Article Text

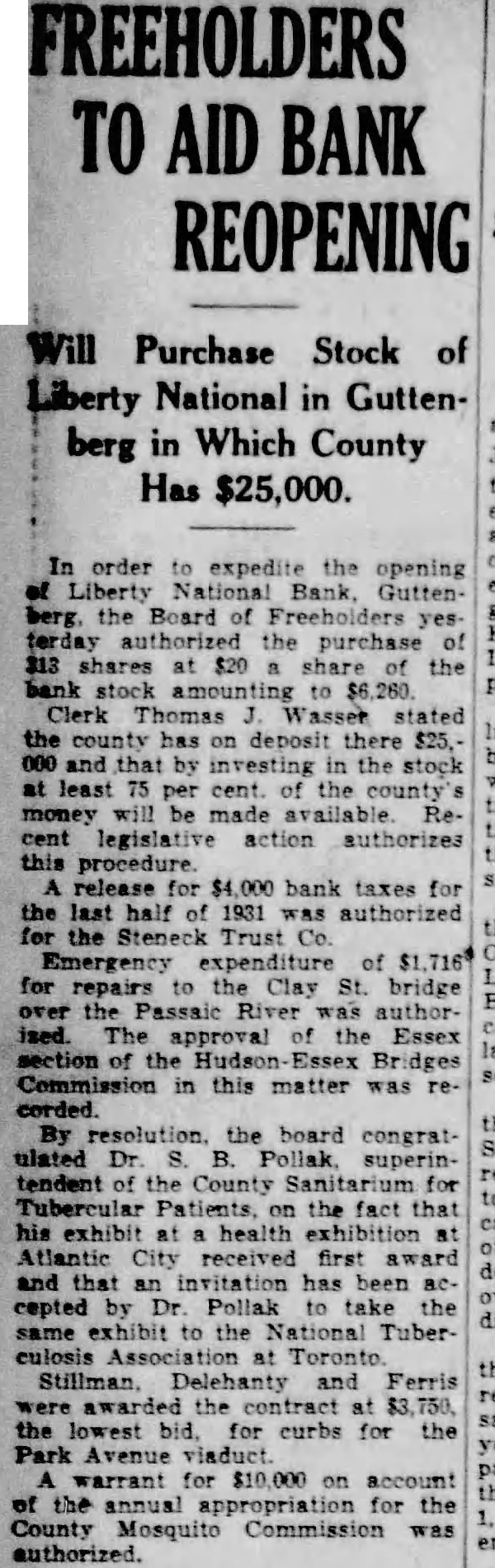

FREEHOLDERS TO AID BANK REOPENING Purchase Stock of iberty National in Guttenberg in Which County Has $25,000. In order expedite the opening Liberty National Bank, Guttenthe Board of Freeholders terday authorized the purchase 313 shares at $20 share the stock amounting Clerk Thomas Wasser stated the county has deposit there $25, and investing in the stock at least 75 per cent. of the county money will made Relegislative action authorizes this procedure. release for $4,000 bank taxes for the last half 1931 authorized the Trust Emergency expenditure of for repairs to Clay St. bridge the Passaic River was authorised. The approval of the Essex section the Hudson Essex Bridges Commission in this matter was recorded. By the board ulated Dr superintendent the Sanitarium for Tubercular Patients, the fact that his exhibit health Atlantic City received first award and that an invitation has been by Dr. Pollak the same exhibit to the National Tubereulosis at Toronto Stillman, Delehanty and Ferris were awarded the at $3,750, lowest for curbs for the Park Avenue warrant for $10,000 account of the annual appropriation for the County Mosquito Commission authorized.