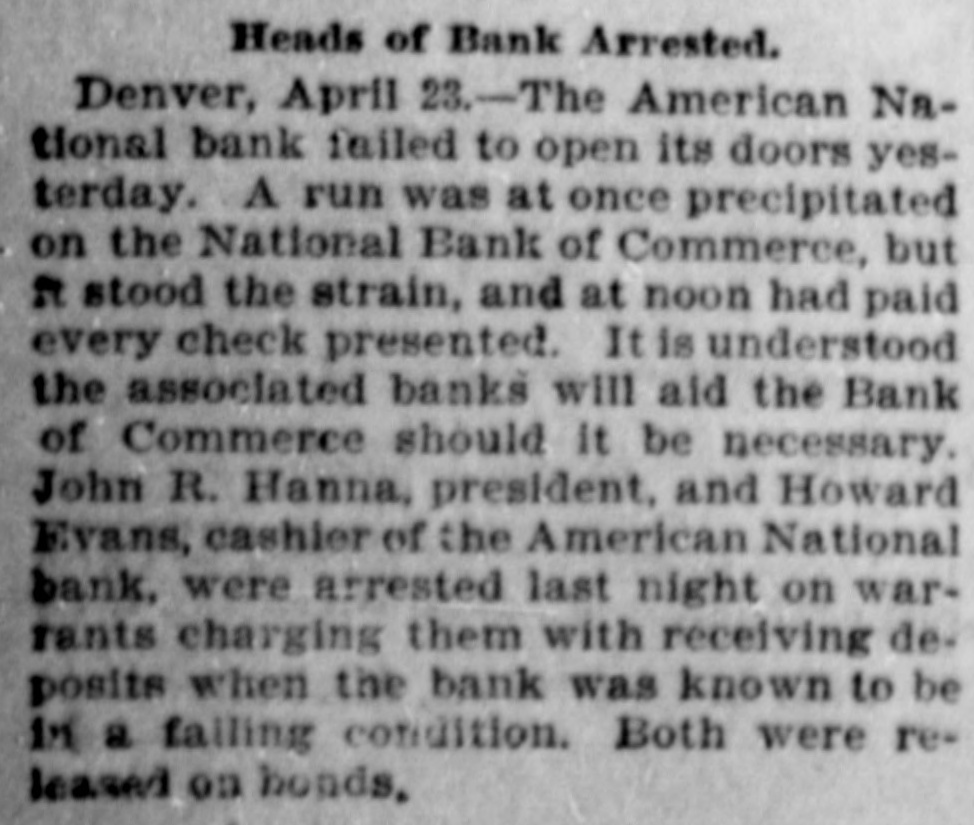

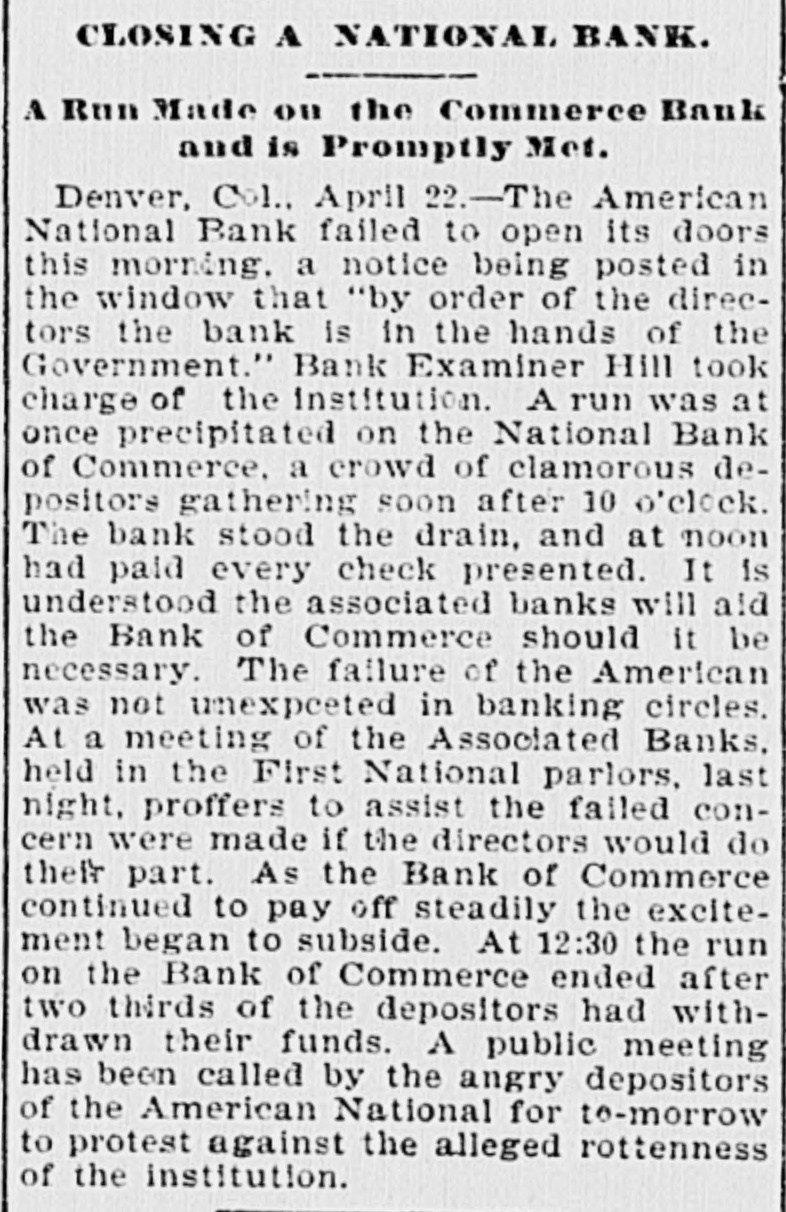

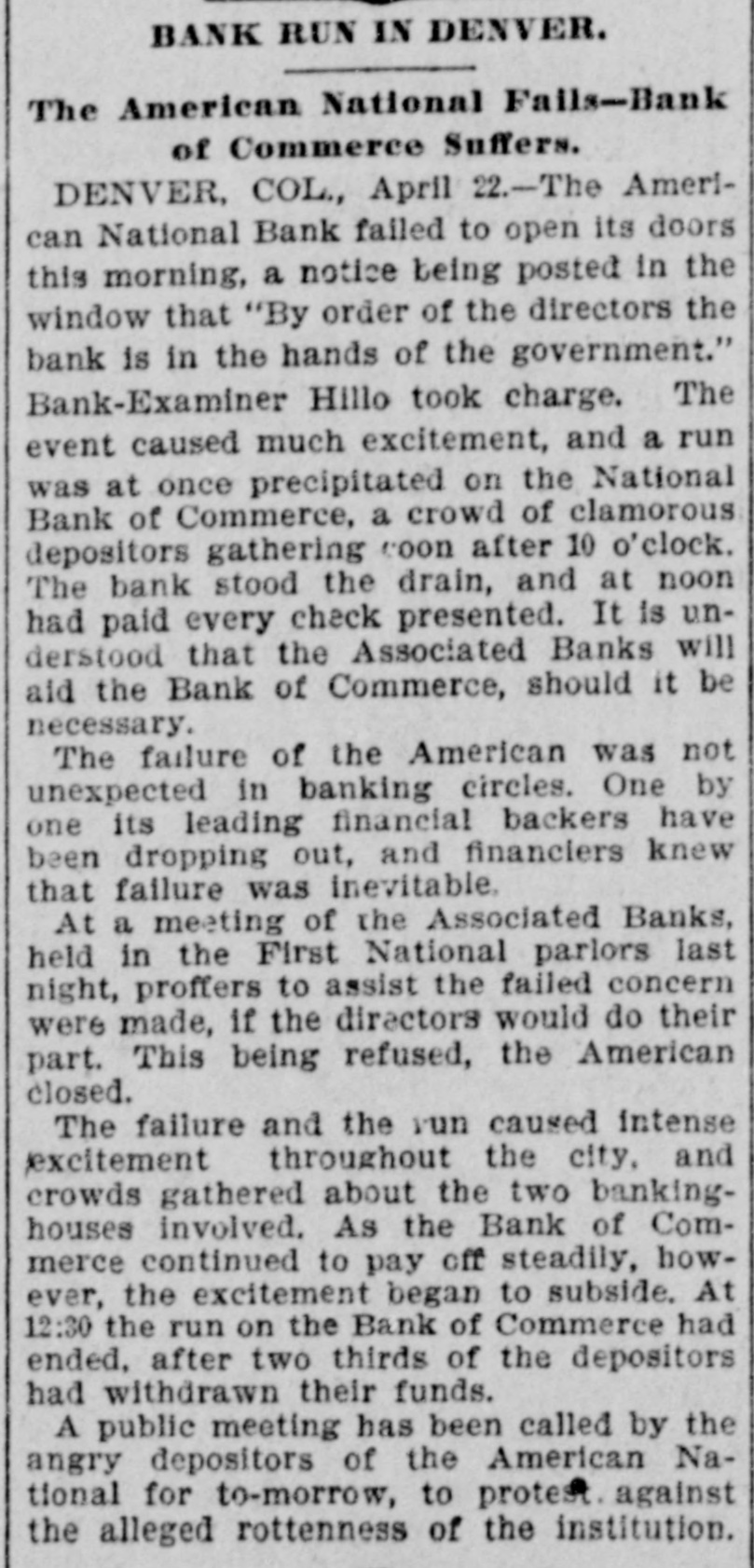

HEAVY BANK FAILURE. American National Bank of Denver Breaks-Run on the Bank of Commerce. Denver, April 22.-The American National bank failed to open this morning. A notice was placed on the door to the effect that the directors had deeided to liquidate. The step was taken on account of internal dissension. It is said all depositors will be paid in full. Seph T. Hill is in charge of the bank on behalf of the government. The posted notice was as follows: "This bank has closed its doors by vote of its directors and is in my hands ES representative of the government. "SEPH T. HILL." The announcement of the failure does not come as a surprise to the business men of Denver nor indicate any lack of confidence in the general business situation. The condition of the bank has been weak for a long time because of disagreements among the large stockholders, directors and officers. The retirement from the directorate and the sale of the stock of several prominent and wealthy men has materially reduced the business of the bank and made it possible to carry it on profitably under present conditions. At the last report made at the close of business March 6. the total deposits were $1,471951: loans and discounts, $1,128,271: cash on hand. $232.265. The capital stock of the bank is $500,000: surplus fund, $150,000. The assets of the bank amount to $2,245,173. and it is claimed that but little trouble will be experienced in realizing on them. The following statement was taken from the books of the American National bank this morning: Resources, cash and exchange, $70,300: bills receivable, $1,078,000; stock and securities, $265,435; real estate, $136,590; excess on circulation, $22,000; total, $1,572,325. LIABILITIES. Individual deposits, $530,712; demand deposits, $28,698; time deposits, $66,297; due other banks, $97,024; borrowed money, $142,500; total, $865,231. A comparison of this statement with that published in March shows that the bank's deposits and reserve have declined very rapidly. Over $200.000 were withdrawn Monday and Tuesday of this week and there being only $70.000 left. the directors decided that the best thing to do was to close the bank Among the bank's assets are notes for $500,000 set aside for the reduction of the capital stock from $1,000,000 to $500.000 which was recently made and one-fifth interest in the Strong mine at Cripple Creek The president of the bank is John R. Hanna. The directorate consists of some Denver, of including the leading business men of Fine Pernst. Wm. and Moritz Barth, Mitchell Benedict and George W. Ballantine. In consequence of the failure a run has been started on the National Bank of Commerce.