Article Text

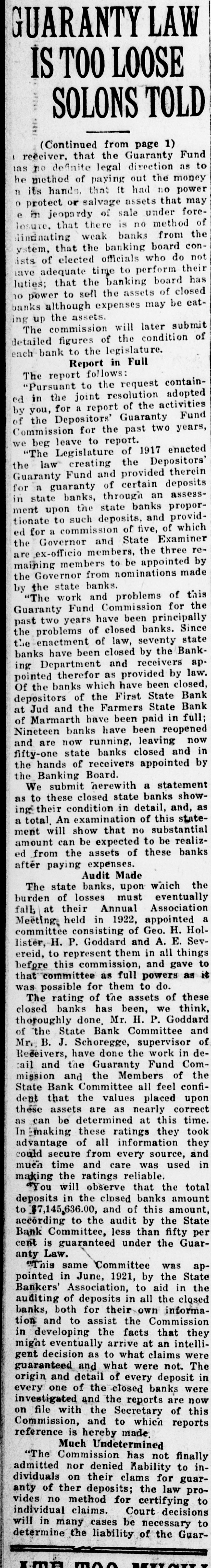

# GUARANTY LAW # IS TOO LOOSE # SOLONS TOLD (Continued from page 1) receiver, that the Guaranty Fund has no definite legal direction as to he method of paying out the money n its hands, that it had no power o protect or salvage assets that may e in jeopardy of sale under fore-closure, that there is no method of eliminating weak banks from the system, that the banking board consists of elected officials who do not have adequate time to perform their duties; that the banking board has no power to sell the assets of closed banks although expenses may be eating up the assets. The commission will later submit detailed figures of the condition of each bank to the legislature. Report in Full The report follows: "Pursuant to the request contained in the joint resolution adopted by you, for a report of the activities of the Depositors' Guaranty Fund Commission for the past two years, we beg leave to report. "The Legislature of 1917 enacted the law creating the Depositors' Guaranty Fund and provided therein for a guaranty of certain deposits in state banks, through an assessment upon the state banks proportionate to such deposits, and provided for a commission of five, of which the Governor and State Examiner are ex-officio members, the three remaining members to be appointed by the Governor from nominations made by the state banks. "The work and problems of this Guaranty Fund Commission for the past two years have been principally the problems of closed banks. Since the enactment of law, seventy state banks have been closed by the Banking Department and receivers appointed therefor as provided by law. Of the banks which have been closed, depositors of the First State Bank at Jud and the Farmers State Bank of Marmarth have been paid in full; Nineteen banks have been reopened and are now running, leaving now fifty-one state banks closed and in the hands of receivers appointed by the Banking Board. We submit herewith a statement as to these closed state banks showing their condition in detail, and, as a total. An examination of this statement will show that no substantial amount can be expected to be realized from the assets of these banks after paying expenses. Audit Made The state banks, upon which the burden of losses must eventually fall, at their Annual Association Meeting held in 1922, appointed a committee consisting of Geo. H. Hollister, H. P. Goddard and A. E. Severeid, to represent them in all things before this commission, and gave to that committee as full powers as it was possible for them to do. The rating of the assets of these closed banks has been, we think, thoroughly done. Mr. H. P. Goddard of the State Bank Committee and Mr. B. J. Schoregge, supervisor of Receivers, have done the work in detail and the Guaranty Fund Commission and the Members of the State Bank Committee all feel confident that the values placed upon these assets are as nearly correct as can be determined at this time. In making these ratings they took advantage of all information they could secure from every source, and much time and care was used in making the ratings reliable. You will observe that the total deposits in the closed banks amount to $7,145,636.00, and of this amount, according to the audit by the State Bank Committee, less than fifty per cent is guaranteed under the Guaranty Law. This same Committee was appointed in June, 1921, by the State Bankers' Association, to aid in the auditing of deposits in all the closed banks, both for their own information and to assist the Commission in developing the facts that they might eventually arrive at an intelligent decision as to what claims were guaranteed and what were not. The origin and detail of every deposit in every one of the closed banks were investigated and the reports are now on file with the Secretary of this Commission, and to which reports reference is hereby made, Much Undetermined "The Commission has not finally admitted nor denied liability to individuals on their claims for guaranty of ther deposits; the law provides no method for certifying to individual claims. Court decisions will in many cases be necessary to determine the liability of the Guar-