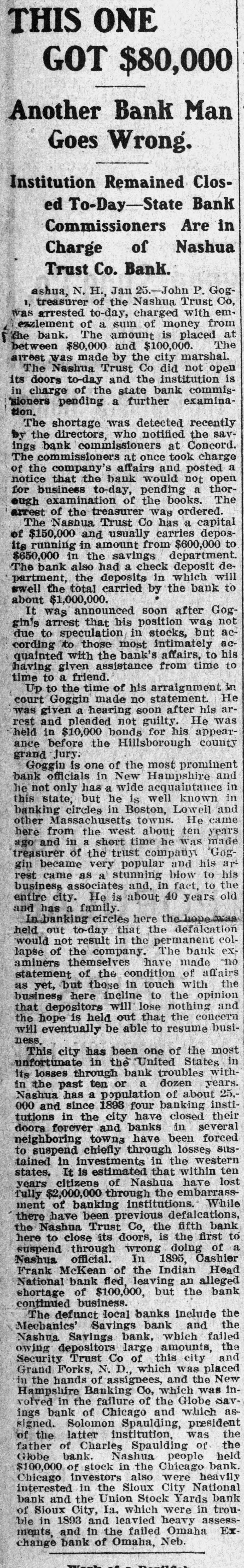

Article Text

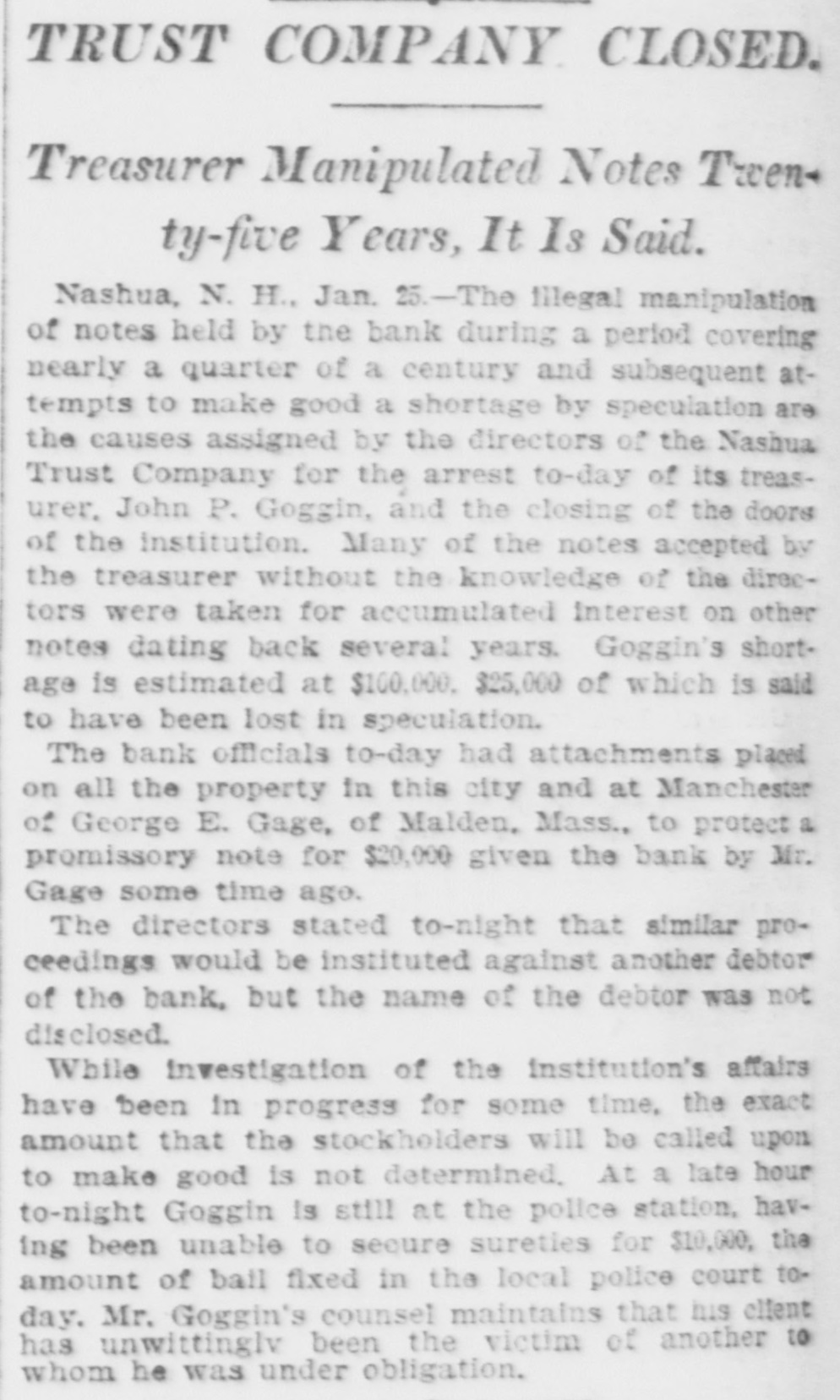

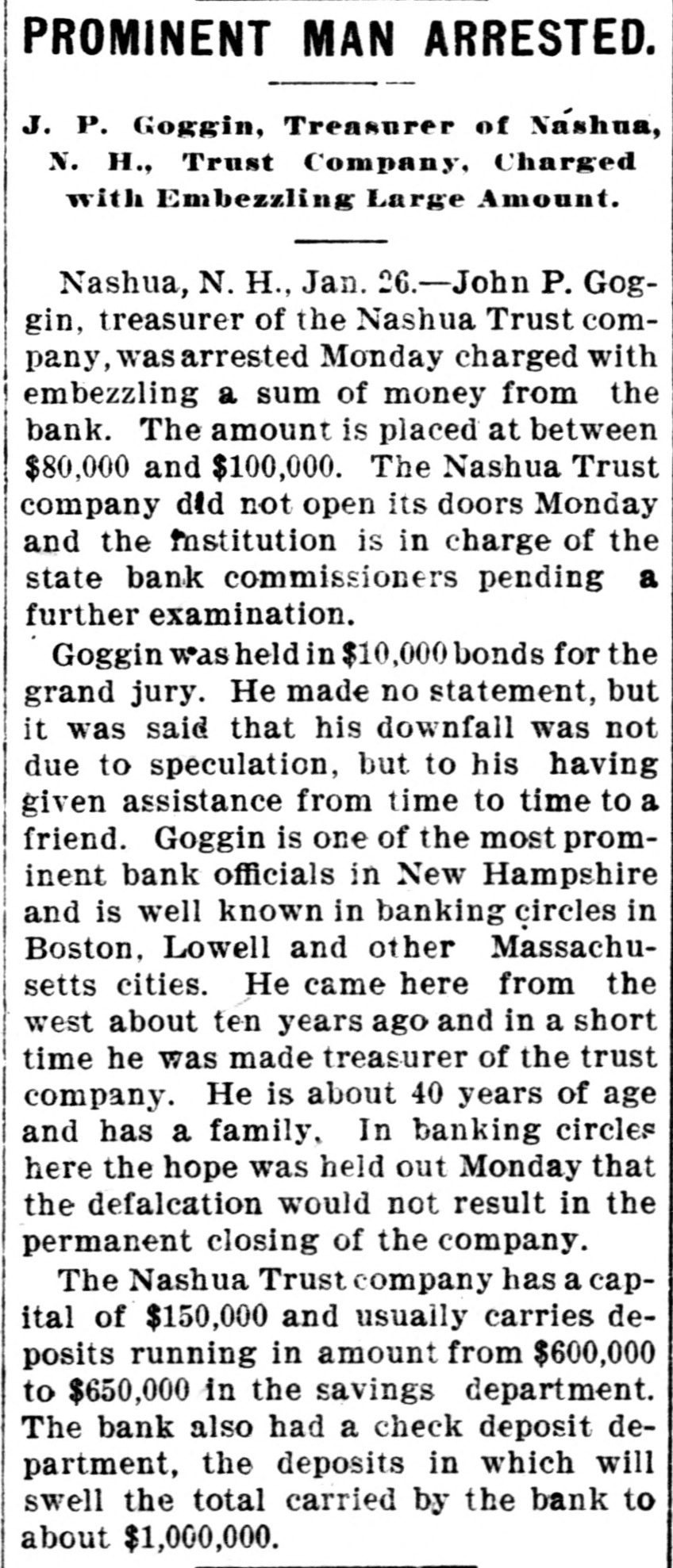

THIS ONE GOT $80,000 Man Bank Another Goes Wrong. ClosInstitution Remained Bank ed To-Day-State Are in Commissioners of Charge Nashua Trust Co. Bank. John P. Gog- Co, ashua, N. H., of the Jan Nashua 25.-Jone Trust with from emtreasurer to-day, charged of money arrested a sum is placed The was eazlement The of amount $100,00marshal at the by the did not is between bank. was $80,000 made Trust and Co city institution open detected its in airest The charge doors Nashua pending to-day of the and a state further the bank examina- recently commis saybank "sioners tion. shortage was who notified at Concord. the by The the directors, commis missioners at once took posted charge a The ings commissioners company Bank affairs would and not a thor- open the of the that the to-day, pending books. The ordered. notice for basimination of was capital eugh of the treasure Trust Co has a carries depos- to arrest Nashua usually $600,000 The $150,000 and amount from department partment, of its running in in the had savings a check in deposit which will to total swell $1,000,000. The $650,000 bank also the deposits carried by the bank Gogsoon after not was about was announced his position stocks, but ac- acIt arrest speculations that in intimatel to his qualities given having friend. his gin's cording qualated due to to with those assistance bank's affairs, from time to arraignment time Up to to a the time made of no soon statement after He his was arin appear. court given Goggin a hearing not guilty. his the held before was rest and $10,000 pleaded bondisborough for county prominent ance grand jury. one of the most Goggin is in New wide acquaintance known bank only has a he is well Lowell came and about was he this bankinfassachungen not state, officials chaches circles but the in Boston, time towns. he ten He years made Gogother here from in a short trust company and his ar ago and of the popular blow to the his business He treasurer became verstunning a and, in fact, to old city. family. gin rest camessociates as is about 40 years hope and entire has banking a circles that here permanent the defalcation held would not company In out today result in the The made bank have of affairs of themselve the the with statement aminers lapse of those the in touch to the opinion and the will yet, but here incline will lose nothing the concern busieventually of the one been business as that hope deposites is be out able that to resume most in States. United withness. This city has in the bank troubles years. 25, unfortunate.ru losses or a about of instiits past population Pour banking their Nashua since city in in the has a 1893 have closed several forced tutions 000 and in the and banks have been losses sustained is It states, doors foreverothwos chiefly through in the western ten of Nashua citizens the neighboring to suspend in investmated that within have lost through tutions. cations, here of 2,000,000 000 banking previous defaic fifth first bank to suspend have been Trust Co, the is the of a In Nashua official. the of Frank Indian the to close through its doors, wrong 1895, Head McKeaned an bank leaving alleged the but bank $100,000, the shortage National of business. banks include and failed the Nashua large owing and of this city depositors The bank, bank amounts, which the Trust was which Forks, placed Grand of the New and assignees inwas Co, which wavGlobe asHamps the hands shire the Banking failure Chicago of and the which the rolved in of Spaulding, was the institutioning of of signed. father ings the of latter Chicago bank. held bank. in the were National and bank City, $100,000 Globe investors stock the Siour also Stock City Yards in bank trouble leaved and the in Union which heavy were assess- EX Omaha of bank of Sioux in 1893 in and the Omaha, failed Neb.