Article Text

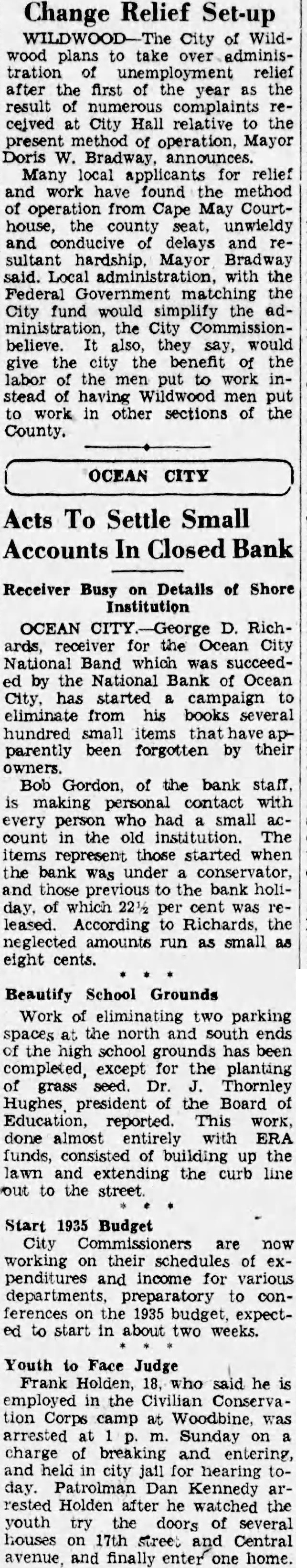

Change Set-up City of Wildwood plans to take administration unemployment relief after the first year the result complaints City relative present method operation, Mayor Doris Many for relief and work have found the method from Cape Courthouse, county seat, unwieldy conducive delays sultant hardship. Mayor the Federal fund would the ministration, the City Commissionbelieve. they would give the the benefit labor work stead having work in other sections of the County. OCEAN CITY Acts To Settle Small Accounts In Closed Bank Receiver on Details of Shore Institution OCEAN Richards, receiver Ocean National Band which was succeedby the National Bank Ocean City, started campaign eliminate from his books several hundred items parently been forgotten by their owners. Bob Gordon, of the bank staff. making personal contact with who small count The items represent those started when the bank under conservator, the bank holiwhich cent leased. According Richards, the neglected run as small eight cents. Beautify School Grounds Work of eliminating two parking spaces the north and south ends the school grounds has been completed, except for the planting grass Dr. Thornley president the Board reported. This done almost entirely ERA funds, consisted of building up the lawn extending the curb line to the street Start 1935 Budget City are now working their penditures and income for various preparatory conferences the 1935 expectto start in about two weeks. Youth Face Judge Frank Holden, said he Civilian tion Corps Woodbine, was arrested Sunday charge and city jail for hearing day. Dan Kennedy rested Holden after watched the youth the doors of several houses 17th and Central and finally enter one home.