Article Text

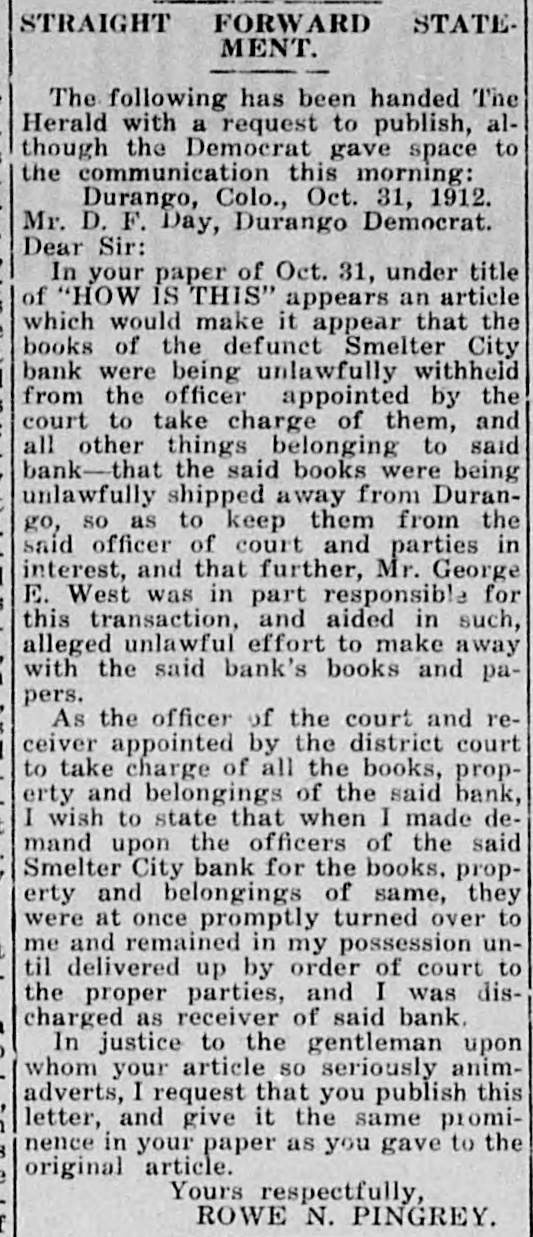

STATEFORWARD STRAIGHT MENT. The following has been handed The Herald with a request to publish, although the Democrat gave space to the communication this morning: Durango, Colo., Oct. 31, 1912. Mr. D. F. Day, Durango Democrat. Dear Sir: In your paper of Oct. 31, under title of "HOW IS THIS" appears an article which would make it appear that the books of the defunct Smelter City bank were being unlawfully withheld from the officer appointed by the court to take charge of them, and all other things belonging to said bank-that the said books were being unlawfully shipped away from Durango, so as to keep them from the said officer of court and parties in interest, and that further, Mr. George E. West was in part responsible for this transaction, and aided in such, alleged unlawful effort to make away with the said bank's books and papers. As the officer of the court and receiver appointed by the district court to take charge of all the books, property and belongings of the said bank, I wish to state that when I made demand upon the officers of the said Smelter City bank for the books. property and belongings of same, they were at once promptly turned over to me and remained in my possession until delivered up by order of court to the proper parties, and I was discharged as receiver of said bank. In justice to the gentleman upon whom your article so seriously animadverts, I request that you publish this letter, and give it the same prominence in your paper as you gave to the original article. Yours respectfully, ROWE N. PINGREY.