Click image to open full size in new tab

Article Text

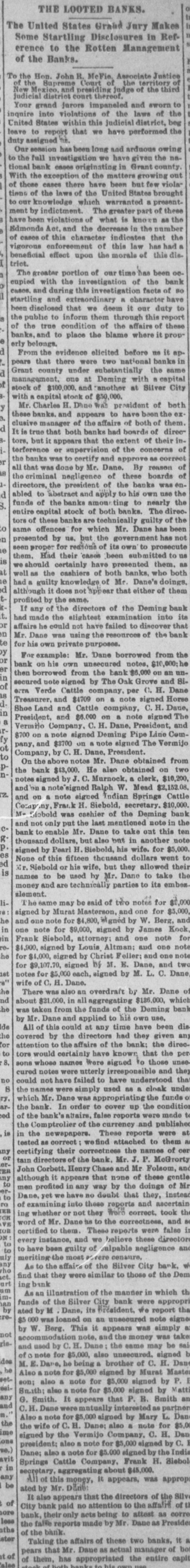

THE LOOTED BANKS. The United States Grand Jury Makes Some Startling Disclosures In Reference to the Rotten Management of the Banks. To of the Hon. John R. McFie, Associate Justice New the Supreme Court of the territory of Mexico, and presiding judge of the third judicial district court thereof. Your grand jurors impaneled and sworn to inquire into violations of the laws of the United States within this judicial district, beg leave to report that we have performed the duty assigned the. Our session has been long and arduous owing to the full investigation we have given the na. tional bank cases originating in Grant county With the exception of the matters growing out of those cases there have been but few viola tiens of the laws of the United States brought to our knowledge which warranted a present ment by indictment. The greater part of thee have been violations of what is known as the Edmonds Act, and the decrease in the number of cases of this character indicates that the vigorous enforcement of this law has had beneficial triot. effect upon the morals of this dis The greater portion of our time has been 00 enpied with the investigation of the bank cases. and during this investigation facts of B startling and extraordinary R character have been disclosed that we deem it our duty t the public to inform them through this repor of the true condition of the affairs of thes banks, and to place the blame where it prop erly belongs. From the evidence elicited before no it ap pears that there were two national banks d Grant county under substantially the sam of management, one at Deming with capits stock of $100,000. and "another at Silver Cit with R capital stock of $50,000. Mr. Charles H. Dane was president of bot these banks. and appears to have been the or clusive manager of the affairs of both of them d It is true that both banks had boards of direc tore, but it appears that the extent of their it terference or supervision of the concerns r the banks was to certify and approve as correo all that was done by Mr. Dane. By reason 18 the criminal negligence of these boards directors, the president of the banks was er d abled to abstract and apply to his own use th S. funds of the banks amou ting to nearly th entire capital stock of both banks. The dire tors of these banks are technically guilty of th to same offences for which Mr. Dane has bee n presented by no, but the government has no 18 seen proper for reasons of its own to prosecut them. Had their cases been submitted to IS we should certainly have presented them. at well as the cashiers of both banks. who bot had a guilty knowledge of Mr. Dane's doing d although it does not sppear that either of the profited by the same. If any of the directors of the Deming ban had made the elightest examination into i or affairs he could not have failed to discover the in Mr. Dane was using the resources of the ban to for his own private purposes. y For example: Mr. Dane borrowed from ti or or bank on his own unsecured notes, $10,000;) then borrowed from the bank $6,000 on an un in secured note signed by The Oak Grove and 8 of erra Verde Cattle company, per O. H. Dar is Treasurer, and $4709 on a note signed Hor Shoe Land and Cattle company, C. H. Dan in President, and $6,000 on a note signed TI a Vermino Company, C. H. Dane. President, an $700 on a note signed Deming Pipe Line Con pany, and $3700 on a note signed The Vermi ot Company, by C. H. Dane, President. to On the above notes Mr. Dane obtained fro pthe bank $43,000. He also obtained on tv D' notes signed by J. C. Murnock, a clerk, $10.20 and on a note signed Ralph W. Mead $2,152.0 z. and on a note signed Indian Springs Catt Comp Frank H. Siebold, secretary. $10.00 M- Siebold was cashier of the Deming bar and not only put the last mentioned note in tl cbank to enable Mr. Dane to take out this to be thousand dollars, but also but in another no p. signed by Pearl H. Biebold, his wife. for $5.00 88 None of this fifteen thousand dollars went ed Mr. Siebold or his wife, but they allowed the is names to be used by Mr. Dane to take t slement. money and are technically parties to its embe liThe same may be said of two notes for : signed by Murat Masterson, and one for $5.00 he and one note for $4,800, *igned by W. Berg, a in one note for $9,000, signed by James Koc in Frank Siebold, attorney; and one note f & $4,900, signed by Louis Altman: and one no he for $4,000, signed by Christ Feller: and one no for $9,107.70, signed by M. E. Dane, and t ist notes for $5,000 each, signed by M. L. C. Dar 8" wife of C, H. Dane. he There was also an overdraft by Mr. Dane nd about $21,000, in all aggregating $186,000, whi he was taken from the funds of the Deming ba by Mr. Dane and applied to his own use, de All of this could at any time have been d he covered by the directors had they given a for attention to the affairs of the bank: the dire to tors would certainly have known that the P 8, sons whose names were signed to those une cured notes were utterly irresponsible and th no could not have failed to have understood the S the names were simply used as a cloak und ry. which Mr. Dane was appropriating the funds arthe bank. In order to cover up the conditi ed of the bank's abairs. false reports were made the Comptrolier of the currency and publish is in the newspapers. These reports were tested as correct wefind attached to them my certifying their correctness the names of o or tain directors of the bank. Mr. J. P. McGror orER John Corbett, Henry Chase and Mr Folsom, a my although it appears that none of these gent to men profited in any way by the doings of B to Dane, yet we have no doubt that they, inste of examining into these reports and ascertai ER ing whether or not they were correct. took t VE word of Mr. Dane as to the correctness, and OR certified to them. These reports were false every instance, and we believe these directo to to to have been guilty of Julpable negligence a uly meriting the most overe censure. As to the affairs of the Silver City bank, et find that they were similar to those of the De urt ing bank am As an illustration of the manner in which 1 mfunds of the Silver City bank were approp by ated by M Dane, its president, we report ti re$5 000 was loaned on an unsecured note sign by W. Berg. This it appears was simply not accommodation note, and the money was tak riaand used by C. H. Dane: the same may be S of a note for $5,000, also unsecured. signed des M. E. Dane, he being a brother of C. H. Da he Also note for $5,000 signed by Murat Mast etson; also a note for $5,000 signed by P. asiSmith: also a note for $5,000 signed by Mat any G. Smith. It appears that P. R. Smith and C. H. Dane eremutually interested as partne Also note for $5,000 signed by Mary L. Da the the wife of C. H. Dane: also a note for $5. me signed by the Vermijo Company, C. H. Da one president: also a note for $5,000 signed by C. we.) Dane: also a note for $5,000 signed by the Ind avit Springs Cattle Company, Frank H. Sieb in secretary, aggregating about $45,000. any All of this money, it appears, was appro be ated by Mr. Dane: It also appears that the directors of the Sil of hore bank City bank paid no attention to the affairs of