Click image to open full size in new tab

Article Text

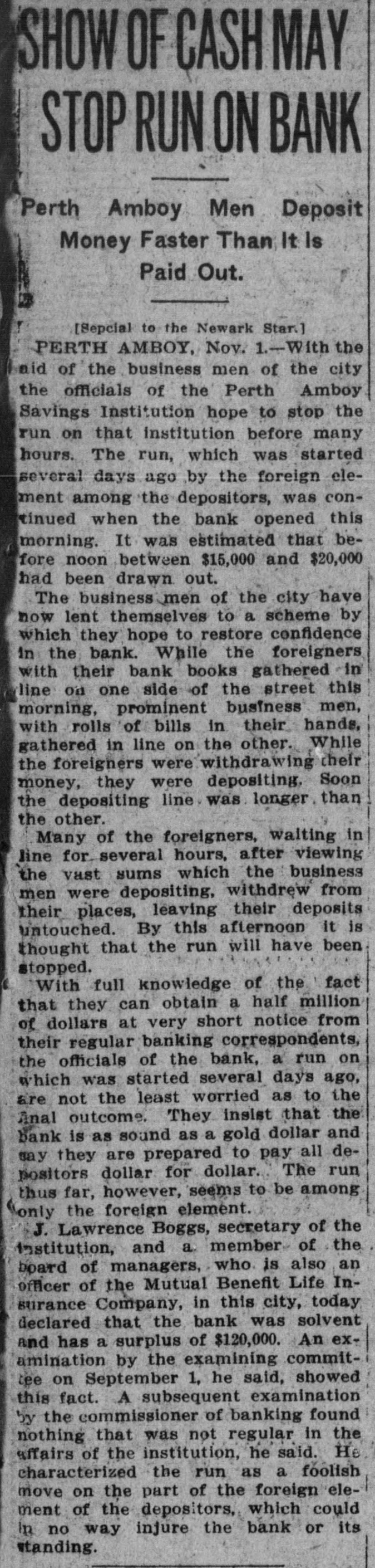

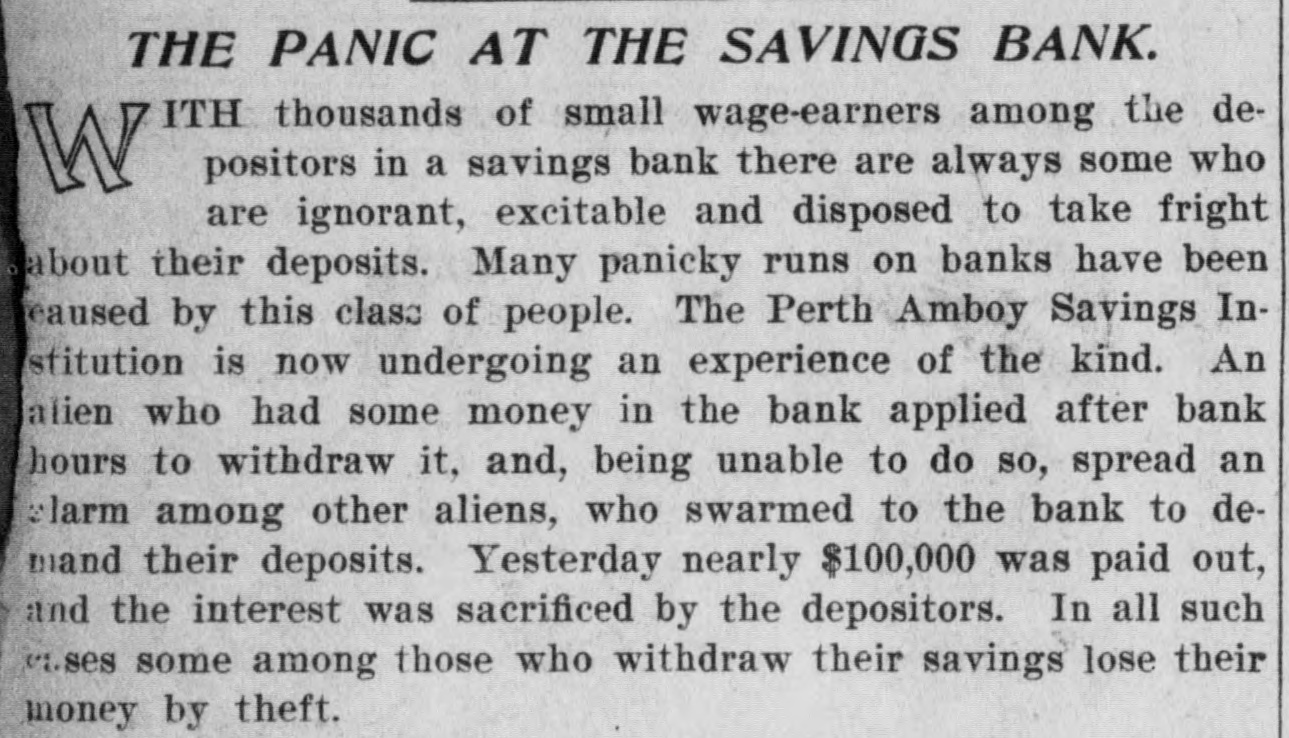

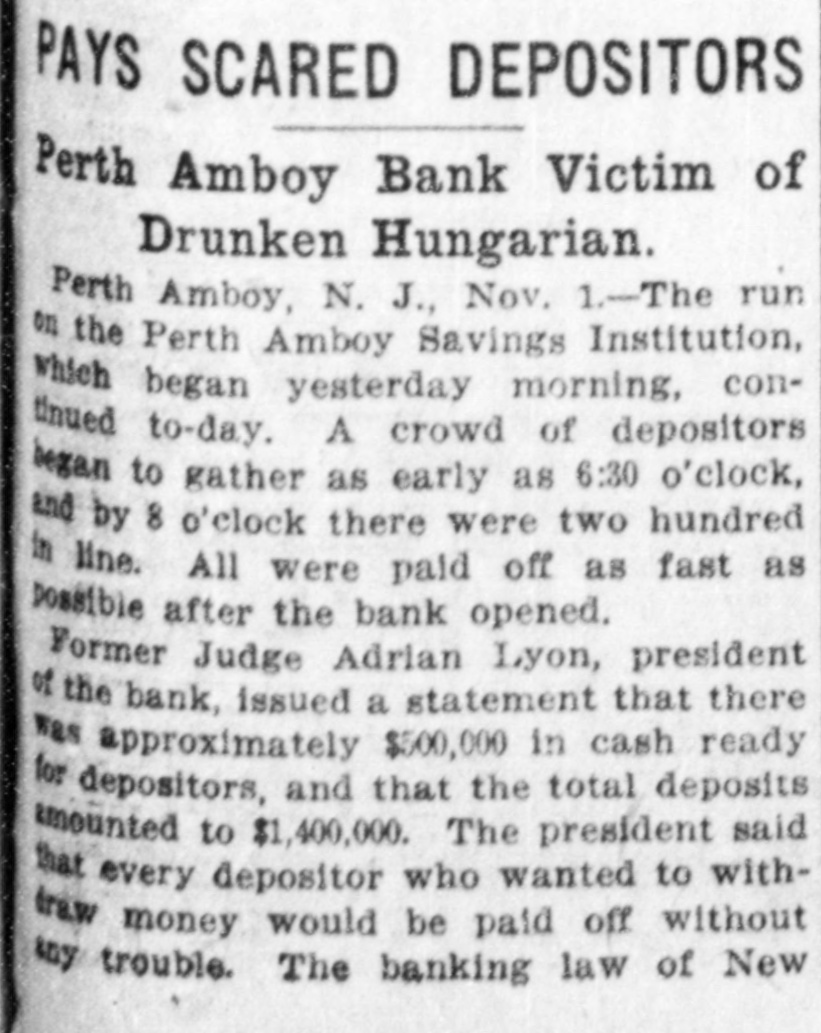

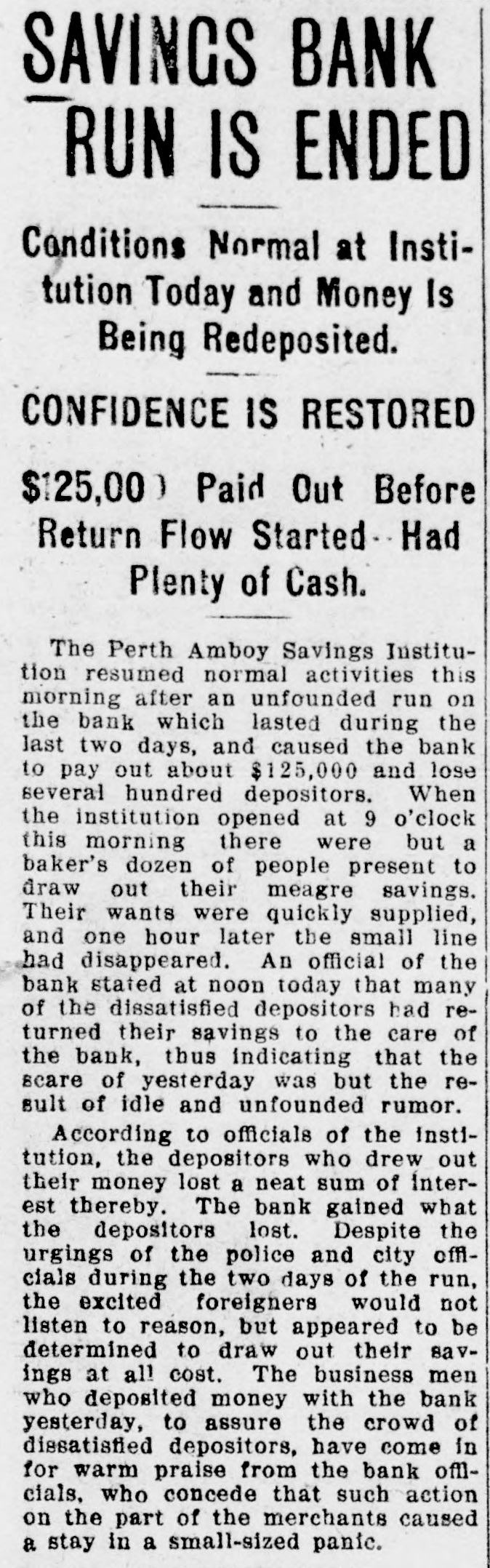

Many People who Withdrew Money Replace It. RUN NEARS END Through the efforts of many prominent business men of the city, the run on the Perth AmInstitution was this and will be boy unexplainable Savings morning, probably checked to a close before the time at 3 o'clock closing brought this bank's after- formnoon. Over 100 business men line in front of the morning and o'clock ed in this bank nearly deposited at $2,- 11 sums ranging from $5 to 000. It is estimated that the bank received from the merchants about $5,000 in an hour; the business men's line rivalled the line of excited men and women who desire to withdraw their earnings. Many foreigners became reassured when the busines men formed in line carrying large sums of money in their hands. The run stopped on the instant and many big holes were made in the line, which contained the dissatisfied depositors, which was nearly a city block long early this morning. It formed at 2 o'clock this morning and did not lose its size is until the merchants appeared. It believed by the institution's officials who that many of the foreigners, will not be accommodated today, will realize their folly before tomorrow to morning and allow their deposits remain unmolested. Several men, who withdrew their savings early this morning, returned with the business men and reopened their accounts. the men whose faith in the reassured on bank Among was the appear- deof the business men was a the ance positor who had over $500 in bank; it was explained to him if that he would lose $10 in interest dehe withdrew his account. The man stand, to allow the account to and cided when he left the line he took siz other men with him. President Lyon's Statement. Lyon, president of the state- institution, Adrian issued the following I ment this morning to the At the time of the last public statement of the institution it had in bonds of the in first in Perth Amboy other and cash of property over $1,750,000, class, $615,000 $35,000 $695,000 property mortgages or $1,500,000. worth $167,000, very first worth over making a total of over due surplus over amounts It of to have increased amounts had depositors a $109,000. somewhat These since the last statement. How the rumor arose that the bank was not in sound condition is to discover. It those things that seems of impossible the seem earth. at one times to spring up' ut of It is more than likely that it arose of some statement from some bank out who had gone to the after person banking hours "that accounted the bank closed." It cannot be such for was on any other than some silly In ground. the last letter from the State Department under date of of 1912, giving the their examination, the October Banking 5, following result insti- paragraph appears: "I find this contution lawfully and prudently to ducted. Every transaction seems care. be carried out with the utmost all board of management and of officers The appear to give the affairs of atbank an unusual amount tention. the and there are no criticisms to We be made." are fully prepared to meet the all demands. We have behind us offtcordial assurances of the First very of our correspondents, the the National cers Bank of Perth Amboy, Union Trust Company of New York, of the Fidelity Trust Company and that we can have anything to we Newark, want in the way of ready cash meet all our needs. ADRIAN LYON, President. 2:30 o'clock this afternoon the At officials reported that $45,000 paid out today, of a $125,000 in the two bank had total been of making days there run. Late this afternoon line, the but thirty people in out awaiting were an opportunity to draw concentheir savings, and it is the will be of opinion that the bank at 9 able sus to resume regular business o'clock tomorrow morning. 3:15 o'clock President Lyon keep At that the bank would usual announced later this afternoon than and open closing time is 3 o'clock in line. -the the persons remaining announcement pay time of the stard At the but several people teller's there in were front of the paying window ing awaiting their turn. EVENING NEWS covers the field.