Article Text

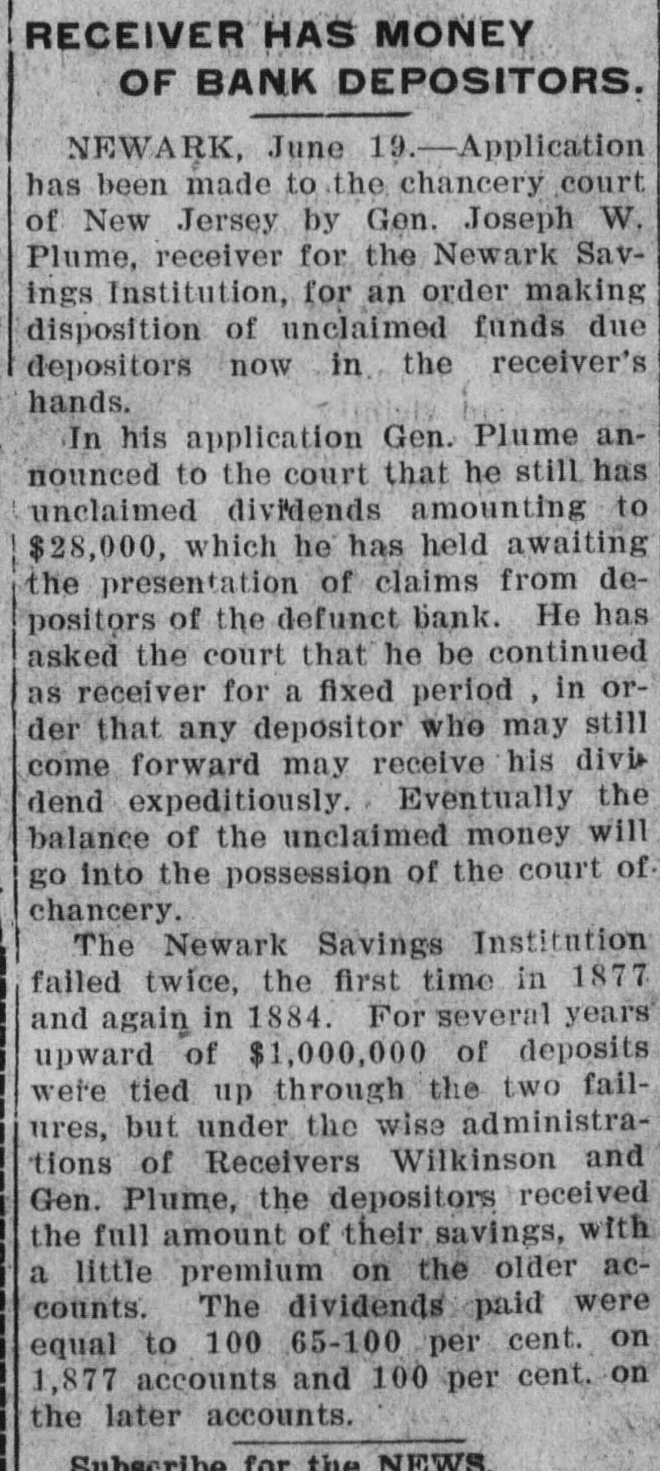

RECEIVER HAS MONEY OF BANK DEPOSITORS. NEWARK, June 19.-Application has been made to the chancery court of New Jersey by Gen. Joseph W. Plume, receiver for the Newark Savings Institution, for an order making disposition of unclaimed funds due depositors now in the receiver's hands. In his application Gen. Plume announced to the court that he still has unclaimed dividends amounting to $28,000, which he has held awaiting the presentation of claims from depositors of the defunct bank. He has asked the court that he be continued as receiver for a fixed period , in order that any depositor who may still come forward may receive his divi dend expeditiously. Eventually the balance of the unclaimed money will go into the possession of the court of chancery. The Newark Savings Institution failed twice, the first time in 1877 and again in 1884. For several years upward of $1,000,000 of deposits were tied up through the two failures, but under the wise administrations of Receivers Wilkinson and Gen. Plume, the depositors received the full amount of their savings, with a little premium on the older accounts. The dividends paid were equal to 100 65-100 per cent. on 1,877 accounts and 100 per cent. on the later accounts. Subscribe for the NEWS