Article Text

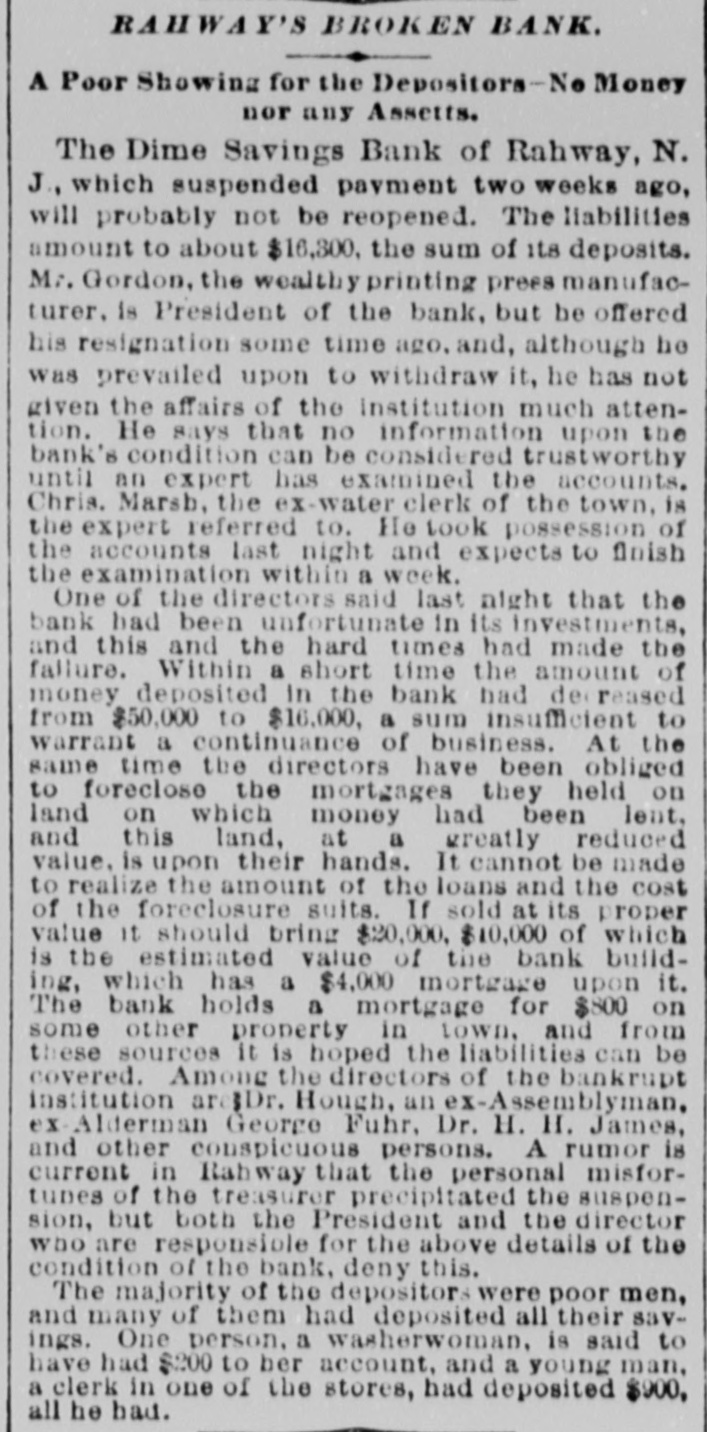

RAHWAY'S BROKEN BANK. A Poor Showing for the Depositors-) Money nor any Assetts. The Dime Savings Bank of Rahway, N. J., which suspended payment two weeks ago, will probably not be reopened. The liabilities amount to about $16,300, the sum of its deposits. Mr. Gordon, the wealthy printing prees manufacturer. is President of the bank. but be offered his resignation some time ago, and, although he was prevailed upon to withdraw it, he has not given the affairs of the institution much attention. He says that no information upon the bank's condition can be considered trustworthy until an expert has examined the accounts. Chris. Marsb, the ex-water clerk of the town, is the expert referred to. He took possession of the accounts last night and expects to finish the examination within a week. One of the directors said last night that the bank had been unfortunate in its investments, and this and the hard times had made the failure. Within a short time the amount of money deposited in the bank had decreased from $50,000 to $16,000, a sum insufficient to warrant a continuance of business. At the same time the directors have been obliged to foreclose the mortgages they held on land on which money had been lent, and this land, at a greatly reduced value. is upon their hands. It cannot be made to realize the amount of the loans and the cost of the foreclosure suits. If sold at its proper value it should bring $20,000, $10,000 of which is the estimated value of the bank building, which has a $4,000 mortgage upon it. The bank holds a mortgage for $800 on some other property in town, and from these sources it is hoped the liabilities can be covered. Among the directors of the bankrupt institution are$Dr. Hough. an ex-Assemblyman, ex Alderman George Fuhr, Dr. H. H. James, and other conspicuous persons. A rumor is current in Rahway that the personal misfortunes of the treasurer precipitated the suspension, but both the President and the director who are responsiole for the above details of the condition of the bank. deny this. The majority of the depositors were poor men, and many of them had deposited all their savings. One person. a washerwoman, is said to have had $200 to ber account, and a young man, a clerk in one of the stores, had deposited $900, all he had.