Article Text

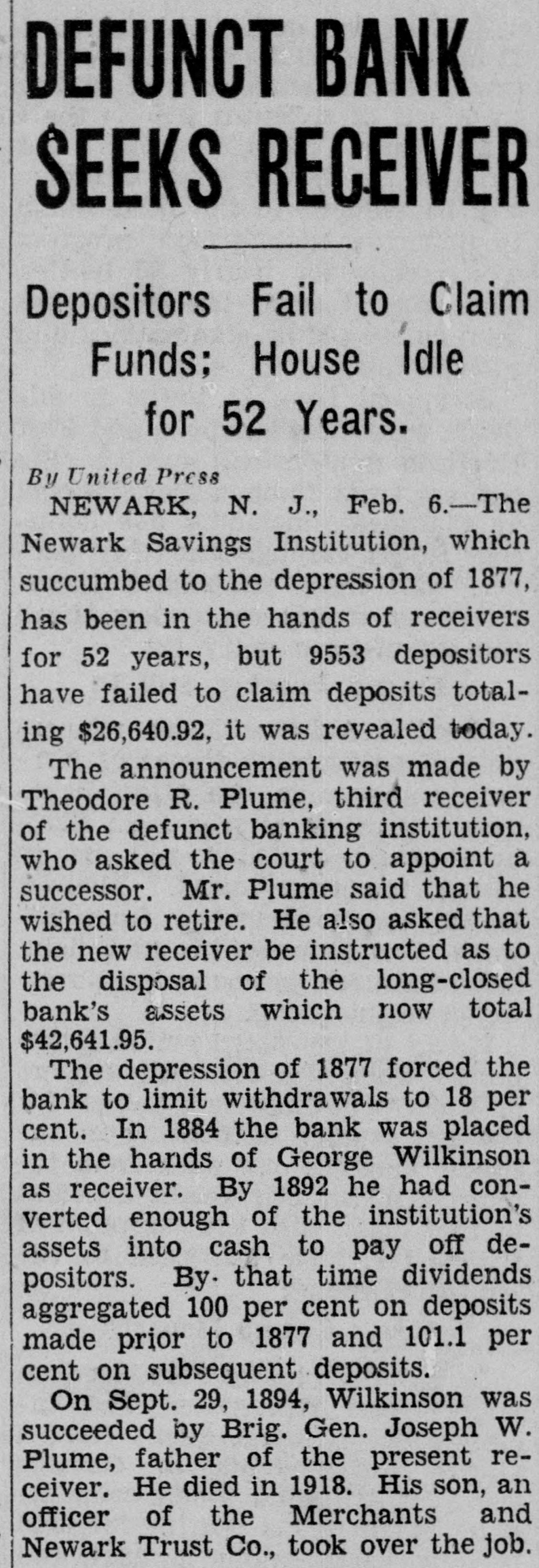

DEFUNCT BANK SEEKS RECEIVER Depositors Fail to Claim Funds: House Idle for 52 Years. By United Press NEWARK, N. J., Feb. 6.-The Newark Savings Institution, which succumbed to the depression of 1877, has been in the hands of receivers for 52 years, but 9553 depositors have failed to claim deposits totaling $26,640.92, it was revealed today. The announcement was made by Theodore R. Plume, third receiver of the defunct banking institution, who asked the court to appoint a successor. Mr. Plume said that he wished to retire. He also asked that the new receiver be instructed as to the disposal of the long-closed bank's assets which now total $42,641.95. The depression of 1877 forced the bank to limit withdrawals to 18 per cent. In 1884 the bank was placed in the hands of George Wilkinson as receiver. By 1892 he had converted enough of the institution's assets into cash to pay off depositors. By. that time dividends aggregated 100 per cent on deposits made prior to 1877 and 101.1 per cent on subsequent deposits. On Sept. 29, 1894, Wilkinson was succeeded by Brig. Gen. Joseph W. Plume, father of the present receiver. He died in 1918. His son, an officer of the Merchants and Newark Trust Co., took over the job.